Platform Features Release: New Zoom Functionality, Chart Panning

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

New Zoom Functionality

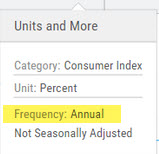

To activate Zoom, click on the Zoom button has been added to the icon toolbar:

![]()

- Once activated, the button changes color.

- Click/drag the mouse/cursor over the area of study.

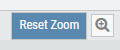

- A “Reset Zoom” button will display when you want to restore the view.

Chart Panning Functionality

Click/drag now pans the time period/price range on the chart – when dragging your mouse/cursor either right/left

Other Additions

- “Choppiness Index” Chart Lower Indictor added

- “Are You Sure You Want To Cancel This Order?” added on Order Status tab

- Clicking on “Quotes By” box (lower right corner) will display source of quotes

Change Log

- Reuse .XSP and .SPX order functionality restored

- Trading Block OTM trade error fixed

- Schwab recognizes BRK.B now

- Resolved Liquidity Range in Screener

Platform Features Release: Set Alert from Option Tab

This Release focused on fixes and set-ups for future capabilities and added the following:

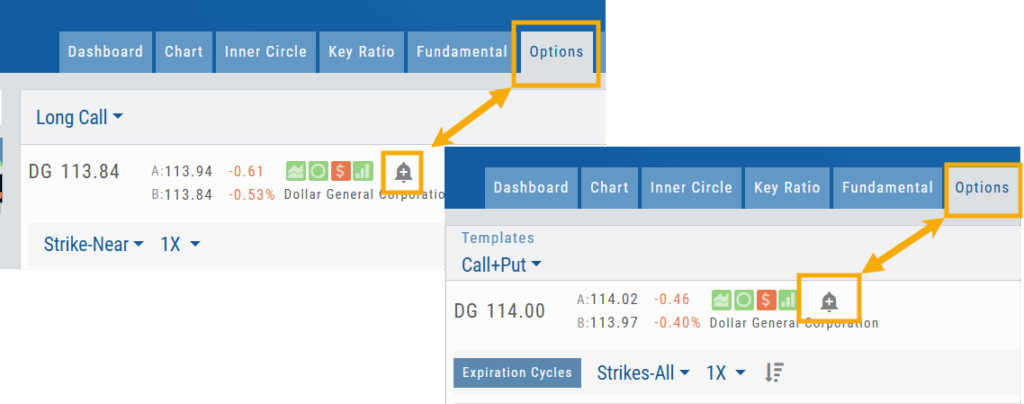

Setting Alerts Enabled from the Option Tab in Research.

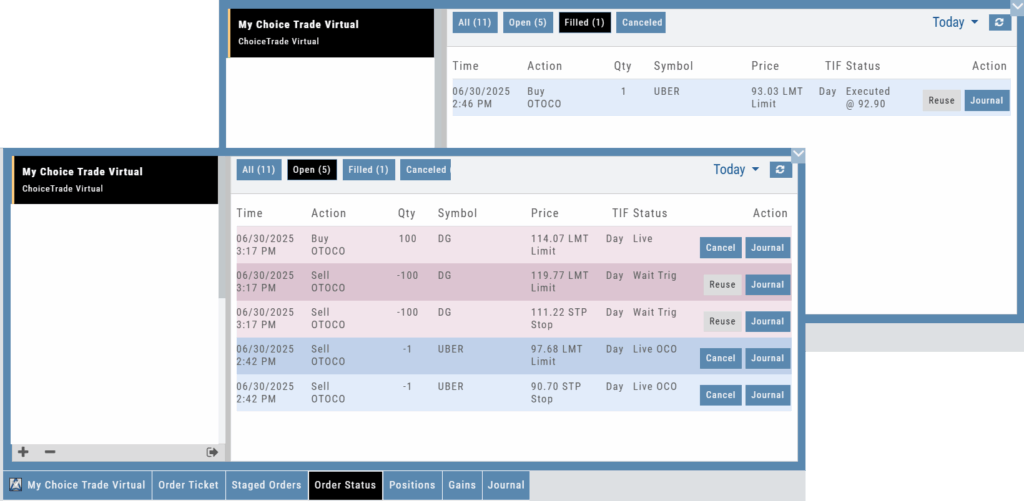

Bracket Order capability in ChoiceTrade Virtual Accounts

Set Alerts from Option Tab

Alerts can be set from the Option Tab – as, in Research, this was the only tab where the Info box on the left side of the screen was not visible.

ChoiceTrade has Bracket Order capability

ChoiceTrade supports Bracket Orders on Stock.

Change Log

- Resolved “Reset Zoom” function on chart vertical expansion

- Alert Expiration is midnight of Expiration day

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: New Zoom Functionality, Chart Panning

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

New Zoom Functionality

To activate Zoom, click on the Zoom button has been added to the icon toolbar:

![]()

- Once activated, the button changes color.

- Click/drag the mouse/cursor over the area of study.

- A “Reset Zoom” button will display when you want to restore the view.

Chart Panning Functionality

Click/drag now pans the time period/price range on the chart – when dragging your mouse/cursor either right/left

Other Additions

- “Choppiness Index” Chart Lower Indictor added

- “Are You Sure You Want To Cancel This Order?” added on Order Status tab

- Clicking on “Quotes By” box (lower right corner) will display source of quotes

Change Log

- Reuse .XSP and .SPX order functionality restored

- Trading Block OTM trade error fixed

- Schwab recognizes BRK.B now

- Resolved Liquidity Range in Screener

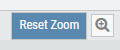

Platform Features Release: Economic Dashboard, Chart Adjustment, Chart Time Period

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the investment/trading decision process.

Economic Dashboard: View chart data from dozens of economic reports. Includes information on why it is important, what to look for, and how to apply the data to trading.

Chart Adjustment: Ability to compress and expand y-axis.

Chart Periods: New look, improved functionality.

Economic Dashboard

Located under the Home/Market Tab, this powerful research tool provides important economic information in chart format.

- Select from 1*, 5,10 or 25-year views

- Allows you to select display order as well as ‘hide’ charts.

- Click on the Title to display: What the data represents, Why it is important, What to look for and How to apply the data in trading

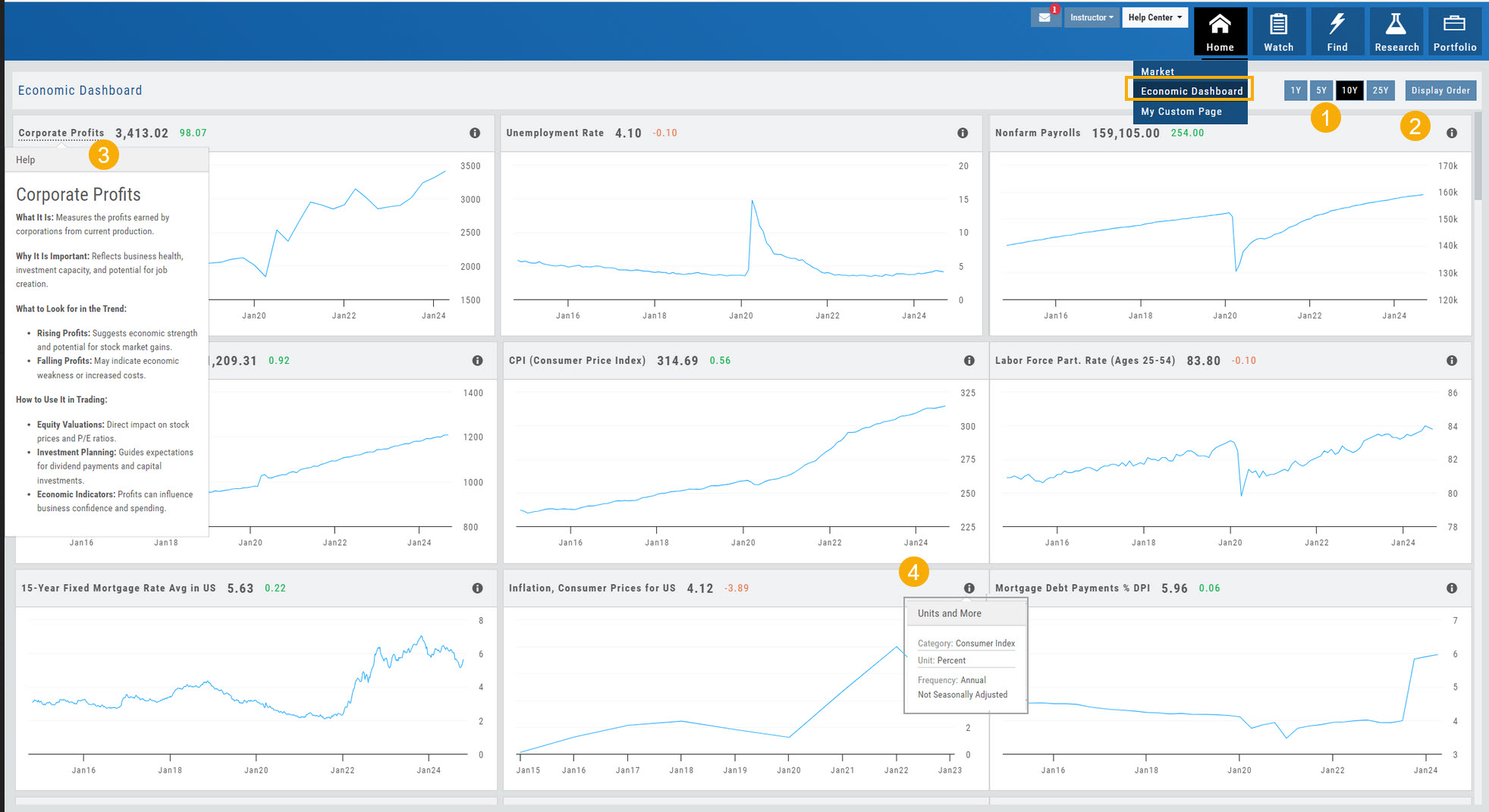

- Provides info on the Economic Report Category (Consumer), what the numbers represent (%, $, units, etc), how Frequent the data is reported (Quarterly, Annually, Monthly, etc)

* Some reports are released annually. 5, 10 or 25 year view are recommended in these instances.

Chart Adjustment

Adjusting the chart’s y-axis gives you more flexibility – whether it’s forecasting, adding notes, viewing current positions, etc.

Simply click you cursor to the right of the y-axis, then drag your mouse/cursor up or down.

To reset, click the ‘refresh’ icon ![]() on the chart toolbar

on the chart toolbar

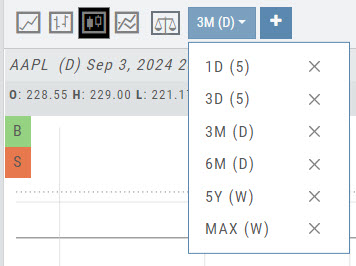

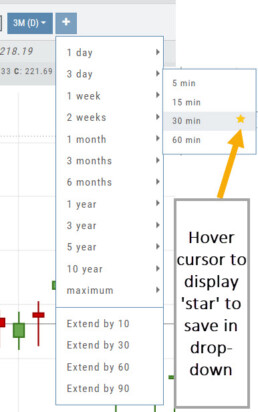

Chart Time Periods

The Chart Period format has been streamlined for a more streamlined look.

The current chart period will be displayed at the top of the ‘favorite’ (saved) drop-down list.

Change Log

- ‘x’ moved to left side of symbol list in Research Tab

- Key Ratio and Compare Views are session sticky

- Seasonal chart corrected to show Price

- Cancel/Reuse display on Credit orders corrected

- Stock data restored on Scan backtest

- Staged Order display on chart functionality corrected

- Schwab Order Ticket close orders corrected

- Trade Station added under “Open New Account”

- Reward/Risk more clearly marked on Trade from Chart

- 1 Day/1 Minute added to Custom Page charts

- Resolved Seasonality percent chart

- Corrected MACD histogram overlap

- 60-minute charts/Schwab conflict resolved

- P/L Insight Graph includes up-to-date data

- Tradier Live Account Ticket credit/debit correction

- Staged Orders/Current Orders display consistency restored

- Screener – Score resulting in 0 candidates resolved

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

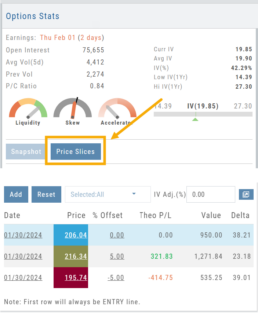

Price Slices - Premium Feature

Price Slices

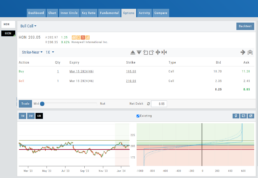

Price Slices allow users to view theoretical outcomes of option positions, while providing the flexibility of changing data points, such as entry price or what the results will be if the stock price moves a specific dollar or percentage amount.

This feature is helpful with building discipline on when to exit a trade if it goes against you.

This feature is accessible when using the Strategy Templates on the Research>Option Tab

The default starting points include:

- Entry Point – shown in Blue in our example.

- High Point – considered Target or Resistance point – shown in Green.

- Low Point – considered Stop or Support point – shown in Red

(Up to 7 Price slices can be added for additional evaluation. See below for more details)

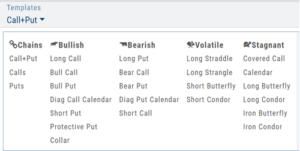

On Research>Option Tab, click the down arrow next to the default “Call+Put” view in the upper left corner of the window to access the Strategy Templates:

Select your Strategy and set up the position:

Quantity, Expiration Date, Strikes

On the right side of the same screen, click the ![]() button to display the default settings.

button to display the default settings.

Using our example:

Entry point is $206.04 (Current Stock Price) shown in Blue

High point – defaults to 5% above Entry: $216.34, shown in Green/Gold

Low point – defaults to 5% below Entry: $195.74, shown in Red

The values are for ‘today’: what the Profit or Loss would be if the stock price were the High or Low price.

The Date, Price and/or % Offset can be manually adjusted, as indicated by the underline – to view different scenarios.

Price Slices – Adjust the % Offset Value

% Offset values were manually changed to 10% and -10%.

The lines on the graph are dynamically updated

Price Slices – Adjust the lines

In this example, the Top and Bottom lines were adjusted on the graph itself.

The new placement dynamically updated the values on the right.

Price Slices – Add, Reset, Go Big

Multiple Position Analysis

We often have more than one position on a particular Stock/ETF, so how can each position, or leg be evaluated?

Platform Features Release: Compare and AI capability added, Tradier Streaming

Join us Wednesday, October 25th for a special Office Hours session for an in-depth review session of the newest enhancements to your platform.

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process.

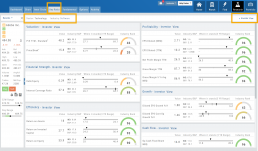

Research Tab/Dashboard:

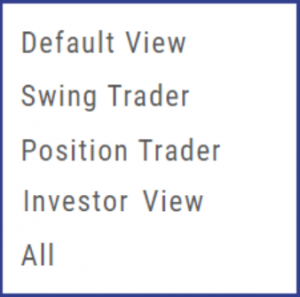

Compare Tab: Provides an at-a-glance comparison of competitors of the same industry group with the ability to change symbols and Swing, Position, or Investor views (also “All” and “Default”)

AI Analysis – AI generated competitive analysis for Large-cap stocks in the same industry group.

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

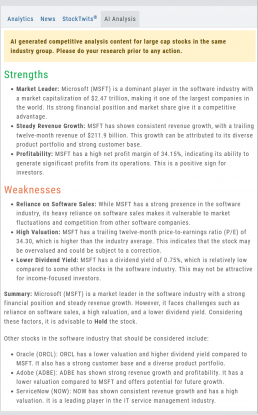

AI Analysis

Located within the Activity Tab in Research, Stock AI analysis has the potential to enhance and streamline the process of evaluating and trading stocks in the financial markets.

Stock AI analysis can quickly process and analyze vast amounts of financial data, news, and market sentiment in real-time. This enables investors and traders to make more informed decisions based on a comprehensive view of the market.

Click on the AI Analysis Tab for the current symbol you are viewing. A progress bar will appear while the information loads for the initial session view only. The information will remain even if you log out and back in again during the same Market Day.

It’s important to note:

While Stock AI analysis offers these benefits, it also comes with challenges and risks, such as overreliance on algorithms, potential biases in data, and the need for continuous monitoring and oversight. Investors and traders should use AI analysis as a tool to complement their decision-making process rather than relying solely on it.

Streaming Quotes with Tradier

Your Tradier Account offers Real-Time Streaming Quotes!

Simply log in to your Tradier account from the platform, and you’ll see the Real-Time quote updates without having to change screens or refresh your browser!

Change Log

- At-the-Money Strike price bolded on Templates

- Long Butterfly template error corrected

- Resolved slider bar/template editing functioning

- Event flag display function preserved

- Slider bar function corrected on template page

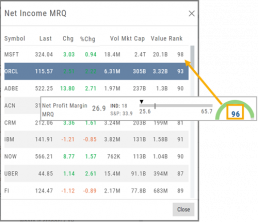

Key Ratio (formerly Valuation)

Key Ratio

A stock’s key ratios provide valuable insights into various financial aspects of the company. They are derived from the financial statements and help investors evaluate the company’s financial health, performance, and overall investment potential.

Assessing Key Ratios may vary by the type of trader one is: Growth Investors differ from Swing Traders who differ from Position Traders. The platform offers different views using Key Ratios for such scenarios.

Key Ratios allow you to not only view the company’s financial health but also view them in relation to others in the same industry, comparing ‘apples to apples’. Having this information allows you to better evaluate potential opportunities.

Deciphering the graphics

The illustrations show how to read the information provided as well as provide context on how the particular stock is performing to the Industry as well as the S&P.

Note: Depending on the Industry and/or S&P values, their tab(s) may not appear on the bar graph.

Select the view that matches your style of trading.

Just like trading, there is no ‘one-size-fits-all’. Those focusing on longer-term trades would not be interested in the same criteria as those who prefer shorter-term positions.

Clickable Key Ratio Value

View other industry stocks’ ranking by clicking on the numeric value as shown.

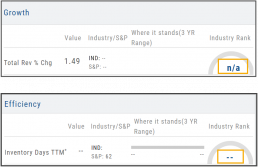

What does “N/A” or “–” indicate?

If a number does not appear in the Ratio criteria, you will see either a “N/A” or “—“

N/A indicates the datapoint is applicable, but the value not currently available

— indicates the data point does not apply, such as Inventory Ratios with Banks

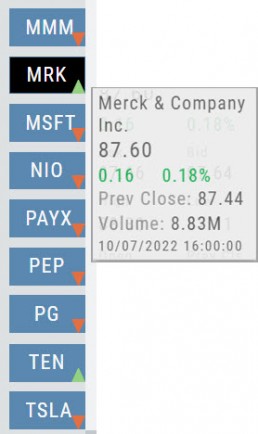

Price Change Indicator

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.