Intraday Trade Finder Scan Updates (Premium Desktop Feature)

Trade Finder Scans are updated every 30 minutes during Market Hours on the Premium Platform. That’s 12 more times than the Standard Platform version, which updates once after the Market opens.

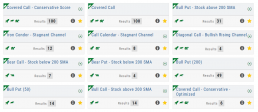

Trade Finder Scans are easily identified with a Rocket Icon in the upper left corner of the Scan box.

Premium Features Release: Intraday Scan Updates, Order Staging, Trade & Journal Sharing

Features Release Notes:

Intraday Scan Updates, Order Staging, Trade & Journal Sharing

Announcing the Premium Features Release of the Trade Tool Trading Platform

These features are exclusive to the Premium Trade Tool Trading Platform and designed to help you make better trading decisions. Trade Finder Scans are updated every 30 minutes throughout the trading day. Order Staging allows Orders to be stored for later consideration. Trade and Journal Sharing provide synergy: share trading ideas/activity with peers or have access to an Instructor’s Trades and Journal activity and history.

Intraday Trade Finder Scan Updates

Trade Finder Scans are updated every 30 minutes during Market Hours on the Premium Platform. That’s 12 more times than the Standard Platform version, which updates once after the Market opens.

Everyone knows the Market fluctuates, sometimes greatly changing direction. The premium scans respond to these changes throughout the trading day allowing you to make more informed trading decisions.

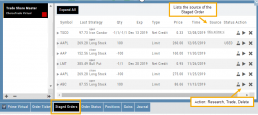

Order Staging

This feature allows the user to save Potential Trades for further consideration to decide the best ones to submit.

Staging is also useful when the Market is closed – to be reviewed when the Market is open to determine if it’s still a high-probability trade.

With one click, you can send to the Research Tab, Move to an Order Ticket or Delete and move on to the next staged order.

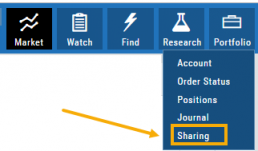

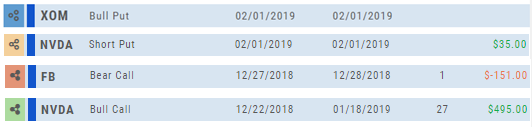

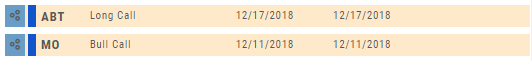

Trade and Journal Sharing

Select “Sharing” under the Portfolio Tab to to access these features of sharing trade ideas with peers or trading groups or have access to an Instructor’s Trades or Journal History.

Trade Sharing allows for potential trades to display in “Order Staging” listing the Source of the Order.

Journal Sharing can be used to follow a Trading Group, Instructors, Peer, Public Accounts as well as Newsletters/Trading Room applications.

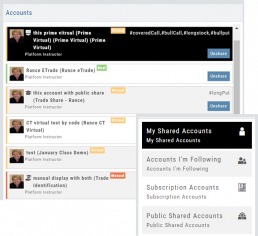

Portfolio>Share is grouped into 4 categories:

- My Shared Accounts – Elect to share Order Staging and/or Journal Sharing

- Accounts I’m Following – Other peers, trading partners, instructors

- Subscription Accounts – Newsletter or Trading Group applications

- Public Shared Accounts – allows access to a Public Directory with performance metrics

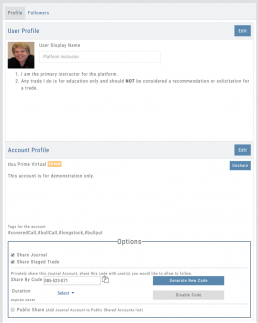

Set up your User Profile:

Add a User Display Name and Information about yourself as it relates to trading.

Account Profile:

Settings are customized per trading account. You can include a summary of what the account is for, tags used, share/unshare.

The Options section allows you to Share Journal and/or Share Staged Trades from this Account.

For Private Share of the Journal Account, set up a code to share with select user(s).

Duration allows you to set how long the Share Capability is active: Single Use, Hour, Day, Week or Until Disabled.

Finally, you are able to set up a Public Share option.

Features Release: E*trade Brokerage added, Portfolio Greek View, Enhanced Journal Marking

Features Release Notes:

E*trade Brokerage added, Portfolio Greek View, Enhanced Journal Marking

We’re pleased to announce the latest Release of the Trade Tool Trading Platform.

The addition of E*Trade Brokerage allows more choices for users to trade directly from the platform, while linking up to 2 months’ of trading history. The extensive Journal features allow users to monitor and analyze trading profitability.

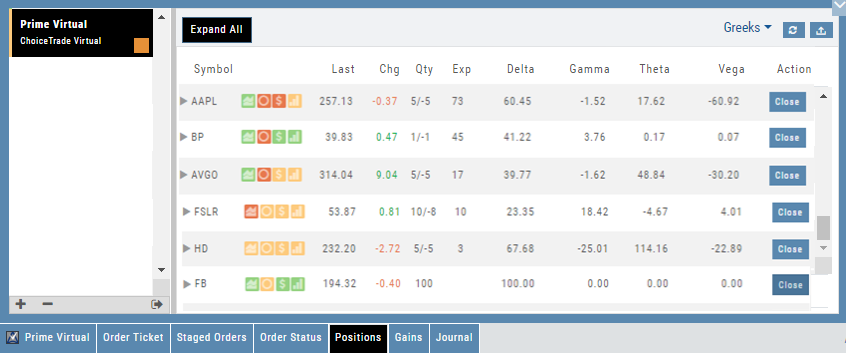

The Positions Tab now offers Greek View for an additional resource of active trade analysis.

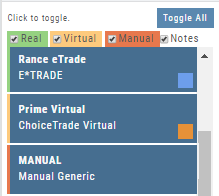

The Journal Tab makes it easier to identify/select the type of accounts to review/analyze by colorizing the summary list to match the account tabs.

E*trade added to platform

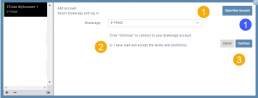

Adding E*Trade to the Platform is easy as 1 – or – 1,2,3!

1. As a New Account, simply click the “Open New Account” Button (as shown) and follow the steps to open your new trading account.

To link an Existing Account:

1. Click on the drop-down box, select E*Trade

2. Read and Agree to Terms and Conditions (check box)

3. Click “Continue“

Greek View in Positions Tab

Analyzing Trades from the Positions Tab is now easier with the new Greek View.

Enhanced Journal Account Identification

The account tabs already have vertical color bar to help identify the type of account:

Green = Live

Yellow = Virtual

Red = Manual

Now the summary tab, above the account list, has clearer markings for the type of account(s) you wish to review.

Change Log:

- Bid/Ask added to Quote Bar (Research Tab)

- Corrected Closing error on Mobile App

- Resolved buffering in Scans>Options>Chain

- Added HR line to HeatMap filter display

- Chart sizing with Compare/Seasonal resolved

- Navigating Chart Compare function corrected for Intraday to Daily charts

- Journal note container display corrected

- Option Strike Display – Near, More or All settings are now session sticky

- Positions $ Change decimal places show .00

- Exporting Positions includes Price

- z-score included in container

Export Reports (Desktop)

Clicking on ![]() located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

located on the upper left corner of the Positions and Gains tabs allows you to export that information as a .csv file.

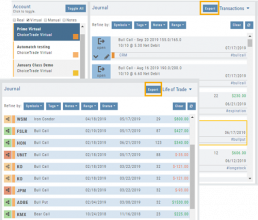

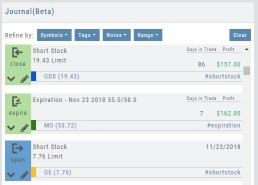

The Journal give you the ability to export reports in a PDF file on your desktop platform. But that’s just the beginning.

You can export from the Transaction or Reconciliation view filtered by Account, Symbol, Tags, Notes and/or Date Range.

Life of Trade View also allows you to filter by Order Status in addition to the above criteria for even more focused report. Only want to print Closed Trades? Want to see how many trades are Unmatched? Select those filters.

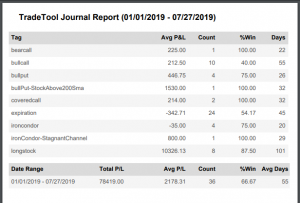

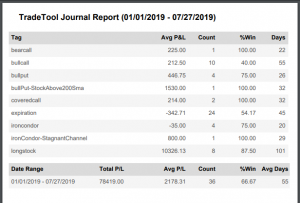

The top of your Journal report displays the Tag Summary based upon the account(s) and filtering criteria selected.

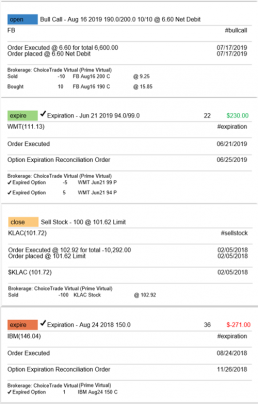

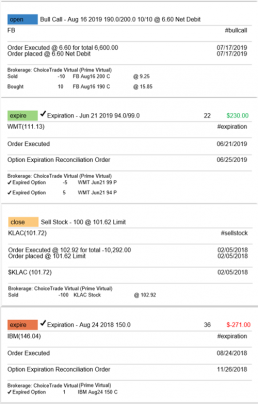

The trade detail report displays the status, Open, Close, Expire with a color code of the trade: Blue=Open, Green=Profit, Red=Loss, Yellow=Unmatched.

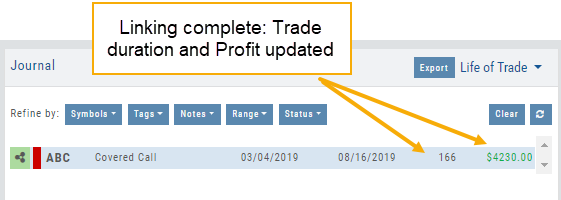

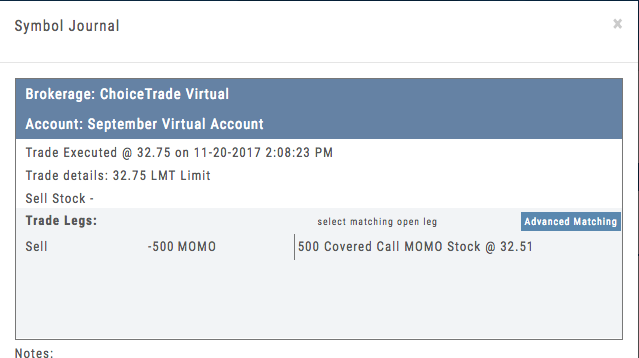

Link Trades in Journal

Trades can easily be linked in the Journal. This is helpful to keep related trades grouped together for easier tracking and analysis.

Some common applications include:

- Covered Calls – keeping stock and selling Calls with different Expirations

- Adjustment/Repair Trades

- Other previously Unmatched trades

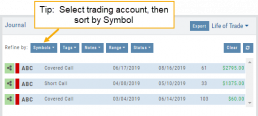

This feature is best used in the Life of Trade View in the Journal.

The following steps will allow you to Link Trades: ![]()

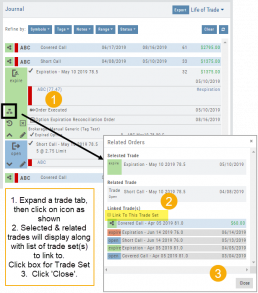

1. After selecting your account and sorting by symbol, expand one of the trade tabs you want to link to another trade group or set.

Click the ‘Link Icon‘

2. A pop-up window will list the Selected (Expanded) Trade, any related trade and Available Trade Sets for that symbol in that account.

Note: You can link trade sets both prior to and following your current, selected trade.

Example: You want to link a May 2019 expired Call to April 2019 and June 2019 Covered Call trade set.

3. Click “Link To This Trade Set” for trade set(s) to link selected trade to, then click “Close“.

In this example, we linked an Expired May 10 2019 short call to an April and June Covered Call trade set.

After linking the trade, notice the total Profit (Loss) Amount updated, but the trade duration did not.

This is because the May Call falls in between the original April trade entry and the June expiration.

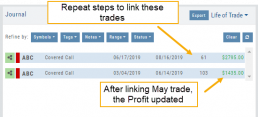

If you have more trade sets to link, repeat the previous steps as outlined.

Final note: If you link a trade in error, simply expand the same trade tab and ‘uncheck’ the Link This Trade Set box.

Features Release: New Mobile Experience, Watchlist Management, Journal Export

Features Release Notes:

New Mobile Experience, Watchlist Management & Journal Export (Desktop), Option P/L Redesign, Position Default View, Research Tab addition

We’re pleased to announce the latest Release of the Trade Tool Trading Platform.

The New Mobile App has been redesigned and now aligns closely to the desktop platform.

Several Features are optimized for Landscape View: Charts, Journal and Option Templates.

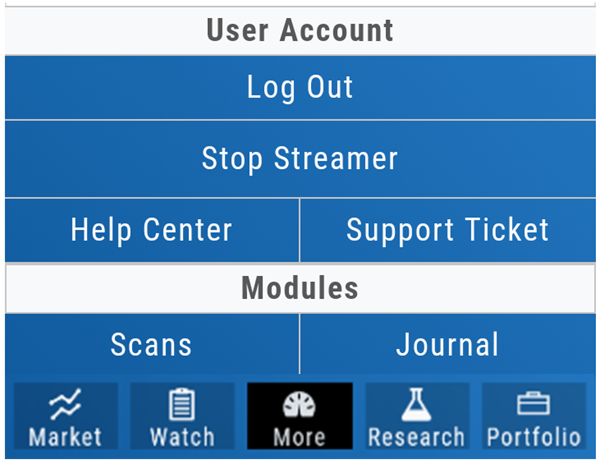

“More” houses several key features including: Scans and the Journal. You can access the Help Center and create a Support Ticket from the location as well.

The Watchlist Tab now offers List Management/Modification features from single icon.

You can now Export Trades from the Journal on the Desktop platform.

The Option P/L table has been restructured with features moved or enhanced for simplification and maximizing space.

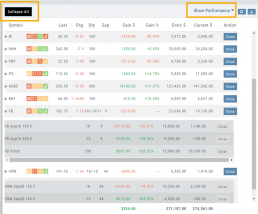

The Position default view is Share Performance and Expand All – multi-leg trades expanded for an easier view on active trades.

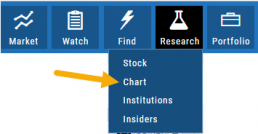

The Research Tab offers a one-click step to view Charts, in addition to keeping other selections.

New Mobile App – Available from the App Store!

The Mobile App has been completely redesigned: Easier navigation with the display, features and functions resembling the desktop version make the New Mobile App more user-friendly.

The Mobile App has been completely redesigned: Easier navigation with the display, features and functions resembling the desktop version make the New Mobile App more user-friendly.

Some features are optimized for Landscape view, including Charts, Option Templates and Journal.

“More” houses the Scans and Journal plus you can access the Help Center and submit a Support Ticket from this location.

Click below to download to your iPhone or Android Mobile

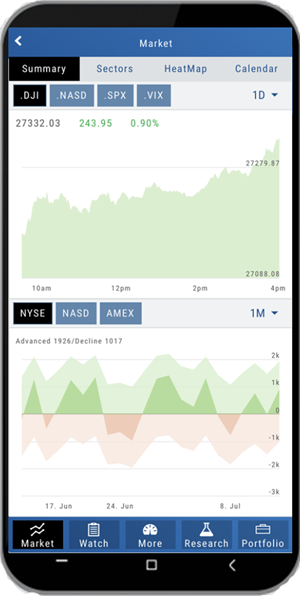

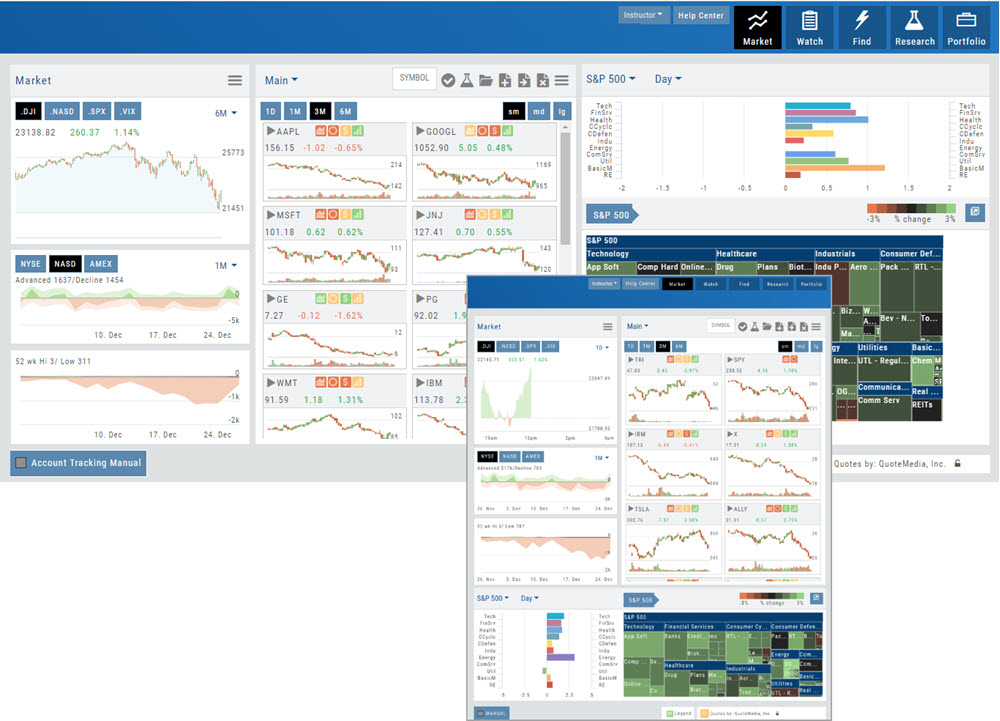

Market Tab

The Market Tab is organized and easy to navigate as it mirrors the desktop version. Select the time-frame and scroll down the screen to view the Summary by Index. View Advanced/Decliners and 52 Week Hi/Low for Exchanges by 1, 3 or 6 Months or 1 Year.

The Market Tab is organized and easy to navigate as it mirrors the desktop version. Select the time-frame and scroll down the screen to view the Summary by Index. View Advanced/Decliners and 52 Week Hi/Low for Exchanges by 1, 3 or 6 Months or 1 Year.

Access Sector overview, just as in the desktop version. The Heatmap features and functions allows you to drill-down by Sector, Industry or Company/ETF and timeframe. From here, navigational icons allow you to send a Symbol to Research or to a Watchlist.

Calendar functions in similar fashion to the desktop version. View candidates in List or Tile View. Add to an Existing or create a New List. Selecting a particular symbol and rotating the screen to Landscape view will display the Chart. Return to Portrait view, to go the symbol’s Dashboard in Research.

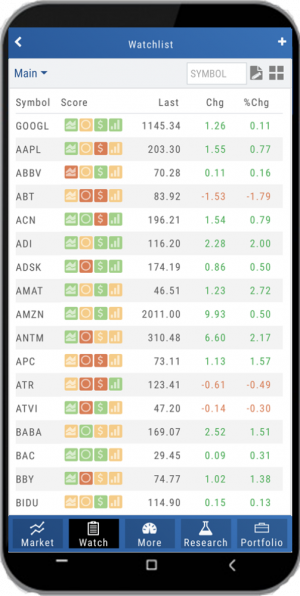

Watch Lists:

Watch Lists:

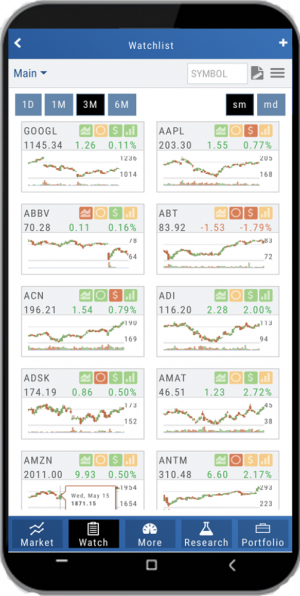

Mobile offers List View and Tile View

List View allows you to scroll to see all data points.

Tile View allows you to select Small or Medium sized tiles

If you select a Symbol then rotate the device to Landscape, the chart will appear.

Both versions allow you to Manage/Modify the selected List.

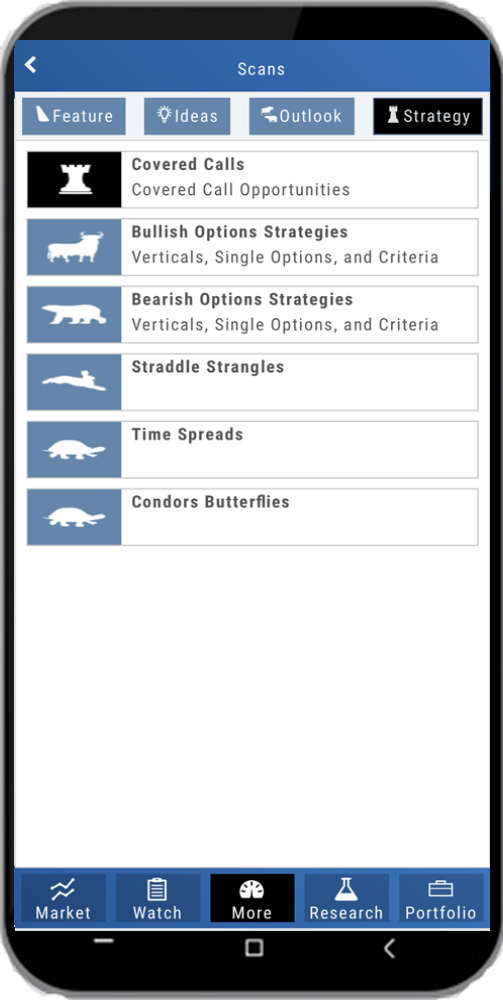

More Tab: Scans, Journal, Help Center & Support Ticket

The Mobile redesign focused on accessibility. The “More” Tab houses major features eliminating layers of navigation.

Access the Scans. TradeFinder Scans can be sent to the Options Template for further analysis. Use the Rolling Icons to make adjustments according to your education’s guidelines. Of course, you can trade directly from this tab in your Live, Virtual or Manual account.

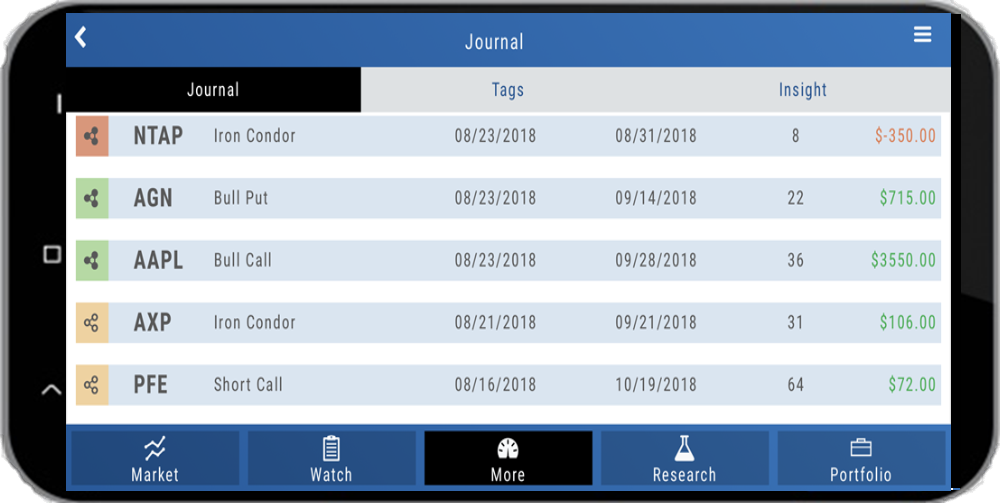

Journal provides the Life Of Trade View, Tags and Insight Graphs– use the Menu Bar in upper right corner to change Accounts.

Journal provides the Life Of Trade View, Tags and Insight Graphs– use the Menu Bar in upper right corner to change Accounts.

Help Center – Access the User Guide, Quick Guides and Video Library

Support Ticket – Click to submit question about or assistance with the app or desktop platform

Journal provides the Life Of Trade View, Tags and Insight Graphs– use the Menu Bar in upper right corner to change Accounts.

Research Tab:

The Mobile Dashboard provides the overview of the Stock/ETF. Simply scroll to view the Research components: Technical, Inner Circle, Valuation (stock) and Fundamental (stock).

The Mobile Dashboard provides the overview of the Stock/ETF. Simply scroll to view the Research components: Technical, Inner Circle, Valuation (stock) and Fundamental (stock).

The feature-rich Chart tab allows you to select Time-Frame, chart profile, add indicators, save new Chart Profiles, etc. Rotate device to Landscape to view a larger Chart View.

Strategy Templates are found in the Option Tab with the Rolling Icons to make adjustments according to your guidelines.

Activity houses previous trade tab entries. News provides detailed articles mentioning or highlighting your current Stock/ETF research candidate.

Journal Functionality

On the Mobile App, your trading accounts are accessed via the Portfolio Tab.

The Journal is found under the “More” Tab which maximizes the features and functionality as found on the desktop version. Click on the Menu Bar (upper right corner)to select Account. You can also filter by specific Symbols, Tags or Date Range.

The Journal displays the Life of Trade for the account and any other filters you select. Rotate to Landscape to optimize view.

Tags and Insight Tabs will also display results from your selected Account and filters to provide feedback on strategies, scenarios and even symbols that have been profitable for you as well as identify those that haven’t been. This allows you to adjust your trading accordingly, perhaps by practicing the less-than-profitable trades in a Virtual Account.

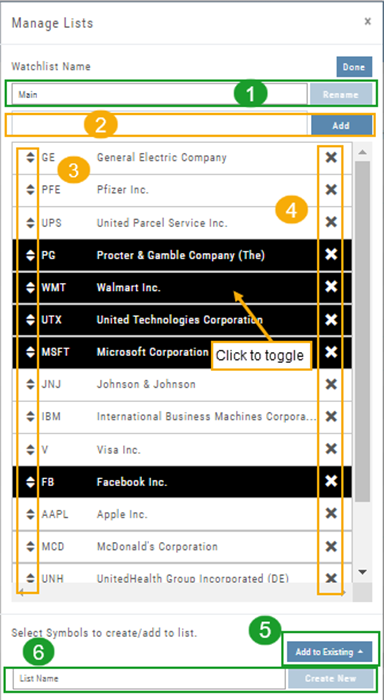

Watchlist Management

Watchlist Management offers the following Symbol and List Management capabilities in one location in Mobile and Desktop.

- Rename currently selected Watchlist

- Add Symbol(s) to the current Watchlist

- Use Up/Down arrows to Drag/Rearrange Symbols in selected List

- Use the ‘x’ to remove Symbol from existing List

- Select/highlight one or more Symbols to add to another Existing Watchlist

- Select/highlight one or more Symbols to Create a New Watchlist

Bonus! Keep your Watchlist sorted by using this feature:

- Sort by any Heading (Example: Price, High to Low)

- Click on Manage Icon, then click “Done” at top of the screen

This setting will be ‘sticky’ until you change it

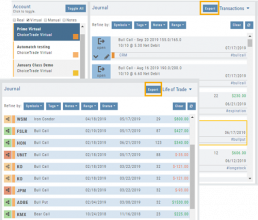

Export Trades from Journal – Desktop

In addition to exporting trade report information from the Positions and Gains tabs, you can now do so from the Journal in a PDF file on your desktop platform. But that’s just the beginning.

You can export from the Transaction or Reconciliation view filtered by Account, Symbol, Tags, Notes and/or Date Range.

Life of Trade View also allows you to filter by Order Status in addition to the above criteria for even more focused report. Only want to print Closed Trades? Want to see how many trades are Unmatched? Select those filters.

The top of your Journal report displays the Tag Summary based upon the account(s) and filtering criteria selected.

The trade detail report displays the status, Open, Close, Expire with a color code of the trade: Blue=Open, Green=Profit, Red=Loss, Yellow=Unmatched.

Option Tab Changes

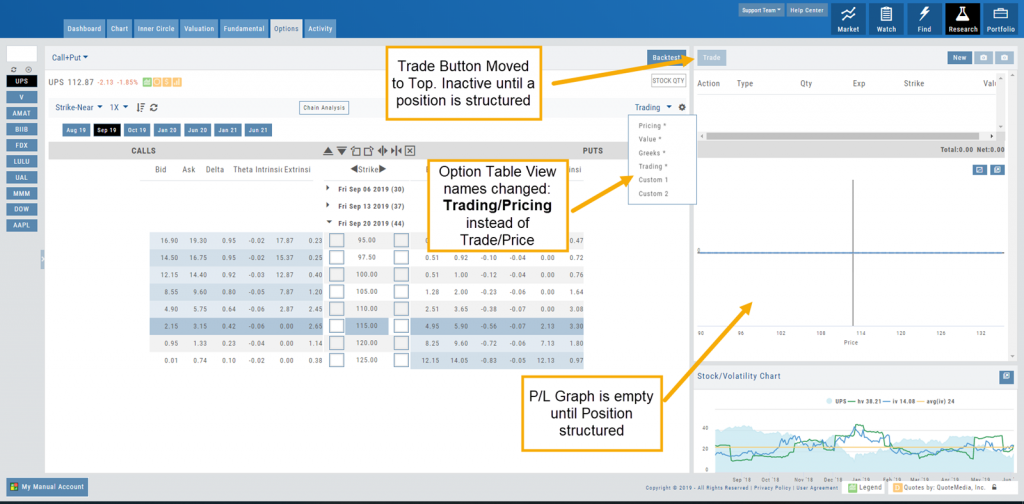

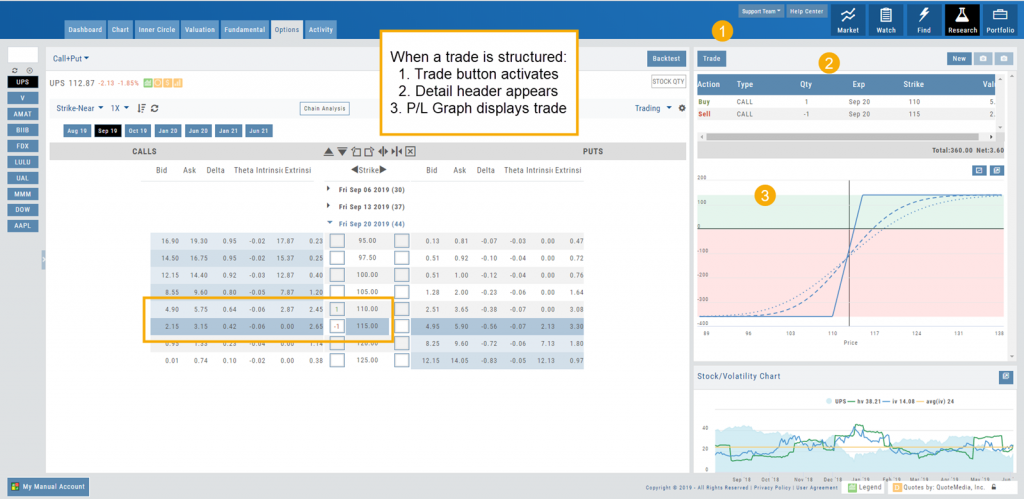

The right side of the Option Tab table has been redesigned and simplified. This offers an easier view of the potential trade(s) and eliminates confusion of how to submit a trade from this table.

On the Option Chain, when there is no position entered:

1.Trade Detail box is blank.

2. Trade button is deactivated

3. P/L graph is blank

In addition, the Trade button was moved to the top of the Trade Detail Box. Two Option Table View names were changed to reduce confusion in understanding how to use the Option Table: Trade to Trading & Price to Pricing

When a Position is entered on the chain:

Trade Button is Activated.

Trade Detail Header appears

P/L Graph displays Trade

Position Tab Default

The Position Tab default view displays Share Performance and Expand All for trade detail on multi-leg positions for a high-level quick view.

Click on “Collapse All” to close all expanded positions.

Change the Position View by clicking on the arrow next to the current view listed.

Research Tab Addition

You now have another way to quickly access Charts: Click on the Research Tab, then select “Chart”.

Clicking “Stock” from the Research tab will still take you to that symbol’s Dashboard which includes the Chart Tab.

The Technical Score icon will also take you to the chart.

Change Log:

- Order Ticket drop-downs allow to click on field to change criteria

- Corrected Strikes loading sequence in “Backtest” mode

- Manual Trade Ticket date reset correction

- Order Ticket add-on buttons accessibility

- Template populating issue on TradeFinder scans resolved

- Search Scans field corrected

- Position Tab container size optimized to reduce need for horizontal scrolling in all views except “All”

- Chart compression resolved

- Crossover arrows on low price stocks functions correctly

Life Of Trade Icon/Color Codes

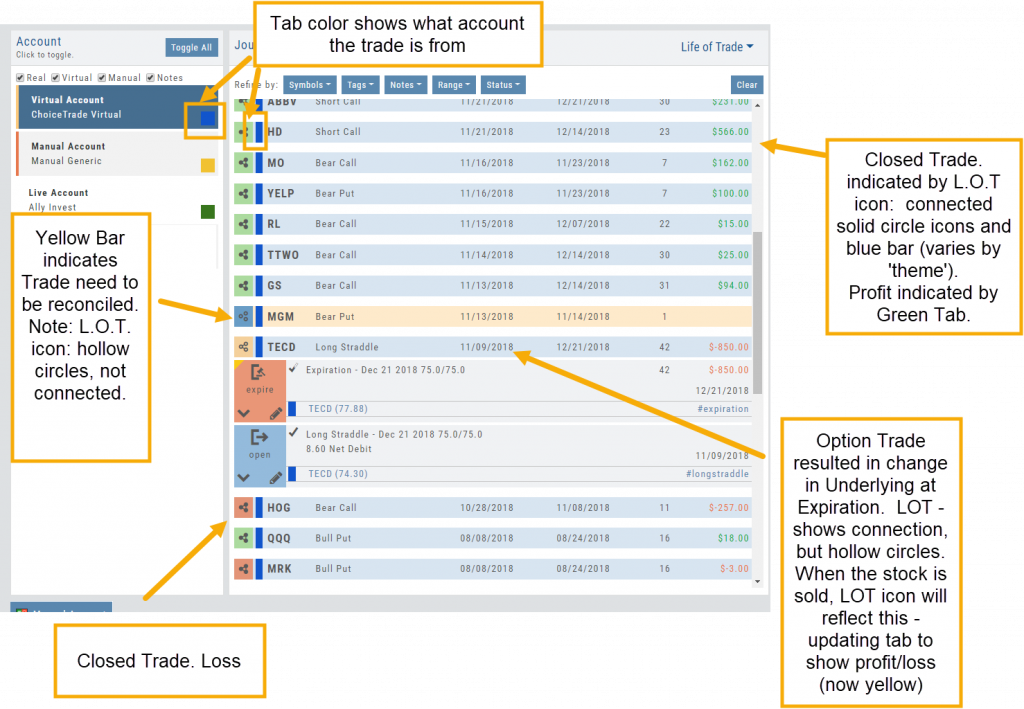

The Life of Trade Icon and Tab/Trade entry color show help you identify the status of your trades.

Icon Display and Color Coding

Note: Orders are automatically updated when you login to your trading account, whether Live, Virtual or Manual

Blue – Hollow Dots – No Connection

Blue – Hollow Dots – No Connection

Active Order or Open Original Trade

Yellow – Hollow Dots – Open Connection

Yellow – Hollow Dots – Open Connection

The Original Trade has been adjusted, but is still an Active Trade

Yellow – Solid Dots – Closed Connection

Yellow – Solid Dots – Closed Connection

The Trade and any Adjustments have been closed, but one or more entries need to be

Matched or Reconciled

![]()

Green – Solid Dots – Closed Connection

Closed trade – which includes any adjustments – resulting in a Profit

![]()

Red – Solid Dots – Closed Connection

Closed Trade – which includes any adjustments – resulting in a Loss

Trade Entry Lines

Note: Depending on the Theme used, the following colors will vary. The bar color denotes whether the trade needs action – such as Reconciliation or Matching to another trade.

Blue Line

No action needed on these entries. The colored left tab shows the status of each trade:

Blue: (Open Trade, hollow dots, no connection), Yellow: (Adjusted, hollow dots, partial connection), Red: Loss (Closed, solid dots, connected), Green: Profit (Closed, solid dots, connected)

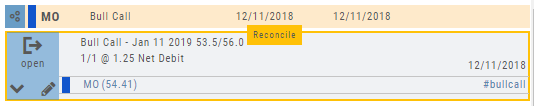

Yellow Line

Action is needed on these trade entries. The Trade may have gone through Expiration and needs to be Reconciled. By clicking on the Trade Line, the Trade Tab will display:

Once the action is completed, the entry will update on all Journal tables including the Tags, P/L Graph & Insight tabs.

It is important to reconcile expired trades to properly display profit and provide updated analytical information on your trading success.

Features Release: Life of Trade Journal View & Enhancements, Go Big Chart View.

Features Release Notes:

New & Enhanced Journal Features, ‘Go Big’ Chart view, Exchange List update.

We’re pleased to announce the latest Release of the Trade Tool Trading Platform. The Journal has an updated look and is more intuitive from automatic syncing and improved trade-matching. Users can now add notes immediately upon placing orders vs. having to navigate to other areas of the platform to do so. The New Journal Features and Functions are user-friendly, allowing more analytic capabilities.

Charts have a ‘Go Big’ button to maximize the chart size. The Exchange list has also been updated on the Dashboard in the Research Tab.

Life Of The Trade

Introducing the new “Life of Trade” View in the Journal.

Trades are grouped by Symbol, making it easier to follow the trade from Open-Adjust-Close – along with any Assigning/Exercising of the underlying stock.

This view further allows you to sort by Account, Symbol, etc for more targeted analysis.

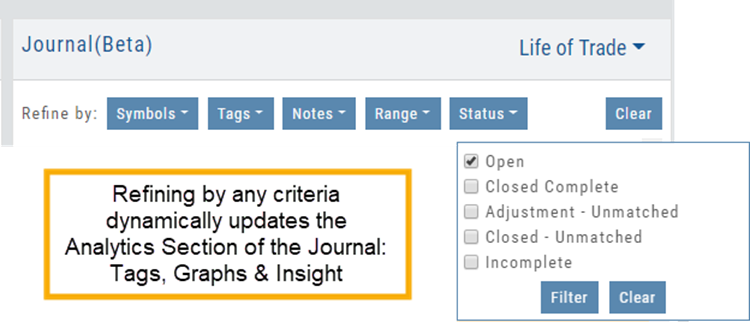

Refine Journal Entries by ‘Status’

‘Status’ provides an additional avenue to refine your Journal updating and analysis in the Life of Trade view.

- Open – current, active trades without prior change in underlying. Identified by Blue Tab.

- Closed Complete – all legs of trade, including any adjustments or change of underlying, have been closed and matched. Identified by Green or Red tab (Profit or Loss).

- Adjustment – Unmatched – the original trade has been adjusted, but the changes have not been reconciled. This entry will be identified by a Yellow tab.

- Closed – Unmatched – the original trade, including adjustments and change of underlying are closed, but one or more components of the trade need to be matched. Identified by yellow tab.

- Incomplete – the original trade resulted in change in the underlying stock being Assigned or Exercised.

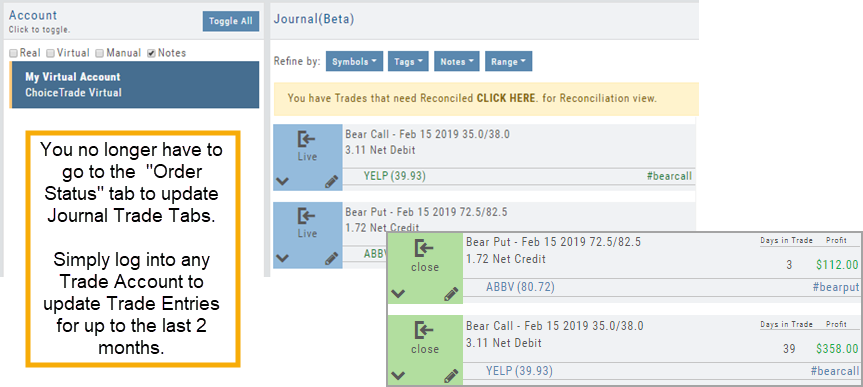

Automatic Account Syncing – Up to 2 Months

When you add your brokerage account to the platform, make sure to select the ‘Auto-Journal’ Feature enabled. By doing so, the system will automatically insert orders/trades from the last two months into the platform’s Journal.

After the brokerage is added, any trade executed on your brokerage website instead of through the platform portfolio will also be captured in the two-month time period.

Finally, there is no need to go to an account’s Order Status tab to update Journal Trade Tabs. Simply log in to the account from the Account Summary Tab. Trade tabs will automatically update for the last 2 months!

Journal Tile View includes more Trade Detail

The new Insight Tab in the Journal offers visual feedback on your trading activity. The graphs are responsive to and update automatically based upon criteria selected including:

- Trading Account

- Symbol(s)

- Tags

- and/or Date Range

The top graph shows the overall activity, as well as Winners & Losers.

The middle line graph displays profitability or losses over the date range selected.

The bottom bar graph shows profit/loss by trade in the selected date range.

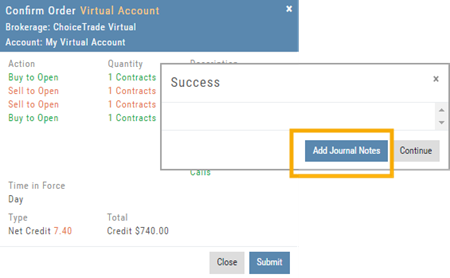

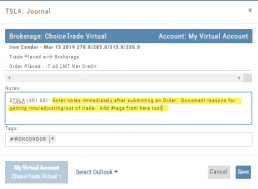

Add Journal Notes Upon Submitting Orders

Users can now document details on Entering, Adjusting or Exiting a Trade quickly and easily after submitting an Order.

Upon successfully submitting an Order, simply click “Add Journal Notes“:

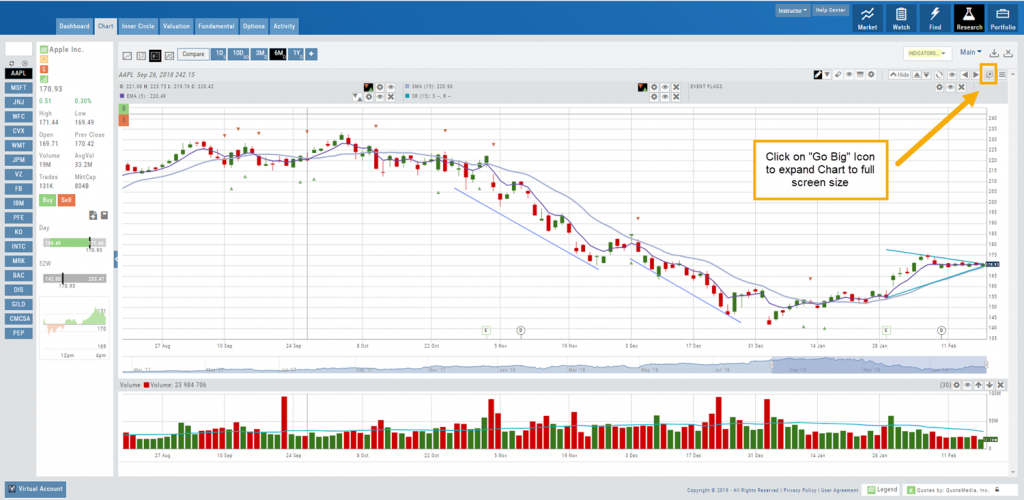

‘Go Big’ Feature for Charts

In addition to the ability to adjust Chart Height and Width, the Charts can now ‘Go Big’ and expand to full screen size.

Click ![]() as shown below:

as shown below:

The Buy/Sell icon, ![]() , located at the upper left of the screen allows you to trade directly from the full view. To return to the regular chart view, simply click the ‘Go Big’ icon or ‘esc’ on your keyboard.

, located at the upper left of the screen allows you to trade directly from the full view. To return to the regular chart view, simply click the ‘Go Big’ icon or ‘esc’ on your keyboard.

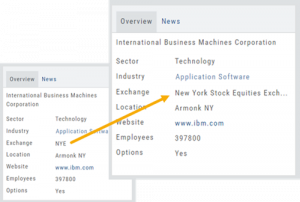

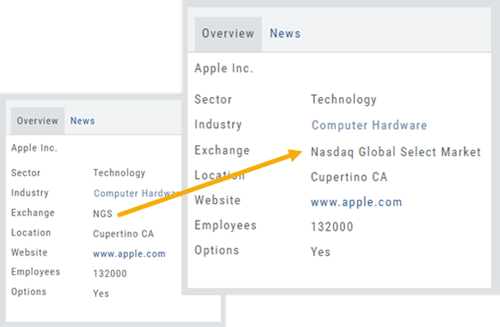

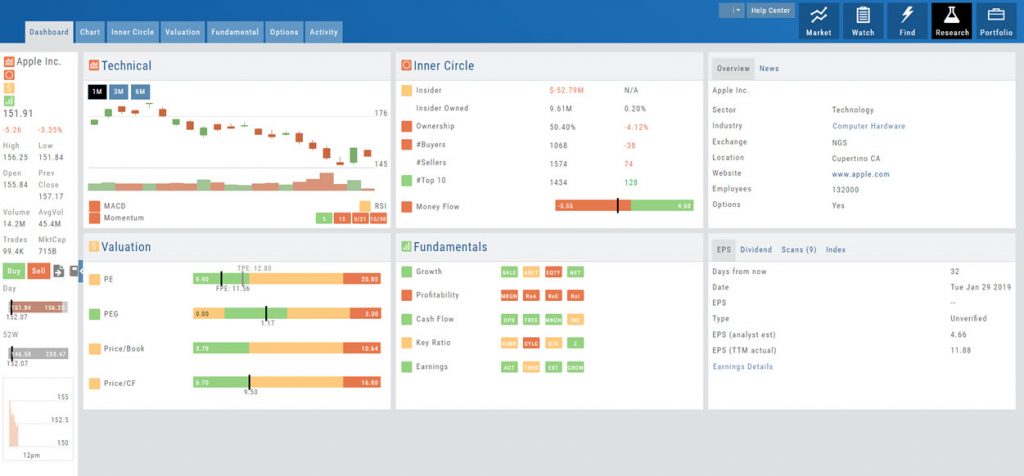

Exchange List updated

The Exchange listed in the Company Overview section of the Dashboard now lists the name of the Exchange, instead of the abbreviation.

Change Log:

- Chrome – Version 72 – work-around to correct display issues caused by bug in browser’s latest Release

- Sending Symbols from Heatmap to Watch Lists has been corrected

- Contrast issues on Dark Themes addressed

- 404 Error resolved for Dashboard>Scans

- Cancelled Trades will not be included in Life Of Trade queries

- Sending candidates from Find>Scans to Research is resolved

- Manually entered entry price will not result in an Unmatched trade

Features Release: Responsive & Adaptive, Journal Enhancements, Tile View Sizes

Features Release Notes:

New Scans, Journal Summary, Analytical Graphs, Earnings Sort feature on select Scans

We’re pleased to announce the new version of the Trade Tool Trading Platform. Previous Releases provided the framework for new features and enhancements made available on this Release.

Cutting-edge technology enables the platform to Adapt and Respond to available space on Desktop and Tablet devices upon which the platform is viewed.

Platform utilizes Adaptive Technology

The platform now utilizes “adaptive” and “responsive” technology. This means the platform will take advantage of the screen size made available to it.

If you have a larger screen, it will stretch the content to fill. The result will be longer, viewable watch lists, options chains, and vertically filling content.

Tablets will stack content which creates a much better experience in Portrait View.

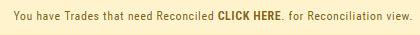

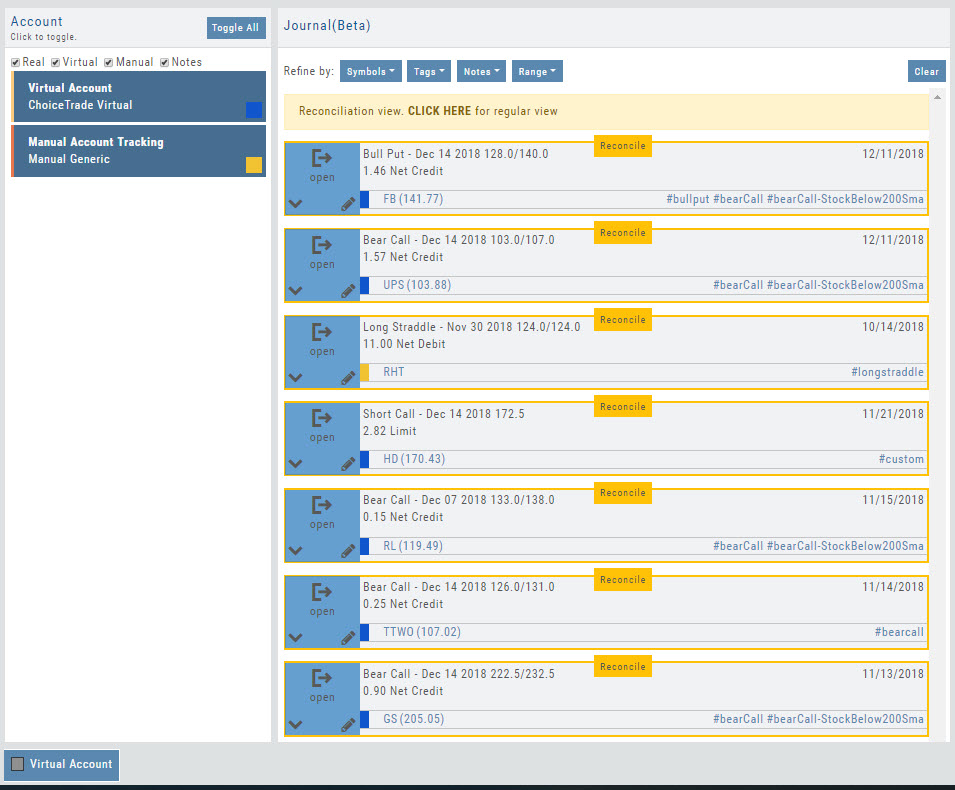

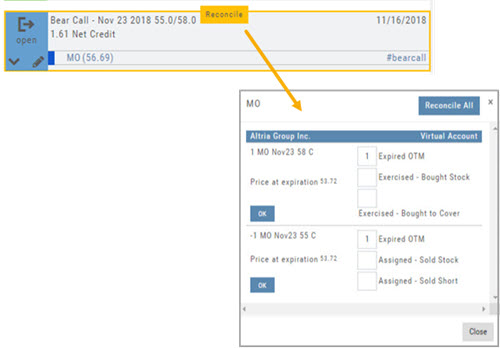

Enhanced Reconciliation in Journal

Reconciling trades is important and necessary for the Journal to accurately display Analytics including Win/Loss ratio. Analysis can be done by Symbol, Account, Tags, Date Range by using the ‘Refine By’ button selections.

Now it’s easier to review such trades. The following notice appears, giving you the ability to view all trades in the selected account(s) needing reconciliation.

Clicking “Reconcile” on the individual trade tab allows you to confirm the outcome of the trade:

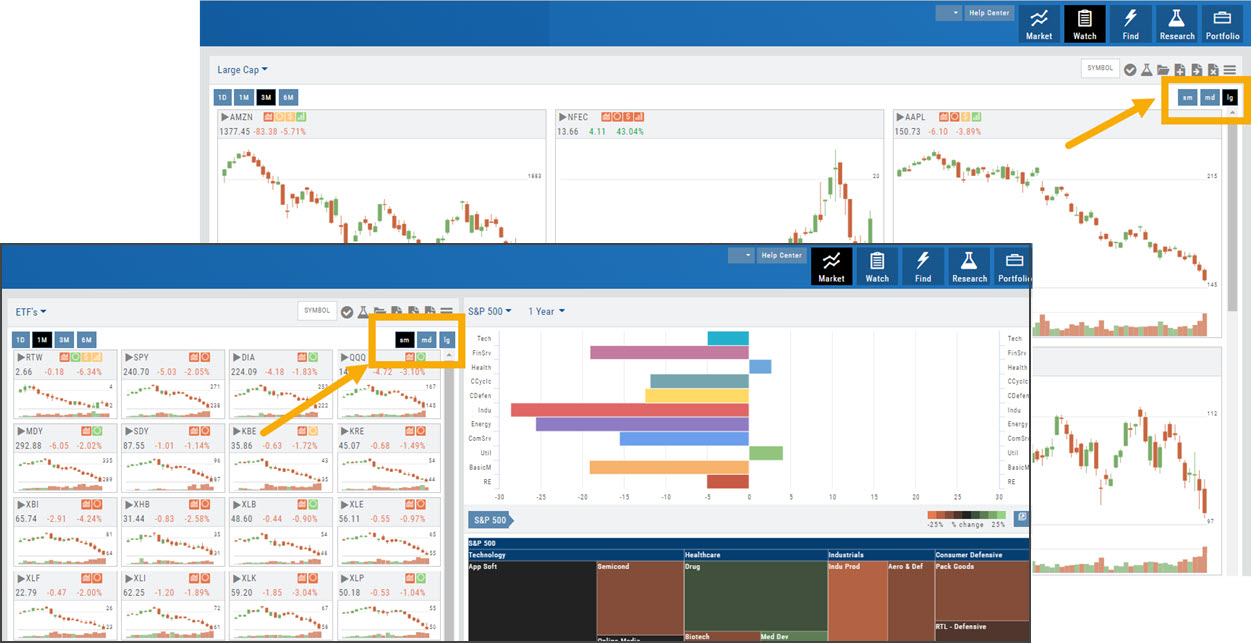

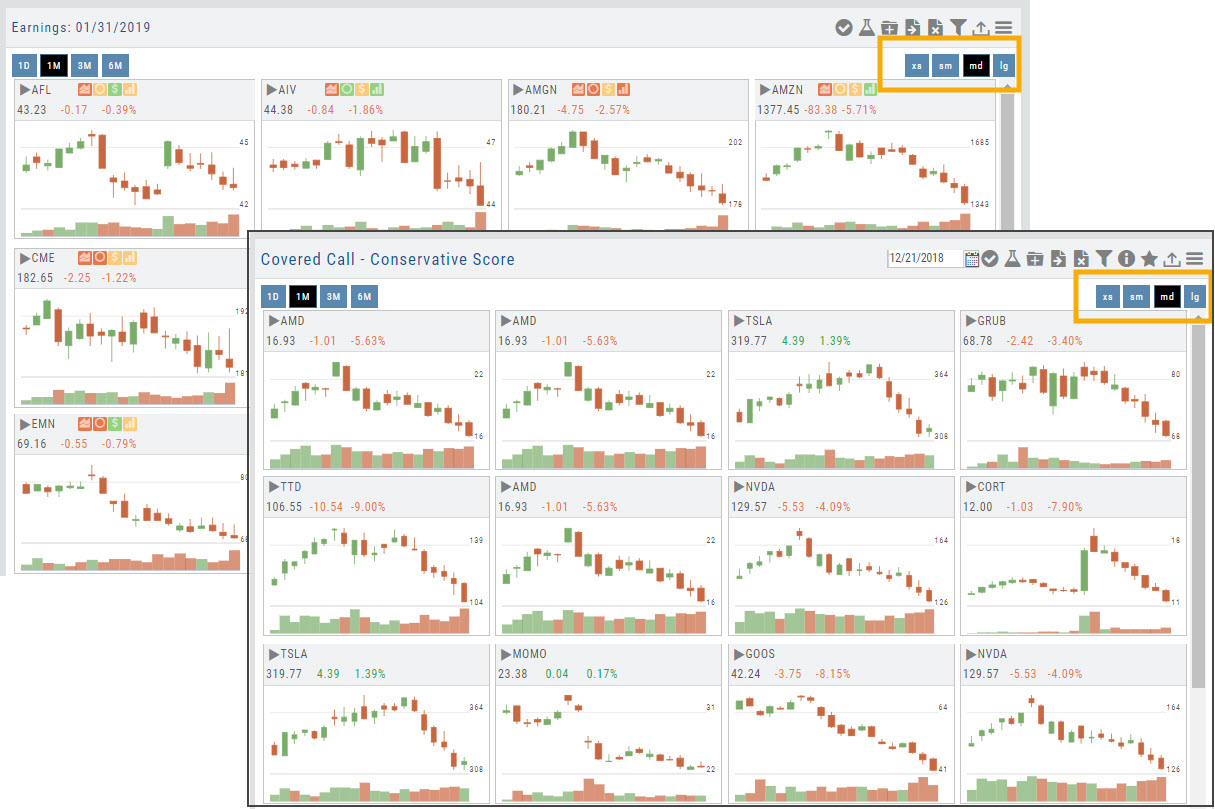

Tile View Size selection available throughout Platform

Tile View offers size options throughout the platform. Size and Periodicity buttons are ‘locked’ at the top of the lists for continued access. The platform’s new Adaptive and Responsive technology adjusts the number of tiles per row based on available space

Select “Small”, “Medium” or “Large” on Market and Watch Tabs

Scans and Earnings/Dividends Calendar offer 4 sizes: Extra Small to Large.

New “Insight” Tab in Journal

The new Insight Tab in the Journal offers visual feedback on your trading activity. The graphs are responsive to and update automatically based upon criteria selected including:

- Trading Account

- Symbol(s)

- Tags

- and/or Date Range

The top graph shows the overall activity, as well as Winners & Losers.

The middle line graph displays profitability or losses over the date range selected.

The bottom bar graph shows profit/loss by trade in the selected date range.

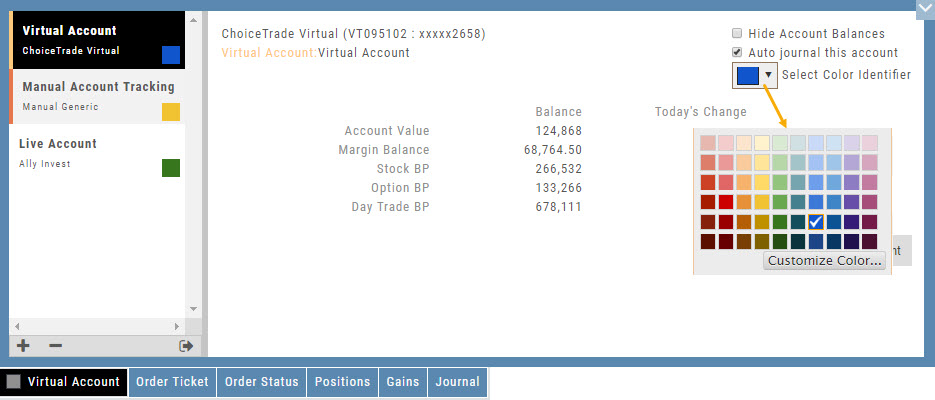

Color Coding Accounts

Each trading account can be assigned a unique color from the Account Summary Tab. Each Trade or Order entry within this account will display this color tab in the Journal for easy account identification.

Journal Activity Line

The Journal Activity Line is customizable. Once this indicator is added to your Chart Profile, simply click the Gear icon ![]() to adjust settings:

to adjust settings:

Enter ‘Line Width‘ as well as other adjustments you wish to make on this Indicator , including Open/Close color/size and Profit/Loss line colors.

When completed, click “Add” to close the Journal Display Box and update display.

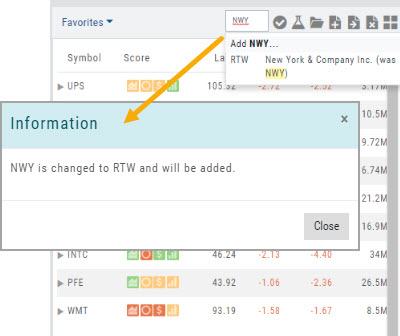

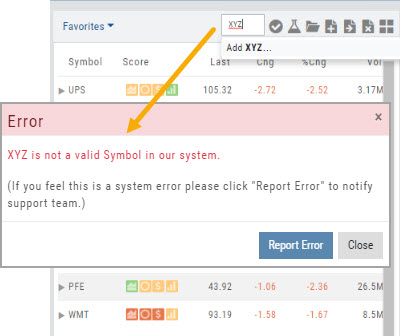

New Symbol Verification

Symbols will automatically update if an invalid symbol is entered and a new symbol exists.

If a symbol is not recognized, an Error notice will popup notifying the user of this. By clicking “Report Error“, the system will automatically research, and, if valid – add the symbol to the platform.

This process helps eliminate incorrect symbols from being added to the platform.

“Go Big” Button added to Strategy Template

Trade Detail of a Trade Finder Scan now includes a “Go Big” option button on the P/L graph.

This allows for not only easier viewing on smaller display screens, but also displays Stock Price/Risk Chart with three price points:

Current day (dotted line)

Halfway point to Expiration (dashes)

Expiration Day (solid line)

Simplified Journal Tabs

Tabs now display action of the Order/Trade for simplified at-a-glance status. Click below for detailed information on color codes of these tabs.

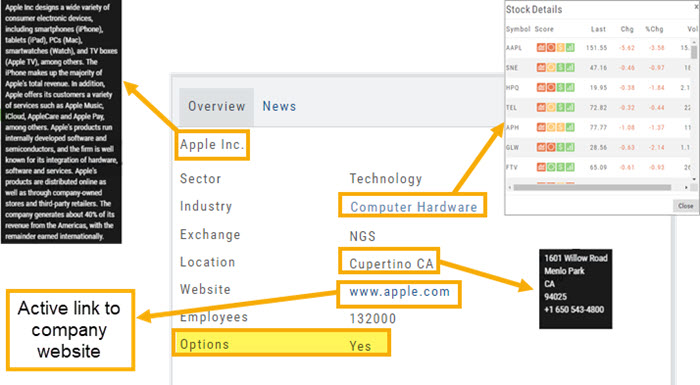

Enhanced Dashboard Overview

The Dashboard Tab, under Research, has a ‘cleaner’ look: Larger tables, easier-to-read data are among the enhancements made possible by the Adaptive/Responsive Technology.

The Overview Table, located at the upper right of the Dashboard, provides additional information, simply by clicking on the following:

- Name: Company Overview

- Industry: Competitors

- Location: HQ address

- Website: Live link to Company website

Finally, this table shows whether or not the stock is Optionable.

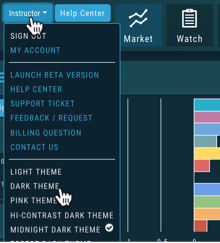

New Themes Available

More theme choices are available, not just “Light” or “Dark”. Simply click on your Username at the top of the platform sen and select from High-Contrast Dark, Midnight Dark, Forest Dark or even Pink.

Additional Journal Enhancements

- Automatic 2-month trade/order status update when logging into account

- Notes can be tagged to Brokerage Account

- Substantially improved Trade Match upon Closing, Legging Out or Adjusting

- Refined rules on Notes filtering

- Improved Reconciliation & Price data

Other New Chart Features

- Tooltip displays TradeFinder name (Ex: BullCall)

- Simplified Chart Header: Improved placement & display

Other Added Features

- “Legend” expands to display individual Score Icons at bottom of platform screen

- Increased Options Chain loading speed

Change Log:

- Covered Call correctly represented on charts

- Newly added brokerage account is default account

- Time zone issue corrected for Journal entries on charts

Select Background Theme

The Tabs on the Journal are Color Coded for Easy Understanding of the Trade

Primary Tab Color Coding (see below for expiration tab coding)

Note: Journal Tabs are automatically updated when you login to that account (Live) or simply select a Virtual or Manual Account. Orders/Trades are updated as far back as two months.

Light Blue

Light Blue

Active Live Order

This indicates that you have a current live order

Dark Blue

Dark Blue

Trade – Open

This indicates the opening transaction of a trade

Grey

Grey

Expired Order

This can be from a order that you canceled, or a day order that did not get filled

Green

Green

Closed Trade – Profit

This indicates a trade that you closed for a profit

Red

Red

Closed Trade – Loss

This indicated a trade that you closed for a loss

Yellow

Yellow

Closed Trade – Unmatched – Profitability not yet determined

You close a trade that the system could not automatically match

Unmatched Trades can happen if there are multiple trades and an entry trade needs to be identified or because a multi-leg trade was split on exit, or change of stock position when an option expired (exercise/assignment)

Unmatched Trades can happen if there are multiple trades and an entry trade needs to be identified or because a multi-leg trade was split on exit, or change of stock position when an option expired (exercise/assignment)

This is easily matched by clicking the edit icon (pencil) and selected which open order to match to. In some cases there may only be one, and it is simply a verification.

Expiration Tab/Tagging Colors

Red or Green with No Color Tagging

Red or Green with No Color Tagging

This indicated the option trade expired Out of the Money (OTM)

There were no options exercised or assigned through expiration

Red or Green with Dark Green Color Tag

Red or Green with Dark Green Color Tag

This indicated that there were ITM options exercised/assigned

However, there was no change is stock ownership. Example: Bull Call where both legs were exercised/assigned.

Red or Green with Yellow Color Tag

Red or Green with Yellow Color Tag

This indicates a change in stock ownership through exercise/assignment

This will happen with single leg options trade or where one leg of a spread was ITM at expiration

It is important to reconcile expired traded to properly display profit. If there are unreconciled expired options, the reconciliation window will automatically display when you go to the options tab.