Journal Tagging - OCO, Trailing Stops, etc.

OCO Journal Tagging

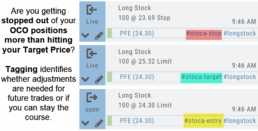

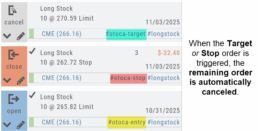

OCO Orders are automatically tagged in the Journal.

Once the Stock Order is Executed (it is an active Position), the Limit and Stop orders are Live (active Orders for the duration selected: Day or GTC.)

If/when the stock hits the Limit price, that order will execute, and the Stop order will be canceled. The Journal tab will be green and display a Gain/Profit.

-OR-

If/when the stock hits the Stop price, that order will execute and the Limit order will be canceled. The Journal tab will be red and display a Loss.

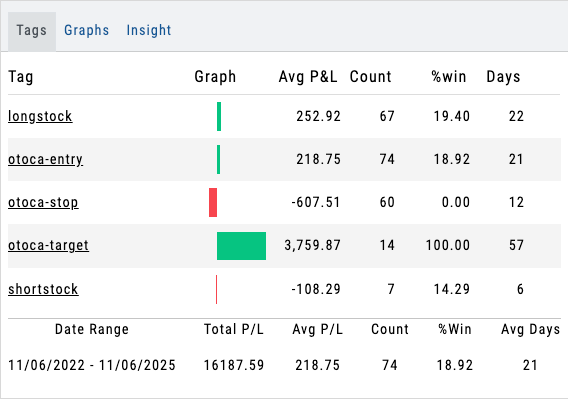

The tagged results show whether you’ve been hitting your target or getting stopped out.

**Note: Past Conditional trades will be tagged as “otoca-entry”, “otoca-target” and “otoca-stop”.

Platform Features Release: Sandbox Trading Account, Order Status Filter & more

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

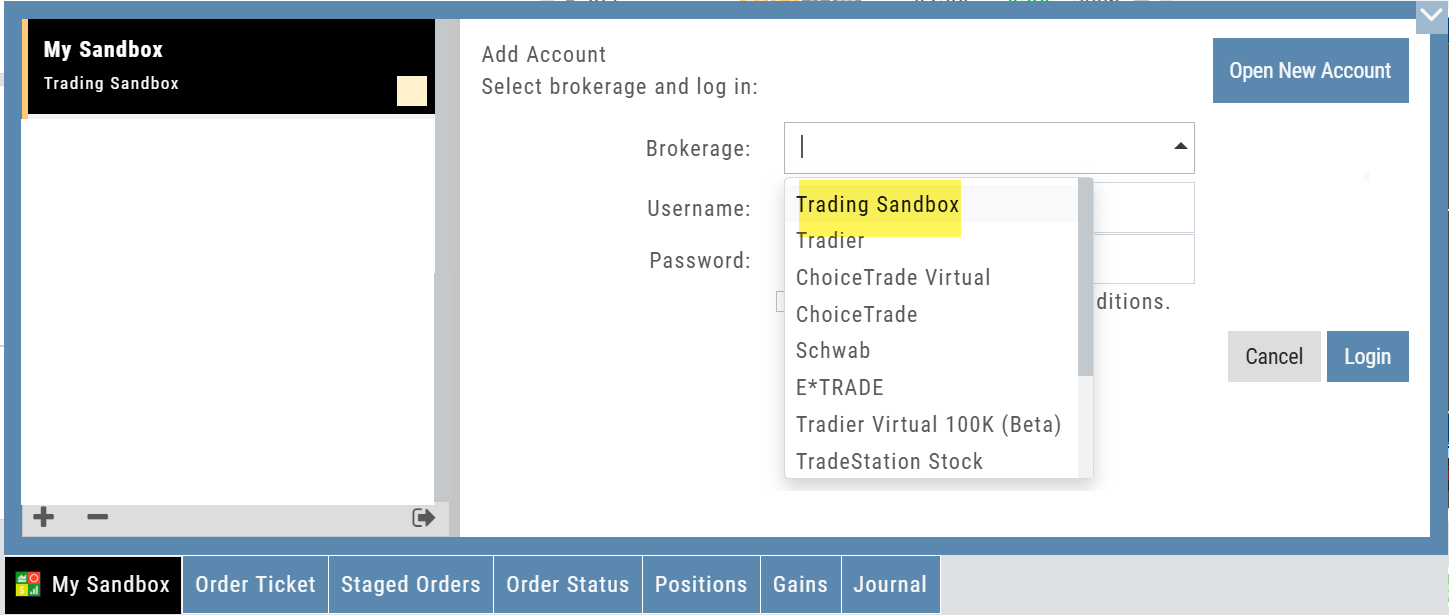

Trading Sandbox Virtual Account

Announcing a new Virtual Account with fast execution, accurate tracking, and reliability you can depend on.

Unlike traditional broker-provided virtual accounts, the Sandbox is not bound by brokerage margin rules or limitations, giving you more freedom to practice and test strategies.

The Sandbox uses delayed market data. In addition to fast, reliable trade execution and accurate trade capture, it also handles options correctly, supports Conditional Orders for stocks, full Journal Support, and more!

Order Status Filter Buttons

The Order Status Tab filter buttons make it easy to locate previous orders

![]()

- All – Everything in the time period is shown on the tab (Today, 1 Week, 1 Month, etc.).

- Open- Orders that have not yet executed as an active Trade/Position – includes Waiting Conditional orders.

- Working – Bracket orders where the underlying stock order is an active position (Stop/Limit orders). Excludes Waiting Conditional orders.

- Filled – Executed orders whether to open/modify/close

- Canceled – Includes both manually canceled as well as day orders that did not get filled prior to the end of the Market Day

OCO Journal Tagging

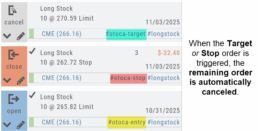

OCO Orders are automatically tagged in the Journal.

Once the Stock Order is Executed (it is an active Position), the Limit and Stop orders are Live (active Orders for the duration selected: Day or GTC.)

If/when the stock hits the Limit price, that order will execute, and the Stop order will be canceled. The Journal tab will be green and display a Gain/Profit.

-OR-

If/when the stock hits the Stop price, that order will execute and the Limit order will be canceled. The Journal tab will be red and display a Loss.

**Note: Past Conditional trades will be tagged as “otoca-entry”, “otoca-target” and “otoca-stop”.

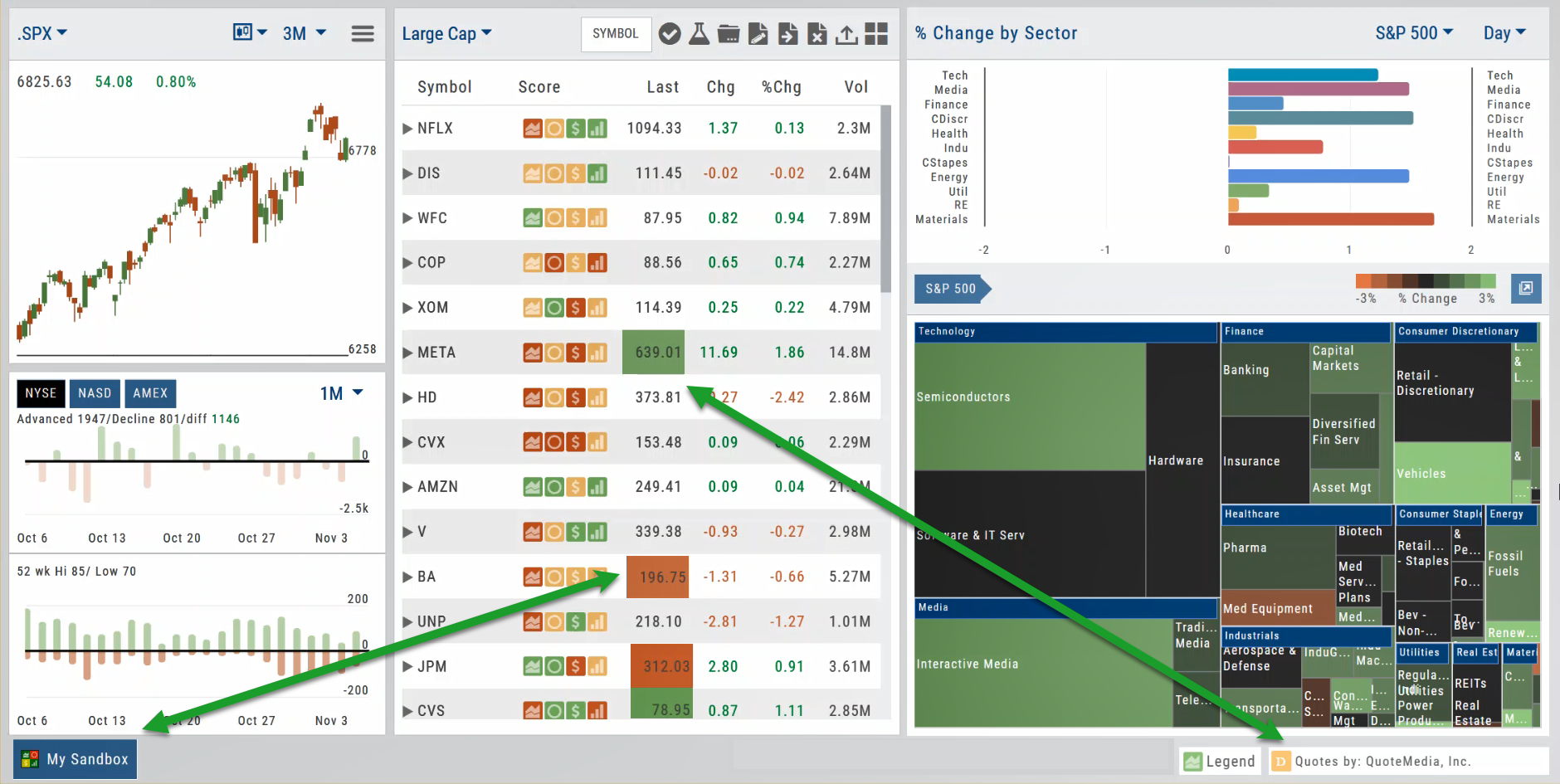

Delayed Streaming Quotes

Delayed Streaming Quotes will appear when you have a Virtual or Manual Account activated.

Click on the account tab so that it appears on the bottom left corner of your screen.

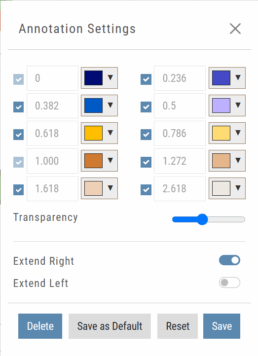

Extend Fibonacci Retracements on Charts

Fibonacci retracements can be extended right and/or left on the chart.

Click an existing Fibonacci annotation, then use the toggle switches to adjust it.

Don’t forget to “Save”

Note: Extend Right/Left can be edited/saved individually, not Set As Default.

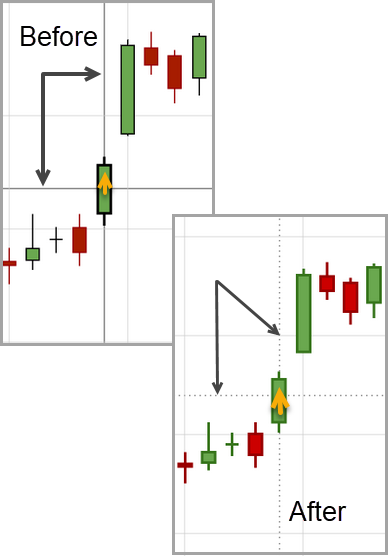

Chart crosshairs

The cursor crosshairs on the chart have been adjusted so they no longer obscure the candlestick wicks

Other Additions

- Set “GTC” as default duration for Exit Order on Trade Ticket

- Modify TTM Squeeze formula to follow industry

- Auto-select Option Cycles for existing Order(s)

Change Log

- Resolved Screener glitch to move candidates to selected watch list

Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

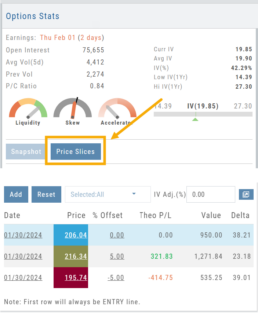

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

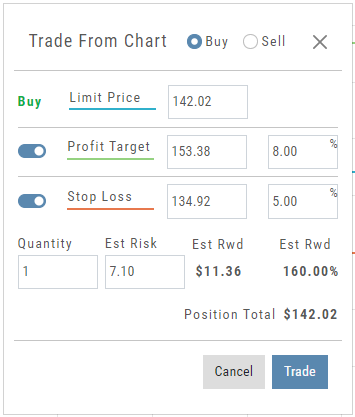

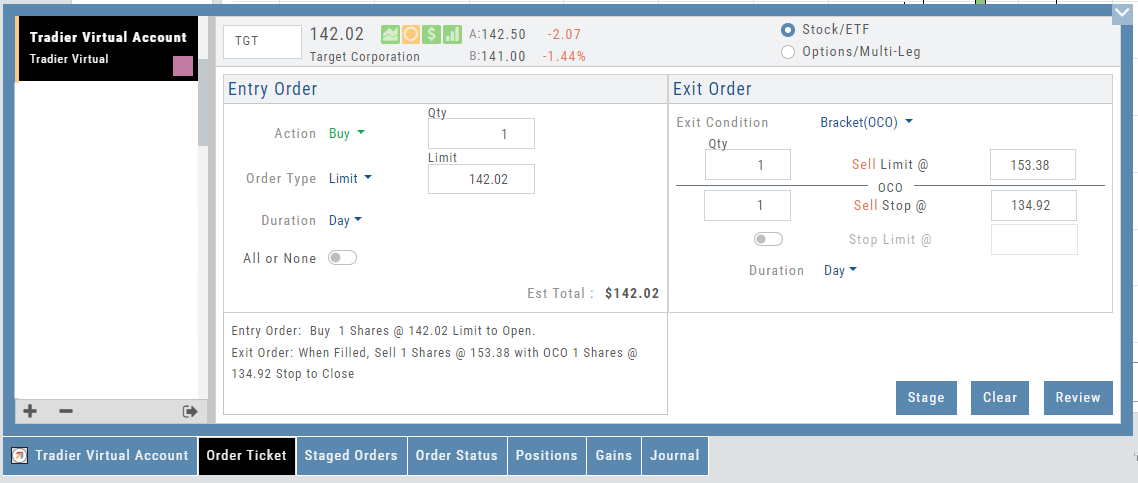

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

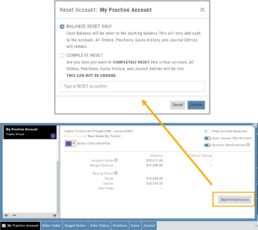

Reset Tradier Virtual Account – 2 options

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Virtual Account Buying Power Calculations

Virtual Account Buying Power Calculation

This is an example of how Buying Power is calculated. Check with your broker for specifics on your real accounts.

Margin

All margin accounts are subject to a $2,000 minimum equity requirement. ChoiceTrade requires $25,000 in account equity for naked put writing and $100,000 for naked call writing. Please click here to read our Risk Disclosure for important information regarding daytrading rules. Please see the terms of ChoiceTrade's Margin and Options agreements.| POSITION | INITIAL MARGIN | MAINTENANCE MARGIN |

| Long Stock | 1. 50% of the purchase price of marginable securities 2. 100% of the purchase price of non-marginable securities $2000 minimum margin account equity for all margin transactions $500 minimum cash balance required for Bulletin Board and OTC Market Stocks |

1. 25% of the current market value of the long securities positions in marginable securities. 2. 100% of the current market value of the long securities positions in non-marginable securities; See Special Notes below |

|---|---|---|

| Short Stock | The greater of: 1. 50% of the sale price of marginable securities; or 2. $5.00 per share $2000 minimum margin account equity for all margin transactions |

1. For marginable securities priced $2.50/share and under: $2.50/share 2. For marginable securities priced $2.51 to $5.00 per share: 100%. 3. For marginable securities priced $5.01 and above: greater of 50% or $5.00 per share. See Special Notes below |

| Long Calls or Puts | 100% of the cost of the options. | 100% of the current market value of options. |

| Short Uncovered Calls | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the underlying stock $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the underlying stock |

| Short Puts | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the strike price. $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the strike price |

| Short Covered Calls | None required on short call. | None required on short call. |

| Debit Spread | 100% of the net debit | 100% of the current market value of the position. |

| Credit Spread Market Orders |

Value of the difference between the strike prices $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Credit Spread Limit Orders |

Value of the difference between the strike prices less the credit to be received $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Long Butterflies/ Condors | 100% of cost of butterfly or condor. | 100% of current market value of butterfly or condor. |

| Short Butterflies/ Condors | Initial margin requirement of the short vertical of the butterfly or condor. | Maintenance margin requirement of the short vertical of the butterfly or condor. |

| Long Straddles/ Strangles | 100% of the cost of the straddle or strangle. | 100% of the current market value of the straddle or strangle. |

| Short Straddles/ Strangles | The initial margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; $100,000 minimum margin account equity |

The maintenance margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; |

| Long Call or Put Calendar Spreads |

100% of the cost of the calendar spread. | 100% of the current market value of the calendar spread. |

| Short Call or Put Calendar Spreads |

Initial margin requirement of short call or put; $2,000 minimum margin account equity |

Maintenance margin requirement of short call or put; |

|

Special Notes Volatile Stock Requirement: Some stocks deemed to be volatile may be held at a higher requirement. New Issues: Generally, newly issued stocks have a 100% initial and maintenance requirement for the first 30 days of trading Leveraged ETFs: Minimim cash requirement for long positions: 2X ETF (200% Leveraged) = 50% 3X ETF (300% Leveraged) = 100% Minimim cash requirement for short positions: 2X ETF (200% Leveraged) = 60% 3X ETF (300% Leveraged) = 100% |

||