Alert Functionality (Premium Desktop Feature)

Alert Functionality

Alerts can greatly improve trading effectiveness by notifying you on a potential trade opportunity and help you decide when to manage, enter or exit a trade.

Set up Alert notifications based on Last Price, Volume, $ Change, % Change, or % Offset.

If you’ve logged into the platform with either Streaming Quotes or RealTime Quotes through a linked brokerage account *within the last 30 days* – Alerts will be Real Time.

Alert Icons

- Add (+) New Alert – This icon is located on the symbol Quote Box

- Hollow Bell – Active Alert, not triggered

- Shaking Bell – Triggered alert, not yet viewed

- Solid Bell – Alert triggered today, already viewed

- Paused (z) or Used Alert – located in Alert Management Page

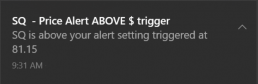

Set Your Alert

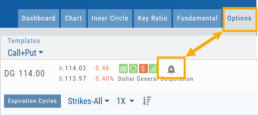

Click the Alert Icon, located on the symbol Quote Box and as shown on the Option Tab for the Chain or Strategy Template. The symbol, Score Icons, Last Price, $ and % Change automatically fill in. To complete the rest:

-

-

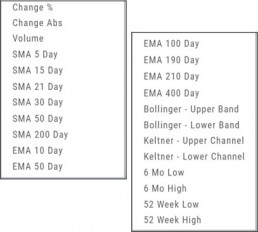

- Select Method: 23 to choose from! See list below

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

An Information notification appears: Alert Successfully Saved

-

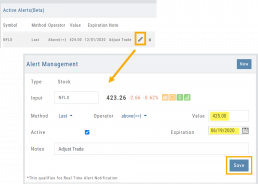

Alert Management

Manage your Alerts by going to: Research Tab>Alerts.

From this page, you can modify or remove alerts, view unread triggered alerts in one location and view prior alerts.

-

-

- Select Method: See List on right

- Select Operator: Above/Equal To or Below/Equal To

- Enter Value: $, % or Quantity (Quantity example: 11,000,000 or 11M)

- Select Expiration: Valid up to 6 months. Click on Calendar Icon to navigate months

- Add Notes, if desired

- Click Save

An Information notification appears: Alert Successfully Saved

-

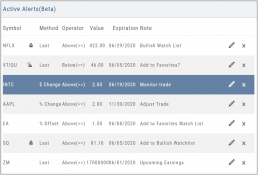

Active Alerts

This table lists all active alerts including:

Trigger notification – A bell icon appears if alert was triggered

Delayed Alert icon, if applicable

Settings – Method, Operator, Value

Expiration Date – Alerts can be active for up to 6 months

Notes

Ability to modify or remove from list

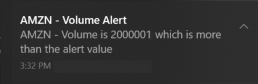

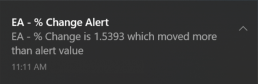

Alert Notifications

In addition to platform notifications, as long as you allow notifications, alerts can be sent to your computer or mobile device even if you are not logged into the platform.

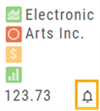

Hollow Bell

The Hollow Bell indicates this Alert is Active, but has not been Triggeredwill appear next to the symbol whether on the QuoteBox in Research or on a Watchlist .

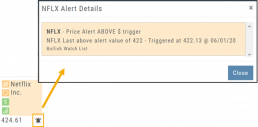

Ringing Bell

The Ringing Bell icon indicates the alert has been triggered and notification sent out. The highlighted area on the Quote Box or where it appears on a Watch List allows you to access the alert notification by clicking on the bell.

This display will show until the alert is read either from a Watch List, Quote Box or the Alert History section of the Alert Page.

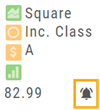

Solid Bell

Once an Alert is read or “Marked As Read” on the Alert Notification page, the icon becomes a Solid Bell.

Clicking on the icon will still display the triggered alert until the next Market Day.

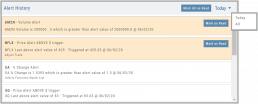

Alert History

This section displays triggered alerts for the time period selected: Today or All. The highlighted entries are Unread Notifications – the notices were not clicked on from the platform.

Click “Mark All as Read” to update entries.

A note about Real-Time & Delayed Alerts

Note: There are two ways 15 minute Delayed Alert Notification applies with Alerts:

1. If it’s been more than 30 days since a linked brokerage account with RealTime Quotes has been logged into – OR – the platform does not have Streaming Quotes.

2. OTC stocks will show as delayed, regardless of RealTime or Streaming Quotes

One of two notices will appear for each Alert

Virtual Account Buying Power Calculations

Virtual Account Buying Power Calculation

This is an example of how Buying Power is calculated. Check with your broker for specifics on your real accounts.

Margin

All margin accounts are subject to a $2,000 minimum equity requirement. ChoiceTrade requires $25,000 in account equity for naked put writing and $100,000 for naked call writing. Please click here to read our Risk Disclosure for important information regarding daytrading rules. Please see the terms of ChoiceTrade's Margin and Options agreements.| POSITION | INITIAL MARGIN | MAINTENANCE MARGIN |

| Long Stock | 1. 50% of the purchase price of marginable securities 2. 100% of the purchase price of non-marginable securities $2000 minimum margin account equity for all margin transactions $500 minimum cash balance required for Bulletin Board and OTC Market Stocks |

1. 25% of the current market value of the long securities positions in marginable securities. 2. 100% of the current market value of the long securities positions in non-marginable securities; See Special Notes below |

|---|---|---|

| Short Stock | The greater of: 1. 50% of the sale price of marginable securities; or 2. $5.00 per share $2000 minimum margin account equity for all margin transactions |

1. For marginable securities priced $2.50/share and under: $2.50/share 2. For marginable securities priced $2.51 to $5.00 per share: 100%. 3. For marginable securities priced $5.01 and above: greater of 50% or $5.00 per share. See Special Notes below |

| Long Calls or Puts | 100% of the cost of the options. | 100% of the current market value of options. |

| Short Uncovered Calls | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the underlying stock $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the underlying stock |

| Short Puts | The greater of: 1. 100% of the option proceeds plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. 100% of the option proceeds plus 10% of the strike price. $100,000 minimum margin account equity |

The greater of: 1. The current marked-to-market value of the option plus 20% of the underlying stock less any amount the option is out-of-the-money; or 2. The current marked-to-market value of the option plus 10% of the strike price |

| Short Covered Calls | None required on short call. | None required on short call. |

| Debit Spread | 100% of the net debit | 100% of the current market value of the position. |

| Credit Spread Market Orders |

Value of the difference between the strike prices $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Credit Spread Limit Orders |

Value of the difference between the strike prices less the credit to be received $2,000 minimum margin account equity |

The lesser of: 1. Value of the difference between the strike prices of the vertical or; 2. The maintenance margin requirement of the short call or put |

| Long Butterflies/ Condors | 100% of cost of butterfly or condor. | 100% of current market value of butterfly or condor. |

| Short Butterflies/ Condors | Initial margin requirement of the short vertical of the butterfly or condor. | Maintenance margin requirement of the short vertical of the butterfly or condor. |

| Long Straddles/ Strangles | 100% of the cost of the straddle or strangle. | 100% of the current market value of the straddle or strangle. |

| Short Straddles/ Strangles | The initial margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; $100,000 minimum margin account equity |

The maintenance margin requirement for the short put or short call, whichever is greater, plus the premium of the other option; |

| Long Call or Put Calendar Spreads |

100% of the cost of the calendar spread. | 100% of the current market value of the calendar spread. |

| Short Call or Put Calendar Spreads |

Initial margin requirement of short call or put; $2,000 minimum margin account equity |

Maintenance margin requirement of short call or put; |

|

Special Notes Volatile Stock Requirement: Some stocks deemed to be volatile may be held at a higher requirement. New Issues: Generally, newly issued stocks have a 100% initial and maintenance requirement for the first 30 days of trading Leveraged ETFs: Minimim cash requirement for long positions: 2X ETF (200% Leveraged) = 50% 3X ETF (300% Leveraged) = 100% Minimim cash requirement for short positions: 2X ETF (200% Leveraged) = 60% 3X ETF (300% Leveraged) = 100% |

||