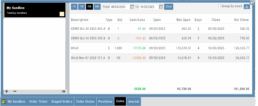

Journal Tab - Reports

Journal Reports

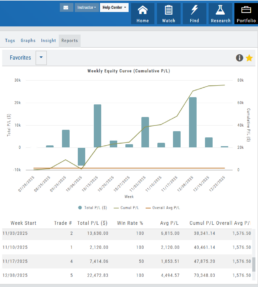

Understanding your trading performance shouldn’t require digging through spreadsheets or guesswork. Journal Reports turn your trading data into clear, visual insights—so you can quickly see what’s working, what’s not, and where to focus next.

With intuitive graphs and concise summary outlines, Journal Reports provide a high-level view of your account performance across multiple categories, helping you connect the dots between results, behavior, and decision-making.

Whether you’re reviewing weekly performance, refining your edge, or building better trading habits, Journal Reports transform raw data into actionable insight—at a glance.

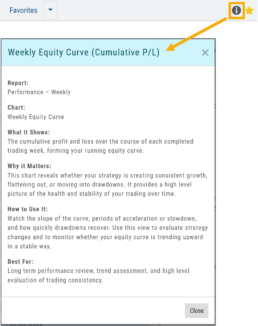

Click the Info Icon ![]() for a detailed outline on:

for a detailed outline on:

- What information the report provides

- Why it matters

- How to use it

- The application(s) the report is Best used for

Report Legend

Each Report has a legend where indicators can be toggled on/off simply by clicking on each one.

![]()

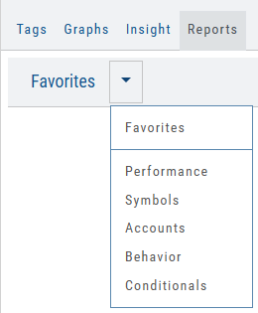

Journal Reports include insights by:

- Performance – Analyze results by time period to spot trends and consistency.

-

Symbols – Identify which tickers were your most and least profitable.

-

Account – Review performance across individual or multiple accounts.

- Behavior – See how trading habits impact outcomes.

-

Conditionals – Evaluate performance based on specific trade criteria or setups.

Click on one of the above categories, then click on the Report to display

To make analysis even easier, users can group their Favorites into a single section—allowing you to focus on the symbols, strategies, or reports that matter most to you.

Simply, click the Star Icon to highlighteach Report to keep under “Favorites”

- The account(s) selected on the left side of the Portfolio Tab display the activity in the center panel for the default time period of 12 months

- Use the Filter Button to adjust the time period, symbols, etc to display

- The results from the center panel will be displayed on the right panel

Trading Sandbox Account - Overview

Unlike traditional broker-provided virtual accounts, the Sandbox is not bound by brokerage margin rules or limitations, giving you more freedom to practice and test strategies.

Trading Sandbox Account was built specifically to overcome these shortcomings, allowing traders to:

-

Test advanced strategies without brokerage-imposed limits.

-

Gain confidence in how options positions will behave through expiration and assignment.

-

Track true results on completed trades for more effective learning and analysis.

As with other simulated trading systems, the Sandbox uses delayed market data. However, it goes beyond conventional paper trading platforms in several key areas:

Fast & Reliable Order Execution

Orders are processed quickly during market hours, creating a more realistic trading experience compared to laggy paper trading systems.

Supports Conditional Orders for Stocks

Effortlessly include Stop and Limit Orders when buying stock.

Options Handling That Works

Options are properly assigned and exercised as they would be in a real account, removing the gaps found in most brokerage simulators.

Accurate Trade Capture

The Sandbox records and captures gains/losses on completed trades, giving you a clear picture of how your strategies perform over time.

Full Journal Support

When auto-journaled (default setting) is set, all activity is captured. Track your progress to see what strategies work, what needs more practice, for important feedback.

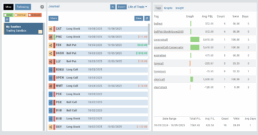

How To Add:

Sandbox has been added as a drop-down selection in the Portfolio section of your trading platform

-

Click the bottom left corner tab of the platform to display all account tabs

-

Click the “+” icon appearing below these tabs

-

Select “Sandbox” from the dropdown list. Check the “I agree…” box

-

Name your account and select a color identifier, if desired.

-

Start trading!

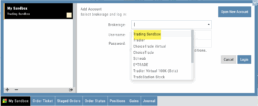

Platform Features Release: Compare and AI capability added, Tradier Streaming

Join us Wednesday, October 25th for a special Office Hours session for an in-depth review session of the newest enhancements to your platform.

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process.

Research Tab/Dashboard:

Compare Tab: Provides an at-a-glance comparison of competitors of the same industry group with the ability to change symbols and Swing, Position, or Investor views (also “All” and “Default”)

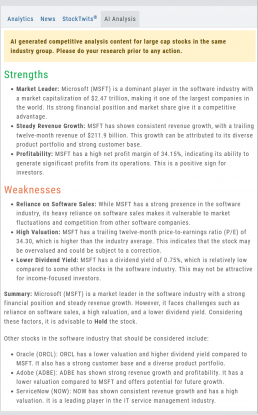

AI Analysis – AI generated competitive analysis for Large-cap stocks in the same industry group.

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

AI Analysis

Located within the Activity Tab in Research, Stock AI analysis has the potential to enhance and streamline the process of evaluating and trading stocks in the financial markets.

Stock AI analysis can quickly process and analyze vast amounts of financial data, news, and market sentiment in real-time. This enables investors and traders to make more informed decisions based on a comprehensive view of the market.

Click on the AI Analysis Tab for the current symbol you are viewing. A progress bar will appear while the information loads for the initial session view only. The information will remain even if you log out and back in again during the same Market Day.

It’s important to note:

While Stock AI analysis offers these benefits, it also comes with challenges and risks, such as overreliance on algorithms, potential biases in data, and the need for continuous monitoring and oversight. Investors and traders should use AI analysis as a tool to complement their decision-making process rather than relying solely on it.

Streaming Quotes with Tradier

Your Tradier Account offers Real-Time Streaming Quotes!

Simply log in to your Tradier account from the platform, and you’ll see the Real-Time quote updates without having to change screens or refresh your browser!

Change Log

- At-the-Money Strike price bolded on Templates

- Long Butterfly template error corrected

- Resolved slider bar/template editing functioning

- Event flag display function preserved

- Slider bar function corrected on template page

Platform Features Release: October 2022

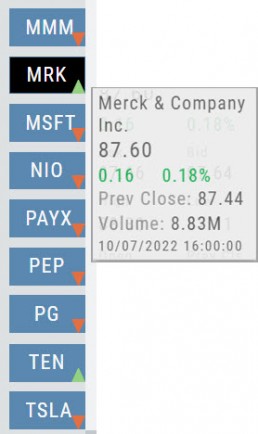

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

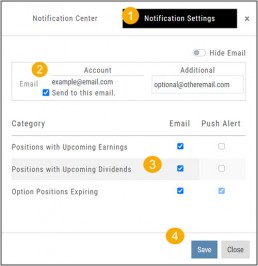

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

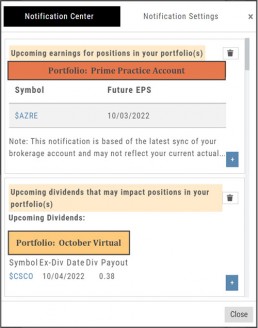

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

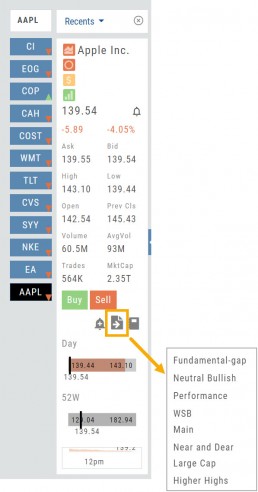

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

The Order Ticket - Stock/ETF

The Order Ticket is designed for ease of use and flexibility.

Selecting “Stock/ETF” or “Options” will display the appropriate ticket.

Brokerages determine what Order Types and Duration selections are available.

All or None allows you to dictate whether to accept partial fill of an order or not. Toggle to turn this on/off.

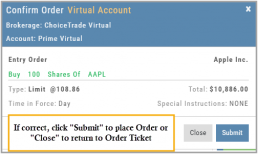

The Order Summary appears below Order details as an additional security step to ensure your order is correct.

Click “Stage” for later review, “Review” to continue the Order process or “Clear” to start over.

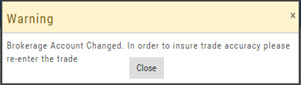

Note: If you start an Order in one account, then switch accounts, you’ll review the following notice:

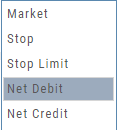

Order Types are in a drop-down box and the types offered often vary from one brokerage to the next.

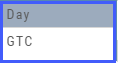

‘Duration’ – How long the order is good for: Day (current trading day) or GTC (Good til Cancelled)

‘Condition’ – Must be met for the order to be filled/executed: “None” (no conditions) or “All or None” (all of the order must be filled, or none at all).

After completing the order ticket, click ‘review’, then ‘submit’.

After completing the order ticket, click ‘review’, then ‘submit’.

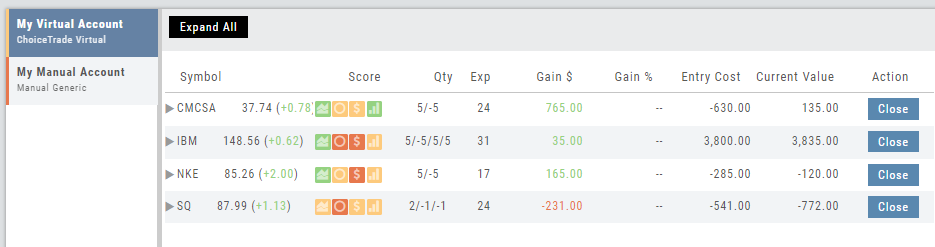

Manual Account Overview

A Manual Account is versatile resource tool which can enhance your trading effectiveness. You can also use this to track trades from an outside brokerage account.

Use the Manual Account for educational purposes.

- It offers flexibility and control, while providing the Analytics and Journal to help you reinforce the “Learning to Earning” process. This allows you to focus on learning the strategies.

- Place trades any time of day or night – all get immediately executed at the price entered. No need for the market to be open.

- No Buying Power limits – no expensive spread margin requirements to adhere to, no limit on how much you can buy/sell

- Place trades in the past.

- Enter trades from Backtest Mode

Use to tracking external accounts

- Can be used to track trades placed at brokers not integrated into the platform

- You can enter the date and fill prices of your actual trades

- This enables portfolio management along with your other accounts

- You can use full Journal function for tracking your progress

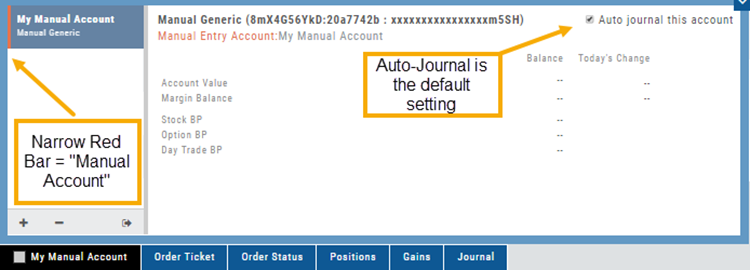

Manual Accounts are identified by a narrow Red Bar and are, by default, Auto-Journaled.

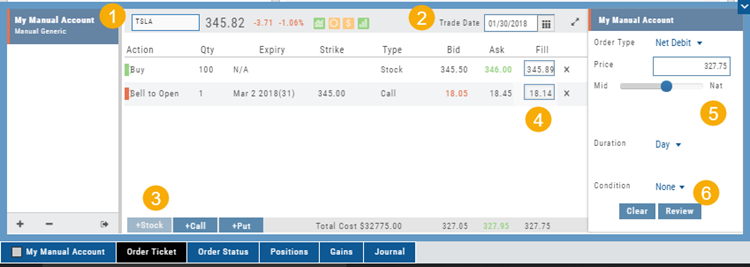

Entering trades in a Manual Account takes only a few steps and is similar to a regular trade.

You can also bring up the ticket from any trade point. Simply start a trade and select the manual account just like you would select any other account.

(Bold indicates unique to Manual ticket):

1. Enter the Stock Symbol, or name of Company (Smart search will display potential matches)

2. If this is a past trade, use the calendar/date picker to select date

3. Click “Stock”, “Call” or “Put” to build trade, change quantity, Expiry and Strike (if applicable)

4. Bid/Ask will automatically populate if a specific price is not entered

5. Complete Order Type, Duration and Condition

6. Click “Review” to confirm information is correct, then ‘Submit” on next screen.

The order will appear in Order Status as “Executed” and operate the same way as other accounts.

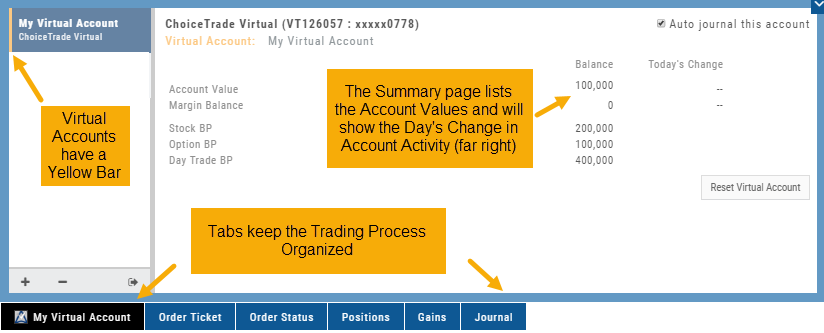

Virtual Account Overview

Virtual Trading gives you the real trading experience without risking any money. It is a valuable “next step” learning tool – designed to mimic the trading experience as closely as possible.

Trades are executed during Market hours – 9:30 a.m. – 4 p.m. Eastern Time, however there is a 15 minute delay after Market open for orders to begin executing.

As with Live Accounts, there are limits on trades if there is not sufficient Buying Power in your Virtual Account. There can be expensive Spread/Margin Requirements to adhere to.

Virtual Accounts do have limitations that Live Accounts do not have:

Virtual Accounts are not subject or responsive to Corporate actions such as buyouts, name or symbol changes, stock/option splits and strike price adjustments to name some examples.

![]()

Virtual Accounts are “Auto-Journaled”. This automatically keeps record of all trades for later analysis and reconciling.

These practice accounts are identified by a yellow bar on the left side of the account window.

Virtual Accounts are powered by Choice Trade to provide the real trading experience.

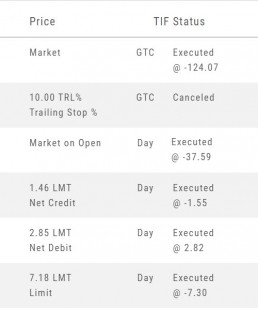

Order Types - How to Enter

Market Order are Buy or Sell orders to be executed immediately at current the Market Price. Execution of the trade is more important than price. As long as there is a willing buyer or seller, the trade will be executed.

Limit Orders (including Net Debit and Net Credit) allow you to set the Maximum Price to Buy or Minimum Price to Sell a security . Because these orders have ‘limits’ they may not be executed. When they are, they will be executed at the Limit Price – or better.

Low Volume, a slow or very fast market may mean your Limit Price may not be reached and thus, your order not executed.

Stop & Stop Limit Orders

These are protective orders, to be placed on a current position.

A Stop Order becomes a Market Order when the Stop Price is reached. This does not mean you will get the Stop Price when the Order executes. You are willing to Buy/Sell at any price once your Price is reached to have the Order execute.

A Stop Limit Order generally offers more protection: Once the Stop Price is reached, the order converts to a Limit Order to execute once that price – or better- is reached. Thus, there are two values to enter on the Order Ticket for Stop Limit Orders.

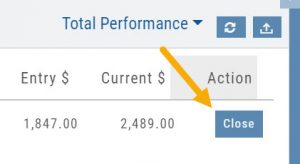

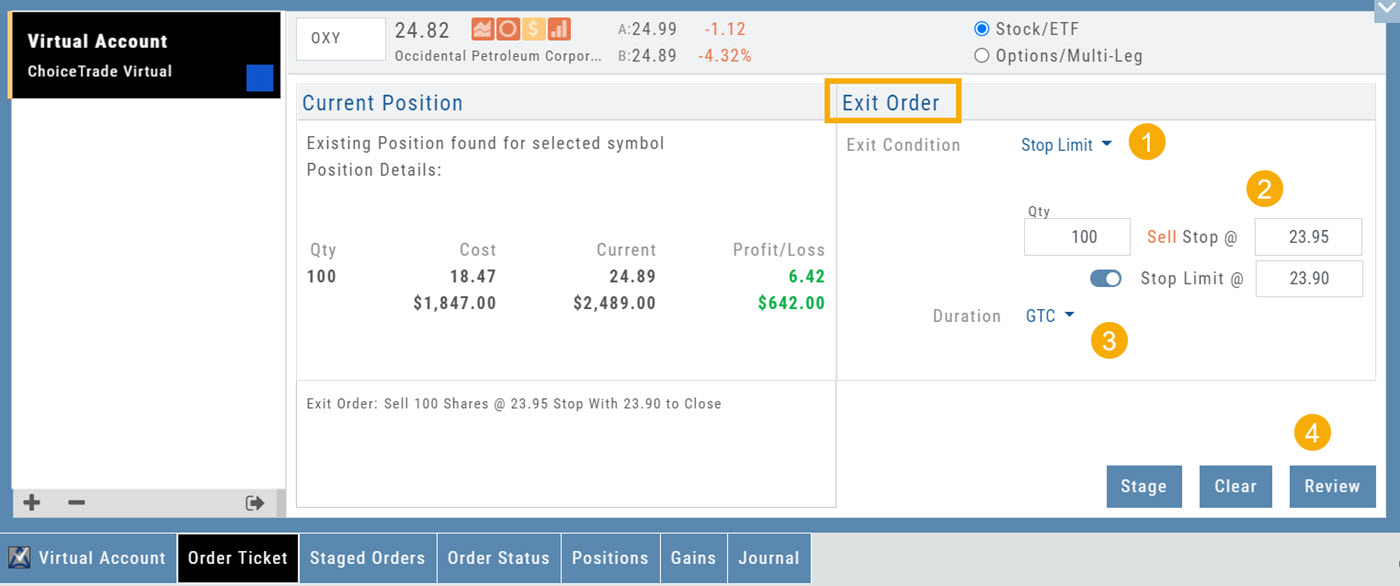

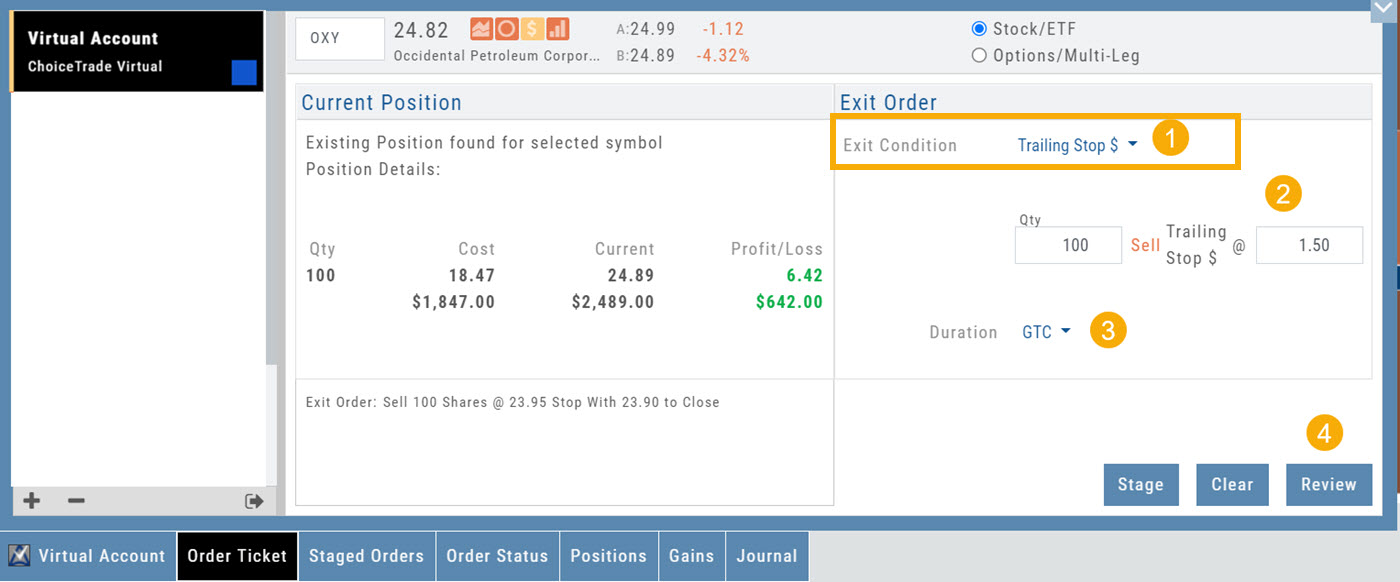

How to enter a Stop Order/Stop Limit Order:

On the Positions tab, click “Close” for the Stock/ETF entry you want to add a Stop/Stop Limit Order to. You’ll be navigated to the Order Ticket tab to continue.

On the right side of the Order Ticket (Exit Order):

1. Change Exit Condition from default “Limit” to “Stop” or “Stop Limit“

2. Enter Stop Price. For Stop Limit Orders, the Stop Price will be the higher of the two values.

Enter Limit Price, if applicable.

3. Change Duration from Day (default) to GTC (which may vary by brokerage)

4. Review & Submit

Notes: As long as it’s not a Day order, the Stop/Stop Limit order will remain Live until you cancel the order or it executes*. (Some brokerages have expiration dates on such orders)

Trailing % and Trailing $

As the names suggest, these orders follow trades upward by a set $ or %. They are placed on a current position. Click “Close” from the Positions Tab, then follow the steps below:

1. Change Exit Condition to “Trailing % (or $)“

2. Enter price or percentage to exit trade

3. Select Duration (Day/GTC)

4. Review, then Submit

This will be a Live Order until it Executes, Expires or is Cancelled.

Bracket Order – One Cancels the Other (OCO)

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

Positions Tab

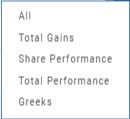

The Positions Tab offers 4 table views of your current trades. You can access these by clicking on the drop-down box in the upper right of the screen. “All” combines the 4 views.

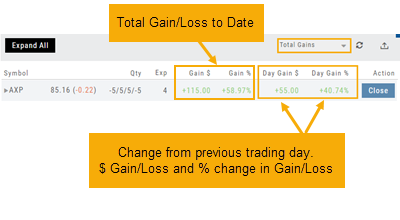

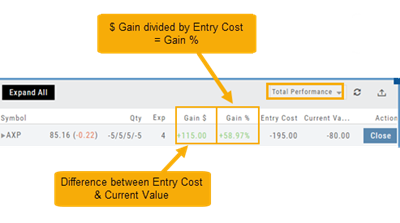

Total Gains

This table view displays the Overall $ and % Gain/Loss and the Daily $ and % Gain/Loss based on the previous trading day’s results.

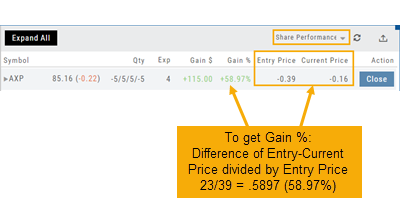

Share Performance

This table breaks down Total Gains by showing Entry Cost compared to Current Value per Share.

Total Performance

Similar to Share Performance, but shows Total Entry Cost and Total Current Value.

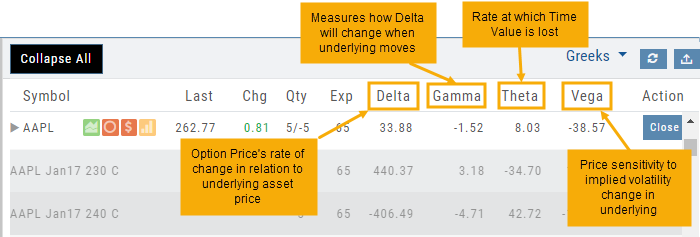

Greeks

Expand Trade Detail - Positions Tab

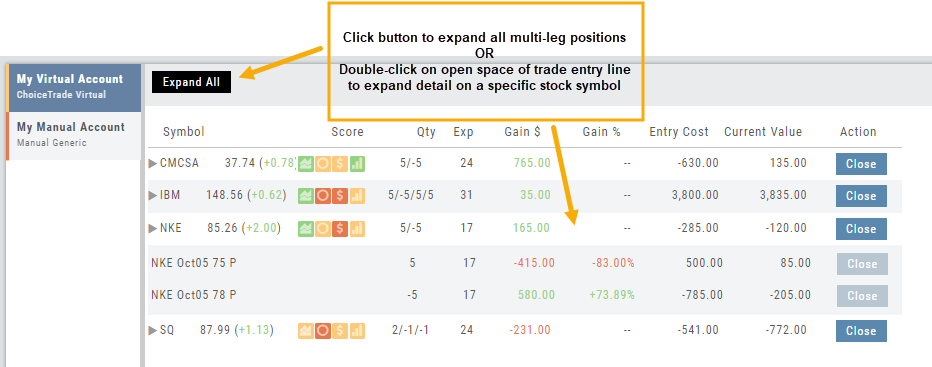

There are 3 ways to expand multi-leg trades in the Positions Tab.

Smart Icon – Click on the ![]() icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

Expand All – Click the button above the trade entries if you wish to expand all multi-leg trades. Once clicked, the button will change to Collapse All.

Double-Click – if you want to expand one trade or specific trades, simply ‘double-click’ on an open space of the trade entry line. Repeat to close.