Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

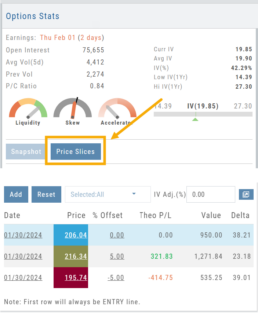

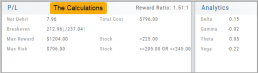

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

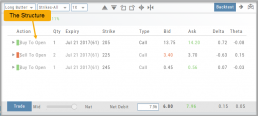

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

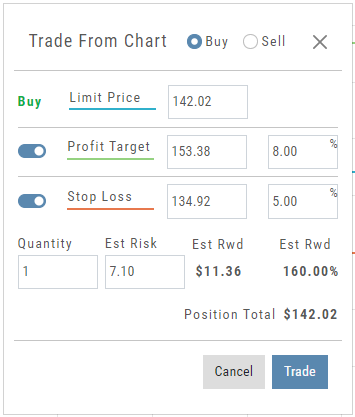

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

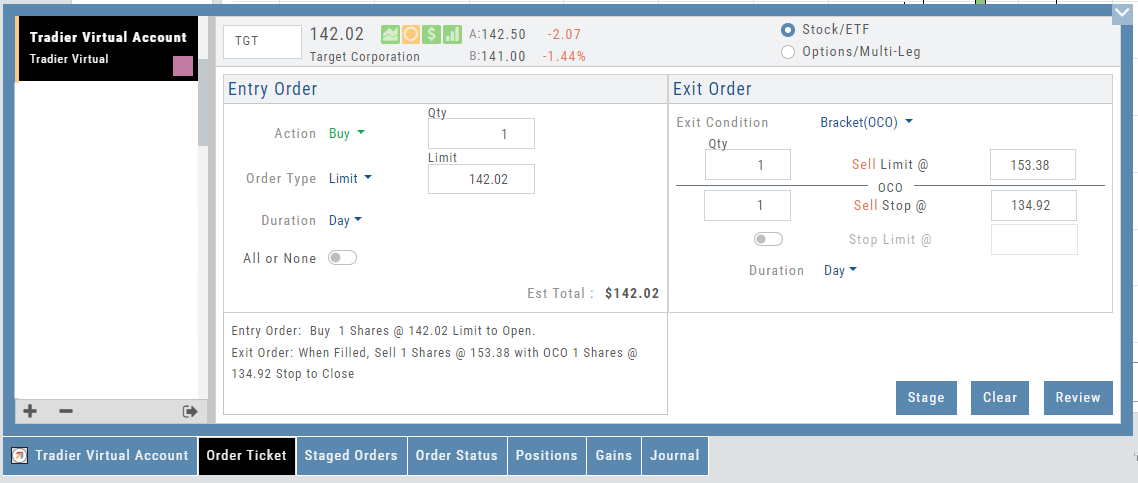

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

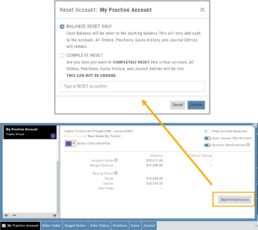

Reset Tradier Virtual Account – 2 options

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Multiple Position Analysis

We often have more than one position on a particular Stock/ETF, so how can each position, or leg be evaluated?

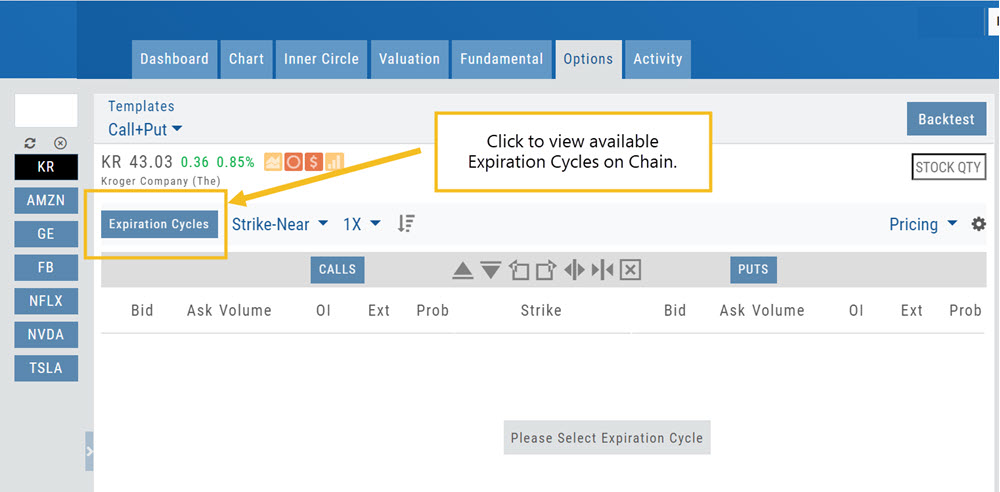

Option Chain Functionality

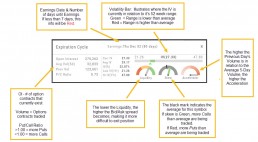

Research>Option Tab, click on “Expiration Cycle” for the “Call+Put”, “Calls” or “Puts” view.

Option Chain Expiration Cycles

The Option Chain Expiration Table gives you control of selecting which Expiration Cycle(s) you want to view.

The Option Dashboard provides a wealth of pertinent information to make informed decisions easier.

See below for more detail

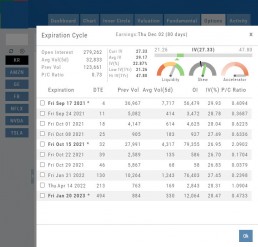

Expiration Cycles: All available options will be displayed. Monthly Options are indicated with an asterick![]()

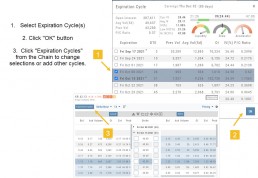

Select Expiration Cycles

Click ‘OK”

Chain will display for selected

Strategy Template

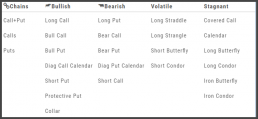

A Strategy Template provides a shortcut to quickly create an option strategy, virtually eliminating structure errors. Once selected, you can modify the structure within the template using the tools on above the option tables: Moving Strikes up/down, rolling Time out/in, widening or narrowing Strikes.

![]()

Some strategies can be changed from all Calls to all Puts (and vice-versa).

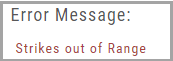

Note: The templates will not allow you to exceed certain parameters, as attempting to do so would result in an invalid strategy. This is a built-in safety net and you would receive a notice similar to:

Options Navigation

Expirations are displayed above the Option Table.

Select the months to view by clicking on the appropriate box. All available dates are displayed. Remember, the further out the option expiration is, the fewer dates are available.

Toggle between Calls Only or Puts Only view.

Change Option Table views to Pricing, Value, Greeks, Trade or new Custom views you create to suit your needs.

The small tab on the left side of the table will collapse the stock summary box & widen the option table.

The scroll bar on the right side and slide bars at the bottom on the table offer additional navigation.

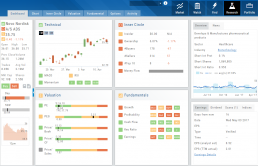

Research

Narrow the field to find the highest probability trades.

Stock

You’ve narrowed the field by selecting potential candidates matching the outlook and selected strategy, but which of those have the highest probability of success? Research allows you to drill down for information as much or as little as you want.

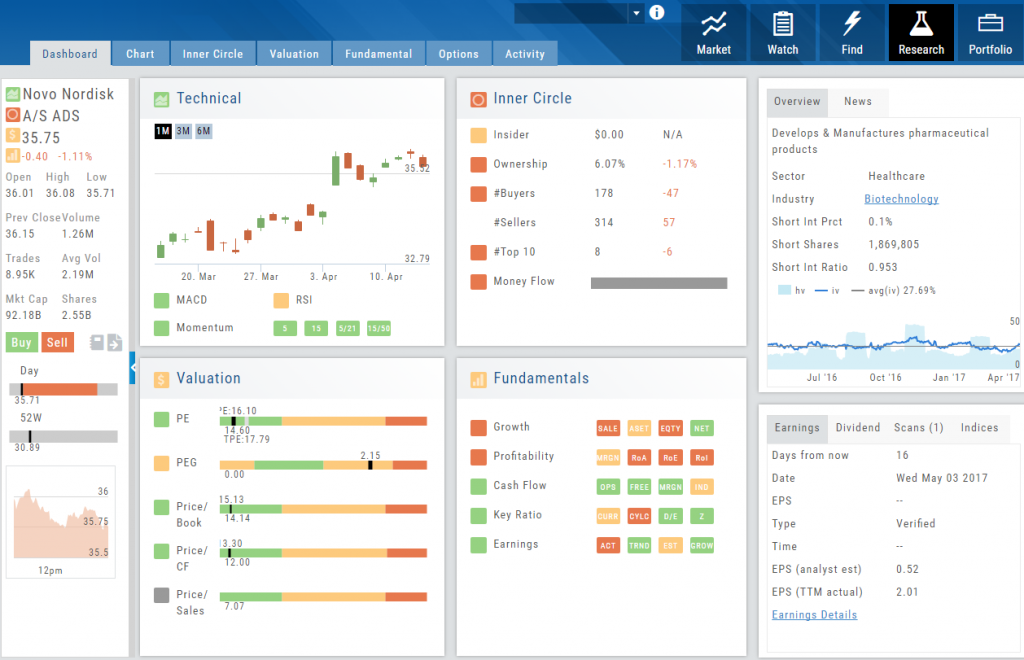

The Dashboard provides an overview: Quote Detail, The Score, Activity such as News/Earnings/Dividends and information about the Company and a list of other company stock symbols in the same industry. Each component has it’s own tab to provide more detail.

Components of The Score are designed to keep the information available to you, but out of the way when you don’t need it.

The Options Tab offers Strategy templates, option chains, snapshots and definitions of strategies, P/L Graph with Risk/Reward ratio, Analytics and Stock/Volatility charts.

The Activity Tab includes a Beta version of the Journal as well as News and StockTwits ®

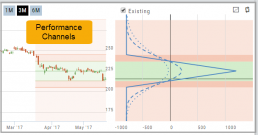

Performance Channels

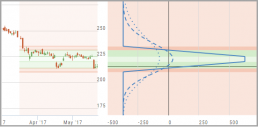

Performance Channels can assist in visual analysis across both the P/L Graph and the Chart.

- Dark Green – Stock movement affects gain

- Light Green – At maximum gain

- Dark Red – Stock movement affects loss

- Light Red – At maximum loss

The width of the channel on the chart represents the timeframe of the trade. If options expire in 30 days, the channel will display back 30 days on the chart. This give a visual reference for the time frame of the trade.

Note: Channels are displayed based on expiration of the trade. Past performance is not indicative of future results. Performance channel date orientation is for reference only.

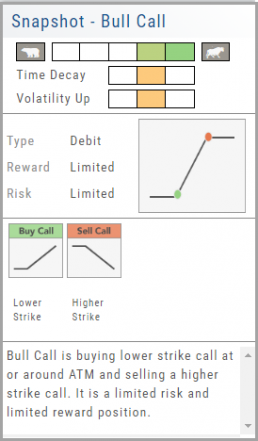

Strategy Snapshot

It’s the “Cliffnotes” version of your strategy

Each strategy template provides a quick reference for the construction and application of the strategy. The snapshot shows:

- what the strategy outlook is on the color-coded range from ‘Very Bearish’, ‘Mildly Bearish’, ‘Neutral’, ‘Mildly Bullish’ or ‘Very Bullish’.

- what effect ‘time decay’ and ‘volatility’ has on the strategy: ‘Increase’, ‘Neutral’ or ‘Decrease’.

- debit or credit trade

- risk & reward level

- strategy structure

- an overview summary of the strategy

Option Tables & Templates

Expanding your Options!

Choose from Call+Put chains, Call Matrix, Put Matrix or from almost 2 dozen Option Templates – covering any market outlook.

Expand the Strikes displayed: Near ATM, More or All.

You can change the click Quantity default increment by changing the default parameter for 1x, 5x or 10x.

You can also sort the Strike prices: Lowest to Highest, or vice-versa.