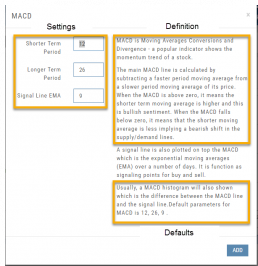

Customizing Indicators

Customize Indicator Settings – even in different Chart Profiles!

Customize the settings by clicking on the “Add Indicator” box at the top, center of the screen. Scroll to the Indicator you wish to add/edit. Left-click on the selection for a customization box to appear.

The Indicator window shows which settings can be changed.

Bonus! You can save different settings for the same indicator in different chart profiles. No need to change settings from one profile to the next.

In addition to the settings, this feature also provides a description of the indicator and the default settings.

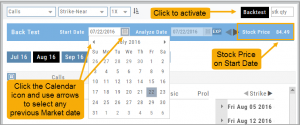

Start Date

Click the Calendar and select any past Market date. You can quickly choose a previous date by clicking on the “month” then arrow back by year. The closing price for that stock will be displayed.

You are now ready to create the position to analyze – either by clicking “Bid” or “Ask” or by entering the quantity in the appropriate box(es).

Note: In order to ‘backtest’, the platform needs to establish an orientation point in time. If you change the ‘start date’, the option expiration cycle may change to re-establish the reference point in which to pull information from.

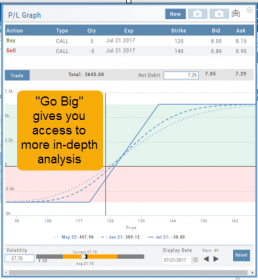

Go Big - Graphs & Charts

Anywhere you see the ‘Go Big’ icon ![]() , you can expand the graphic and access additional information.

, you can expand the graphic and access additional information.

The Chart Tab under Research has such a button in the icon toolbar as shown:

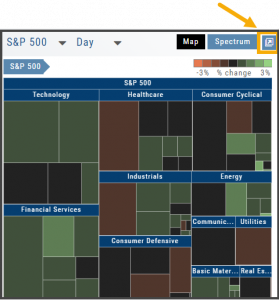

The Heat Map on the Market Tab will allow you to filter criteria such as stock price, volume, market cap, etc.

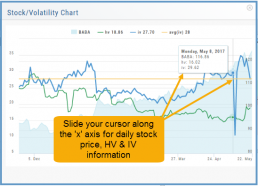

In the Options Tab, you can do this with the P/L Graph and the Volatility Chart. The icon is located at or near the upper right of the graph or chart.

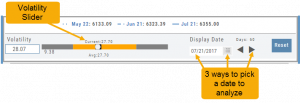

Expanding the Stock/Volatility Chart allows you to view past Historic Volatility, Intrinsic Volatility and stock price on a day-to-day basis.

For deeper Trade Analysis, use the Volatility Slider tool and the Date Picker, located at the bottom of the P&L Graph:

Trend Lines, Notes & Shapes and Advanced Annotations

Customize your charts with Trend Lines, Notes and Advanced Annotations.

These tool icons are available above the chart, just below the Indicators drop-down box.

These tool icons are available above the chart, just below the Indicators drop-down box.

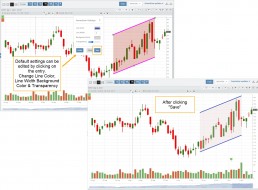

Each Annotation can have a Default Setting. This means all initially created lines, for example, will have the same settings, such as color and thickness.

Select your Annotation.

Draw it on the chart.

Click to display the dialog setting.

Adjust settings, then click “Save as Default.”

“Reset” will revert to initial settings.

You can still customize individual lines by saving the settings instead of saving as Default.

Fibonacci Too!

The Fibonacci Annotation has been enhanced to allow you to select which Retracement Levels you want to view, in addition to adjusting the color for each and the overall transparency.

The settings can be set as the Default for new chart entries or customize each entry, then “Save”.

**Please note: Existing Fibonacci annotations cannot be edited with this new coding. They must be deleted, then added back.

In addition, individual retracements can be extended Right and/or Left. Click the annotation on the chart to open the dialog box.

Note: The Extend Right/Left option cannot be set as a default setting.

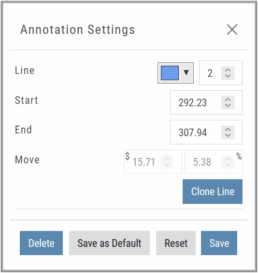

Clicking on any Trend Line, Note, or Advanced Annotation, will display the “Annotation Settings” box for that entry.

The Annotation Settings box can be repositioned elsewhere on the platform, if needed.

Line Color, Line Width and if applicable, Background Color and Transparency can be changed.

Be sure to click ‘Save’!

Note: Parallel channels are initially drawn horizontally. To change orientation click on the annotation then grab one of the ‘edit dots’ to drag to the position you wish.

Then click “Save” on the dialog box.

Crossover Arrows

The Crossover Arrows ![]() identify the crossover points on indicators.

identify the crossover points on indicators.

For upper indicators, you can select 2 indicators and the chart will show the crossover arrow.

Example: If you select the 5 day and 20 day SMA the Green arrows will show the 5/20 crossover points when in an upward movement, Red for downward.

Only 2 moving averages can be selected at a time when utilizing this tool. If you wish to make a change to another moving average indicator, one must first be deselected before adding the new indicator.

indication

User Menu

Take a tour, have a question, change the theme – all from one place.

The User Menu is one of the 6-point Navigation system of this trading platform. You can access The Help Center from here, ask a support question, check your account, suggest a feature idea or provide feedback on the platform, even change the platform ‘theme’ (example “light” or “dark”) and more.

Journal Tag Analytics

Want to know how effective your trading strategies and practices are? This is where you’ll get your answers

Get visual feedback broken down by strategies and analytical data including a Profit Graph, Average Gross P&L, the frequency of each strategy executed, % Win Ratio, Number of Days in a Trade.

Journal Analytics is a powerful tool to reinforce consistency in the practice of the trading process- from the overview, evaluation, research, execution and exiting. Journaling identifies what works, what needs more discipline, etc. Analytics provide this information in easy-to-read data.

Add New #tags and Auto-Tagging

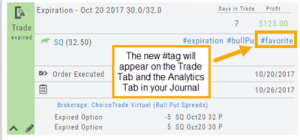

Trade Finder Scans have #tags that will automatically appear on the corresponding trade tabs in the Journal, such as #BullCall, #BullPut or #CoveredCall, for example. Trades built manually will default to #custom. In addition, trades that have expired will be auto-tagged: #expiration.

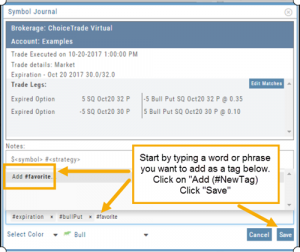

You can revise these tags and/or add your own, by the following steps:

1. On the Journal Tab, select the Trade entry you wish to edit by clicking on the Pencil Icon.

2. In the Tags section (lower part of box), start typing the word/phrase you wish to use. Example: favorite

(It is not necessary to enter the ‘#’ symbol first).

3. Click on “Add (#NewTag)“, then Save.

4. The new Tag will be on the individual Trade tab and the Analytics section of the Journal.

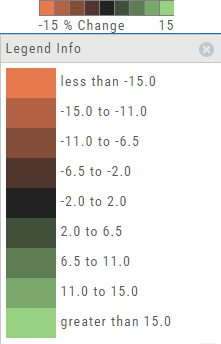

The Legend - Heat and Spectrum Maps

The Legend shows the range of % negative or positive change represented by a color spectrum. It is important to note: the range does adjust according to the data filters you select for the Heat or Spectrum Maps.

Clicking on the legend will show specific range of each color in the spectrum and give additional information about the definition.

Analyze Date

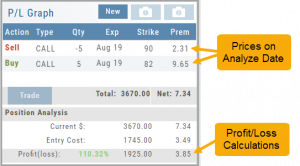

After the position is entered, click on the “Analyze Date” calendar to select the date.

![]()

You can click “EXP” to further analyze the trade on the option’s expiration date or use the arrows to move the original analyze date forward or back.

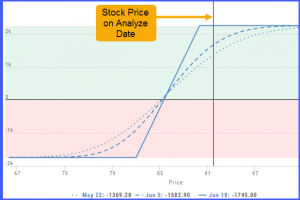

Your Position Analysis will display with estimated gain/loss calculations and the P/L Graph.

The P/L Graph will also display the stock price on the analyze date via the vertical line.

Note: The prices in the options chain will show the start date prices. The prices in the Analysis Panel will reflect the Analyze Date prices.

Note: The prices in the options chain will show the start date prices. The prices in the Analysis Panel will reflect the Analyze Date prices.

Once you have selected your date for analysis, you can edit the position, or try a different position, and the analysis will dynamically update.