Options Navigation

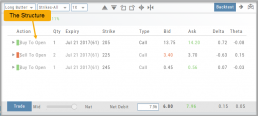

Expirations are displayed above the Option Table.

Select the months to view by clicking on the appropriate box. All available dates are displayed. Remember, the further out the option expiration is, the fewer dates are available.

Toggle between Calls Only or Puts Only view.

Change Option Table views to Pricing, Value, Greeks, Trade or new Custom views you create to suit your needs.

The small tab on the left side of the table will collapse the stock summary box & widen the option table.

The scroll bar on the right side and slide bars at the bottom on the table offer additional navigation.

Top Level Navigation

Designed so trading workflow makes sense.

Home provides an overview of the current market from charts to maps and customize your own view.

Watch more detail of selected stocks matching overall outlook.

Find identify opportunities from scans, strategies, outlook and more.

Research gives you all the detail you need on the intuitive Dashboard

Portfolio keeps your accounts, trades and journal in one place.

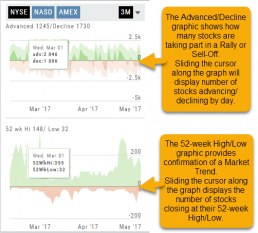

Advanced/Declined & Highs/Lows

The Graphs on the left side of the Market page can provide confirmation of whether there was a Rally or Sell-Off in the time frame selected by providing the numbers of stocks taking part in of the movement.

The 52-week High/Low Graph further confirms if there is a Market Trend by showing how many stocks closed at their 52-week High/Low.

Note, you can select a 1, 3 or 6 Month or 1 Year time frame in which to view the data. By sliding the cursor along the horizontal ‘0’ (zero) line on each graph, data for each day will appear.

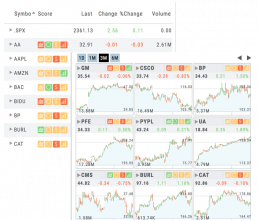

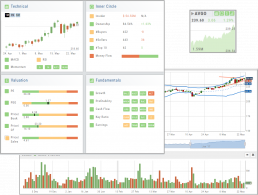

List or Tile View

View any list in traditional List View or Tile View —both show The Score.

Tile View shows thumbnail charts of the entire list. These can be viewed in a variety of periodicies. Volume is included in the 1, 3 & 6 month views to assist with quick analysis. Horizontal Reference Lines show where the Low Price and 90% of the High Price points the stock had for the selected time period.

The Score icons are also navigation shortcuts which will take you directly to Charts, Inner Circle, Valuation or Fundamentals.

Clicking on the Action Icon ![]() next to the Stock symbol in either the List or Tile View will bring up a menu offering additional choices for that Stock.

next to the Stock symbol in either the List or Tile View will bring up a menu offering additional choices for that Stock.

The Power of "The Score"

Our Proprietary Scoring System: Technical Analysis, Inner Circle, Valuation, and Fundamentals.

Designed with your workflow in mind and to give you the level of information you want, while keeping it out of the way when you don’t.

The order of The Score is based on the speed at which the stock is affected: Technicals being the fastest, and Fundamentals the slowest. For example, a very short term trader may not put as much weight on Fundamentals as with the Chart. However, as an actively managing investor, Fundamentals will be more influential on your trades.

Scans - Find Opportunities - Overview

Stagnant? Uncertain? Bearish or Bullish? Short or long term? No problem!

This “Find” category is where to find opportunities based on current Market activity and outlook, or select opportunities based on events, such as Earnings or Dividend announcements.

Whether looking for opportunities based on The Score, Events, Chart Patterns, Bullish, Bearish, Stagnant or Unknown outlook, a scan will help you find potential trade opportunities.

You can drill-down for scans by Category, Sub-Categories, then Group.

Example: Strategy>Time Spreads>Call Calendar Spreads. You can use the drop-down box, above the Category boxes to search for the scan you want or type in the box a generality about the scan. Examples: “Earning”, “Bull”, “Bearish”. “Score”, “Red”, “Green” will yield scans with that particular name in the scan

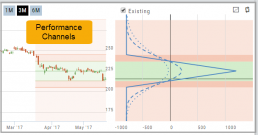

Designed to provide the level of information you want

As much information you want. When you want it.

Each of our scoring algorithms are derived from several factors, all captured in a user-friendly format.

The stock dashboard provides a more detail summary layer view of The Score. Each component: Technical, Inner Circle, Valuation and Fundamentals allows you the ability to obtain the information you want, when you want it – and kept tucked away, when you don’t.

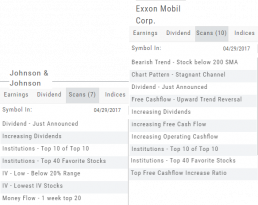

The Dashboard Scan Tab

Get the current ‘story’ on a stock.

The Scan Tab is particularly interesting. In addition to providing a list of scans the stock is currently included in, it can give you a “story” about the stock. Based on the scans that the stock is showing up in, you can get an overview of outlook on the stock.

For example: JNJ shows solid longer term positive outlook.

XOM Shows stagnant with improving longer term outlook

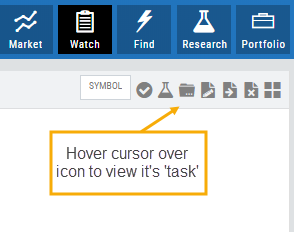

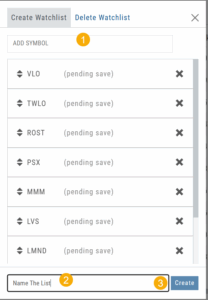

Create Watchlists

The Market & Watch Tab Icon ToolBar allows you to Create/Modify/Manage your Lists.

Hover your cursor over the icon to view it’s ‘task’:

Select Candidates

Send to Research

Create/Delete a List

Modify an existing List

Send candidates from one List to another

Remove candidates from existing List

Change View: List or Tile

To Create a New Watchlist:

1. Under ‘Create Watchlist’, enter symbols to automatically add

2. Enter the name of New Watchlist

3. Click “Create”

Other ways to Create Lists include:

Research>Chart>”Recents” list.

From the Find Tab>Scans and Find Tab>Calendar.

Selecting candidates from Scans (Ex: Bullish Ascending Triangle ) or Calendar for an Earnings or Dividend date to get the list of stocks that fit your selected criteria, click the “Check” icon to the stock symbols you want to keep, then click the Folder + icon to , name your new Watch List then click “OK”.

You can also copy/paste up to 100 symbols from an outside source to a newly created (or existing list) provided the following apply:

The symbols are separated by:

A Space: TSLA ZM GOOG NFLX

Or by a Comma: TSLA,ZM,GOOG,NFLX

Or a Return:

TSLA

ZM

GOOG

NFLX