26-01 Release Notes: Bracket Order Adjustment, Journal Reports, Show Confirmation

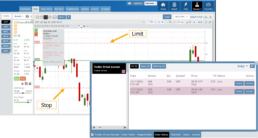

Adjust Limit and/or Stop Orders from the Chart

- Click on the Limit (or Stop) Order Dashed Line

- The Modify Order Price dialog box will appear

- Either move the dashed line to the new position, this will temporarily show up as a solid line. OR enter the new price in the dialog box.

- Click Modify

Once modified, the Limit order becomes a dashed line at the updated price.

Journal Reports

Journal Reports transform your trading data into visual insights that highlight performance trends, behaviors, and outcomes at a glance. With intuitive charts and summaries, you can easily evaluate results, refine strategies, and build more consistent trading habits.

Show Order Status (Go to Order Ticket)

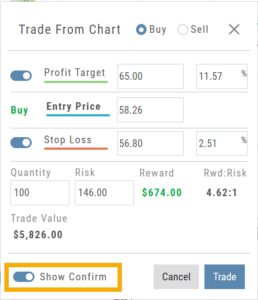

When trading from the Chart (OCO orders), you can elect to Show Confirmation – or not.

Toggling “On” will take you to the Order Ticket to review and submit your Order to the supporting brokerage.

The Order Ticket tab allows you to further adjust and even Stage the Order.

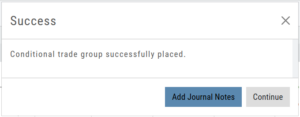

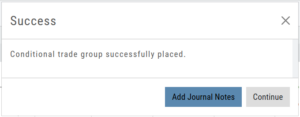

Once reviewed and submitted, you’ll get a confirmation the order was submitted, as shown here:

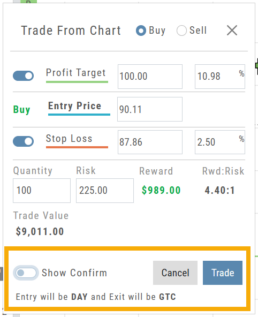

Toggling “Show Confirm” to Off, will bypass the Order Ticket window and convert the “Trade from the Charts” action to an Order Ticket itself.

Notice: The Entry is a Day Order, the Exit is a GTC order

Clicking “Submit” will send the order directly to the supporting brokerage.

Since the Order Ticket is bypassed, additional adjustments or Staging is not permitted when “Show Confirm” is in the “off” position.

Once submitted, as with “Show Confirm” activated, you’ll see this notice:

Platform Features Release: Additional Features/Adjustments to Streamline Functionality

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to streamline/improve functionality.

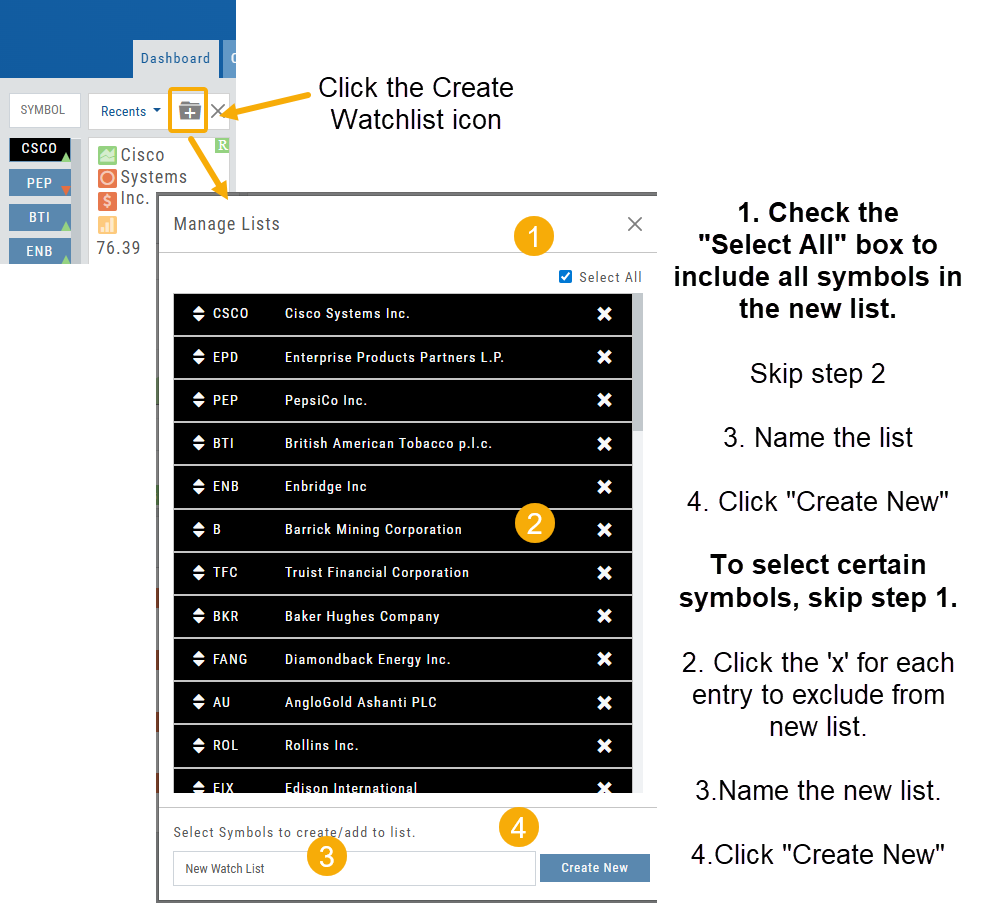

Build a Watch List from “Recent” List

Build a new Watchlist directly from the “Recent” list in Research.

Navigation Bar

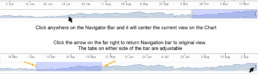

Order Status Time Stamp

Hover your cursor over the Order’s Date/Time info to display the Order’s activity Time Stamp.

Other Additions

- Enter a symbol, and it will appear in the symbol box. This works on any of the Research tabs.

- Adding a symbol when Creating a new Watchlist automatically adds to the list. The “Add” button has been removed.

Change Log

- Corrected “Close” action from Staged Trade

- Trailing % display corrected

- Renamed tooltip from “Add Watchlist” to “Create/Delete” vs. “Add/Delete”

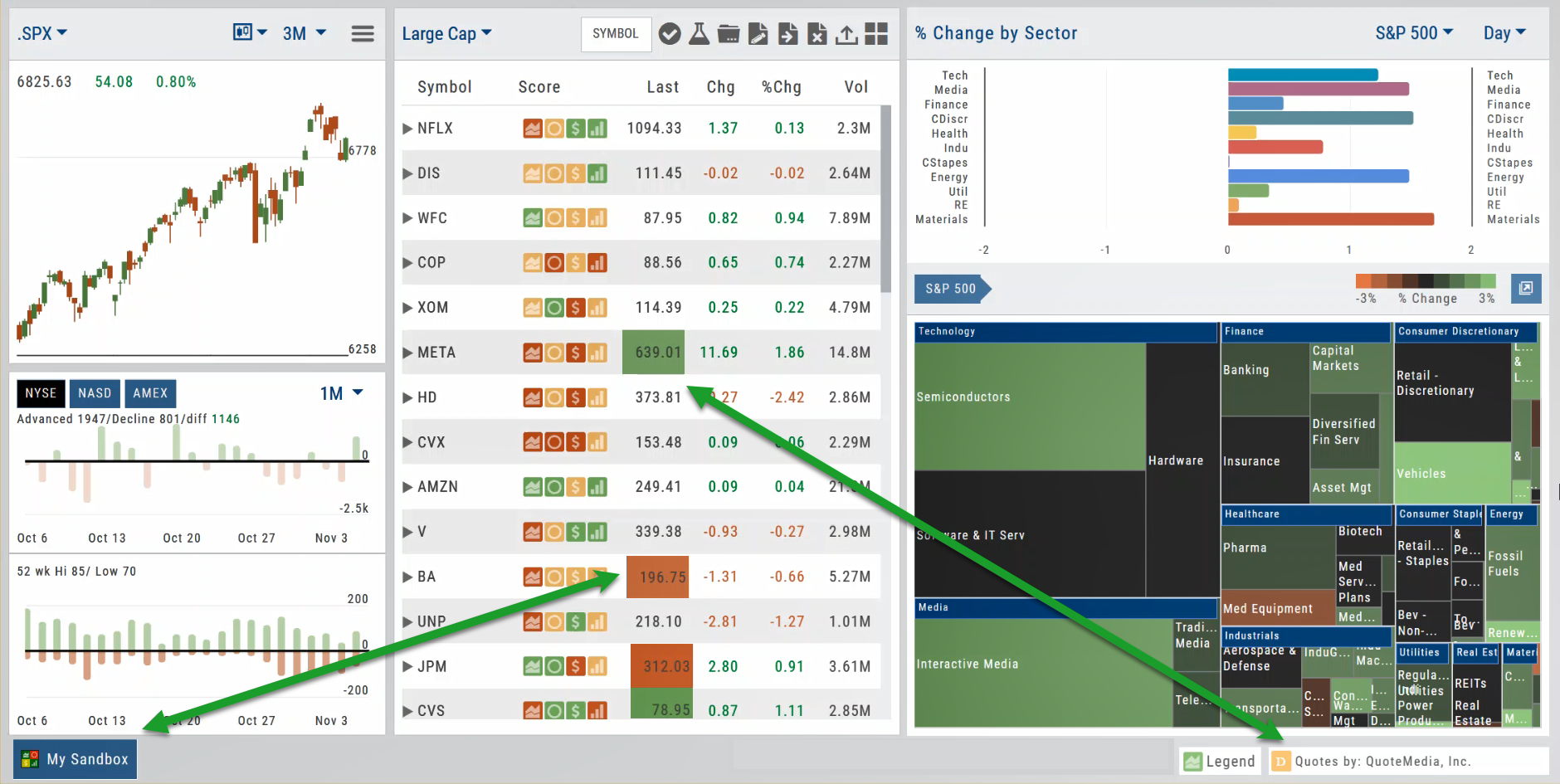

Platform Features Release: Sandbox Trading Account, Order Status Filter & more

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

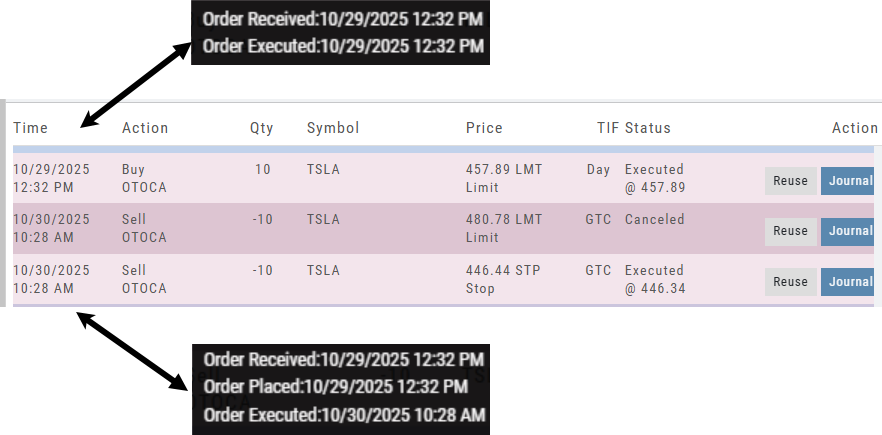

Trading Sandbox Virtual Account

Announcing a new Virtual Account with fast execution, accurate tracking, and reliability you can depend on.

Unlike traditional broker-provided virtual accounts, the Sandbox is not bound by brokerage margin rules or limitations, giving you more freedom to practice and test strategies.

The Sandbox uses delayed market data. In addition to fast, reliable trade execution and accurate trade capture, it also handles options correctly, supports Conditional Orders for stocks, full Journal Support, and more!

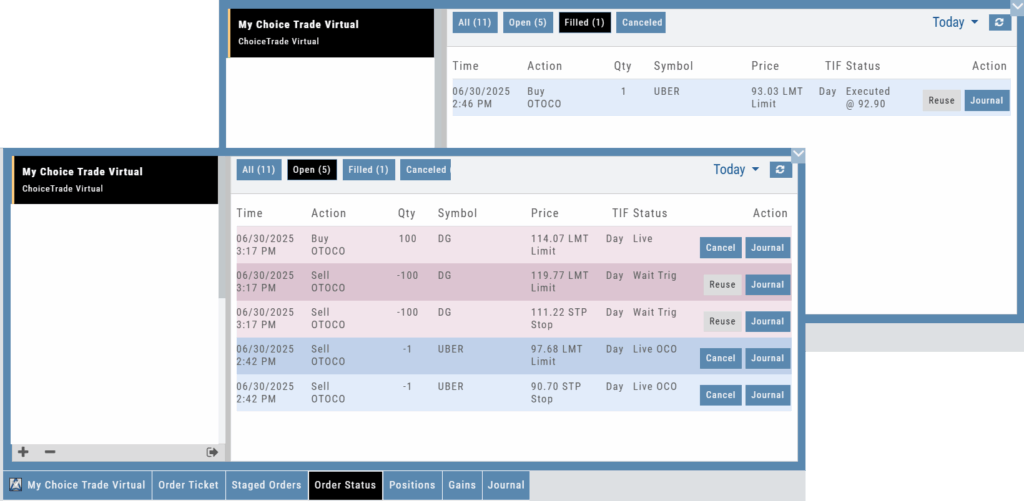

Order Status Filter Buttons

The Order Status Tab filter buttons make it easy to locate previous orders

![]()

- All – Everything in the time period is shown on the tab (Today, 1 Week, 1 Month, etc.).

- Open- Orders that have not yet executed as an active Trade/Position – includes Waiting Conditional orders.

- Working – Bracket orders where the underlying stock order is an active position (Stop/Limit orders). Excludes Waiting Conditional orders.

- Filled – Executed orders whether to open/modify/close

- Canceled – Includes both manually canceled as well as day orders that did not get filled prior to the end of the Market Day

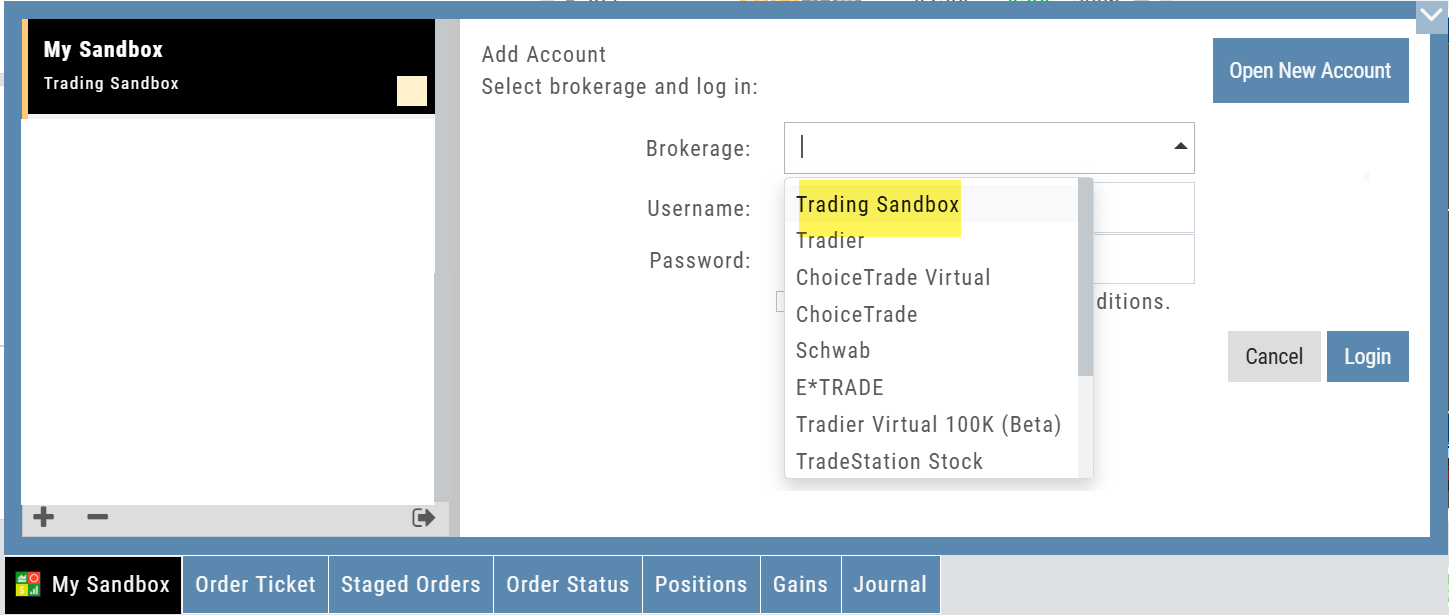

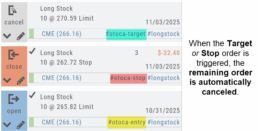

OCO Journal Tagging

OCO Orders are automatically tagged in the Journal.

Once the Stock Order is Executed (it is an active Position), the Limit and Stop orders are Live (active Orders for the duration selected: Day or GTC.)

If/when the stock hits the Limit price, that order will execute, and the Stop order will be canceled. The Journal tab will be green and display a Gain/Profit.

-OR-

If/when the stock hits the Stop price, that order will execute and the Limit order will be canceled. The Journal tab will be red and display a Loss.

**Note: Past Conditional trades will be tagged as “otoca-entry”, “otoca-target” and “otoca-stop”.

Delayed Streaming Quotes

Delayed Streaming Quotes will appear when you have a Virtual or Manual Account activated.

Click on the account tab so that it appears on the bottom left corner of your screen.

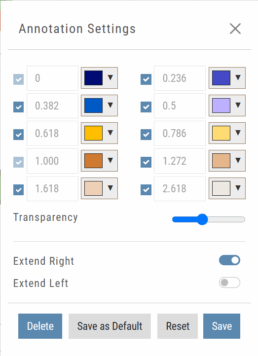

Extend Fibonacci Retracements on Charts

Fibonacci retracements can be extended right and/or left on the chart.

Click an existing Fibonacci annotation, then use the toggle switches to adjust it.

Don’t forget to “Save”

Note: Extend Right/Left can be edited/saved individually, not Set As Default.

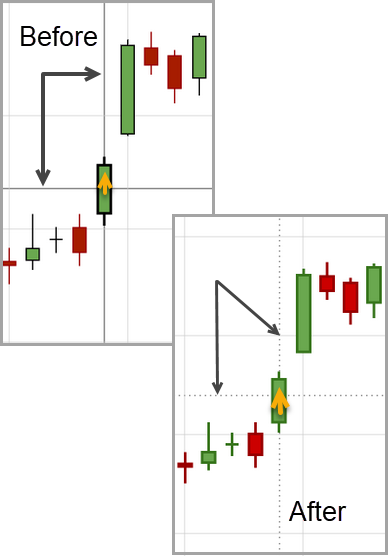

Chart crosshairs

The cursor crosshairs on the chart have been adjusted so they no longer obscure the candlestick wicks

Other Additions

- Set “GTC” as default duration for Exit Order on Trade Ticket

- Modify TTM Squeeze formula to follow industry

- Auto-select Option Cycles for existing Order(s)

Change Log

- Resolved Screener glitch to move candidates to selected watch list

Platform Features Release: New Zoom Functionality, Chart Panning

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

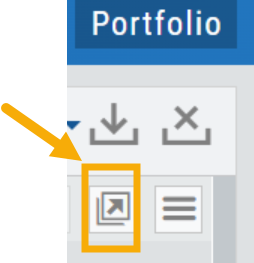

New Zoom Functionality

To activate Zoom, click on the Zoom button has been added to the icon toolbar:

![]()

- Once activated, the button changes color.

- Click/drag the mouse/cursor over the area of study.

- A “Reset Zoom” button will display when you want to restore the view.

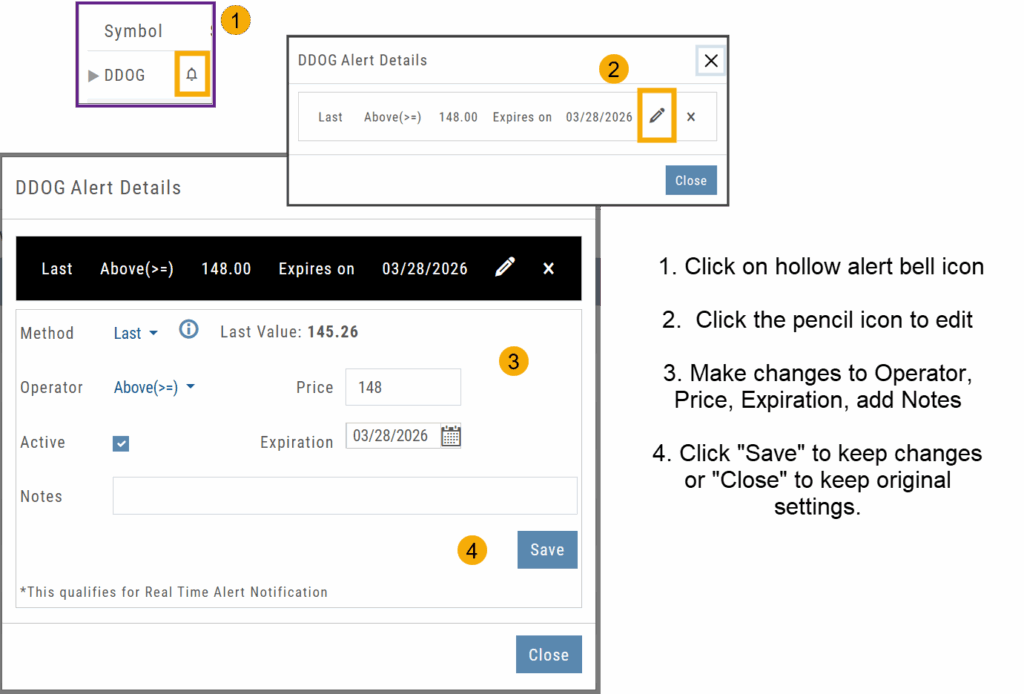

Chart Panning Functionality

Click/drag now pans the time period/price range on the chart – when dragging your mouse/cursor either right/left

Other Additions

- “Choppiness Index” Chart Lower Indictor added

- “Are You Sure You Want To Cancel This Order?” added on Order Status tab

- Clicking on “Quotes By” box (lower right corner) will display source of quotes

Change Log

- Reuse .XSP and .SPX order functionality restored

- Trading Block OTM trade error fixed

- Schwab recognizes BRK.B now

- Resolved Liquidity Range in Screener

Platform Features Release: Alert and Chart Feature Enhancements

Announcing the latest Release of Charting and Alert enhancements.

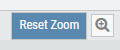

Edit Alerts from any Accessible Screen

Price Info added to Go Big Chart View

Last, Bid, and Ask values have been added to the Big Chart window, with Trade capability

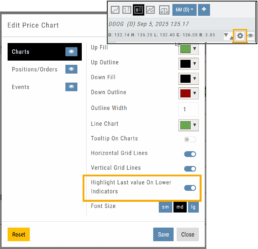

Price Chart Control

Toggle switch on/off to show/hide last value of certain lower indicators.

Change Log

- Price Slices bug fix

- Brokerages to set Virtual Account Limits

Platform Features Release: Annotation Enhancements, Condor Trade Set Up

Announcing the latest Release of Annotation improvements and Strategy template adjustment. We’ve also made several practical changes for better access to features/functions.

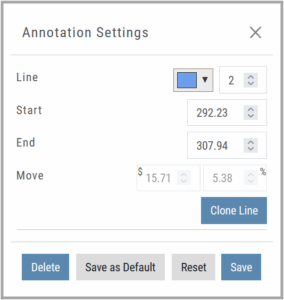

Independent Default Settings for Annotations

When adding Annotations such as lines, rays, arrows, etc, to the chart, the settings for that type of annotation can be set as a “Default”. Line settings are independent of other annotations’ settings.

Add the Annotation.

Click on the annotation to display the Dialog box (shown).

Make any adjustments.

Click “Save as Default”

The newly added and future annotations of the same type will have the new settings.

Click “Reset” to revert to original settings.

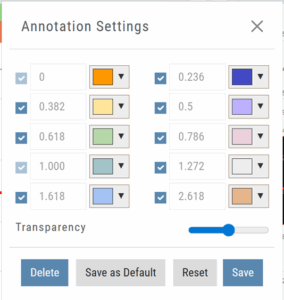

Fibonacci Too!

The Fibonacci Annotation has been enhanced to allow you to select which Retracement Levels you want to view in addition to adjusting the color for each as well as transparency overall.

The Fibonacci Annotation has been enhanced to allow you to select which Retracement Levels you want to view in addition to adjusting the color for each as well as transparency overall.

The settings can be set as the Default for new chart entries.

**Please note: Existing Fibonacci annotations cannot be edited with this new coding. They must be deleted, then added back.

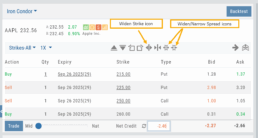

Condor Strategy Template Adjustment

The core functionality of Condor Strategy Templates has been adjusted. (Iron/Long/Short)

The center strikes are now anchored by default and will only change if you adjust them manually on the template itself or by using the “Widen Strike” icon —making trade construction more intuitive and consistent.

Widening/Narrowing of the center Strikes will change the spread of the Condor, which can be done manually on the template or by using the “Widen” or “Narrow Spread” icon.

Other Additions

- EOD lower Indicators will display “Chart Unavailable for intraday charts.”

- Zoom feature now includes a double-click “on-off” functionality

- HeatMap legend (Find>HeatMap) is movable

Change Log

- Heatmap legend is no longer fixed when clicked to view

- Transparency for shapes is resolved

- Price slice functionality adjusted for price changes

- Zoom feature is now toggle functionality

- Scrolling chart/arrow functionality resolved

Platform Features Release: Set Alert from Option Tab

This Release focused on fixes and set-ups for future capabilities and added the following:

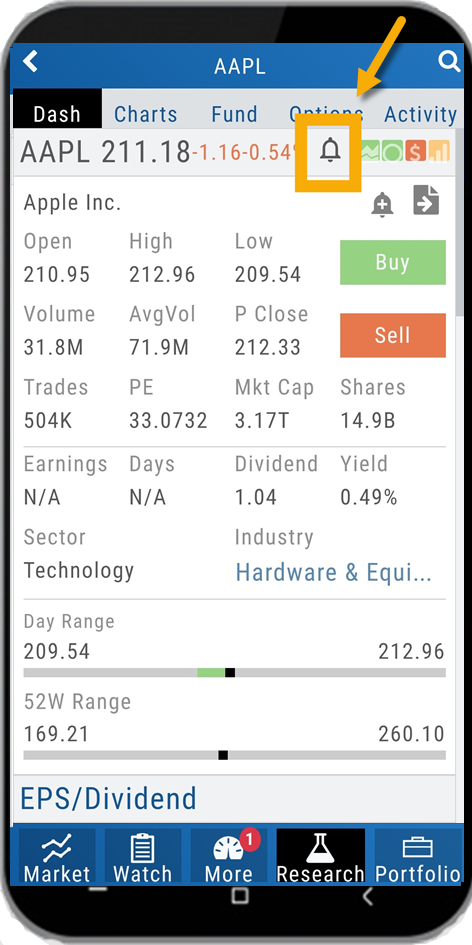

Setting Alerts Enabled from the Option Tab in Research.

Bracket Order capability in ChoiceTrade Virtual Accounts

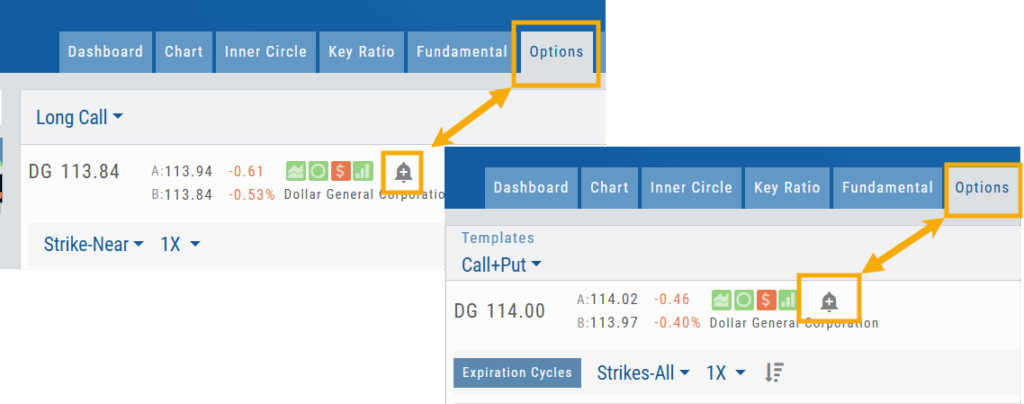

Set Alerts from Option Tab

Alerts can be set from the Option Tab – as, in Research, this was the only tab where the Info box on the left side of the screen was not visible.

ChoiceTrade has Bracket Order capability

ChoiceTrade supports Bracket Orders on Stock.

Change Log

- Resolved “Reset Zoom” function on chart vertical expansion

- Alert Expiration is midnight of Expiration day

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: New Chart Periods, Mobile App Updates, Order Status Message

This Release includes Mobile App enhancements with some important upgrades, New Chart periods added and important Order Status messages.

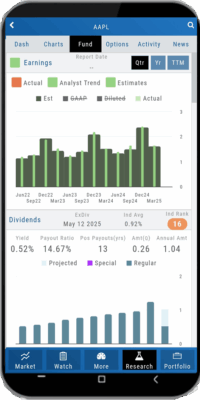

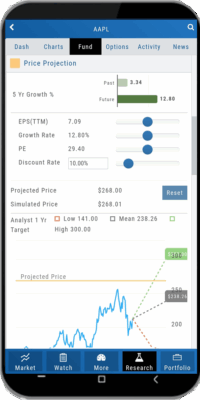

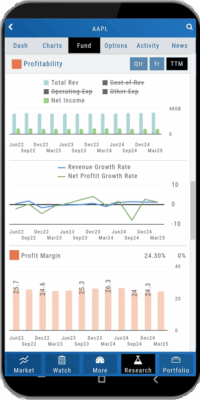

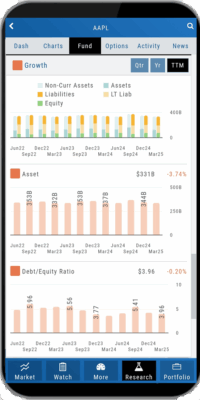

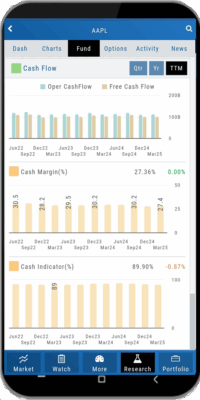

Fundamental Data: This tab greatly expands the amount of data provided, mirroring what is displayed on the desktop browser version

Faster response time: Technological updates enable the app to perform actions more quickly.

Alert Functionality on Mobile App: Upon enabling Notification functionality on your devices, you will receive alert notifications on your mobile device, even when not logged into the platform!

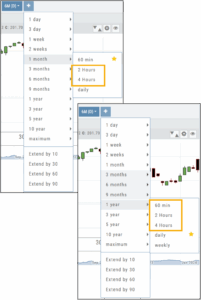

One, Two & Four-Hour Chart Views – New periods allow for more technical analysis.

Order Status Message – The status provides feedback if an order is rejected.

Mobile App – Fundamentals

The Fundamentals Tab allows you to scroll to see the same datapoints as on the desktop version. This includes the ability to select, where applicable, The last Quarter, Year or Trailing Twelve Months (TTM).

Toggle data displays by clicking on the individual datapoint in the legend for each section.

Enhanced Alert Functionality on Mobile

Enabling Alert notifications on your device will allow you to receive important updates – even when you aren’t logged into the app!

If you are logged in and such notifications are enabled, the notifications will appear as a pop-up on your desktop if you are logged into your platform or to your browser if you aren’t .

Alerts can be set up on Desktop (web and app) and the Mobile App.

Chart Periods

2-hour and 4-hour candlesticks have been added to the 1-Month Chart Period.

3-Months through 1-Year, inclusive, offer 1-hour, 2-hour, and 4-hour candlesticks for more in-depth chart analysis.

To add to the dro

p-down list of Chart Periods as a “Favorite”, hover your cursor to the right of the period selected for a sta

r to appear. Click.

To remove from the drop-down, click on the Star again.

Order Status Message

If an order gets rejected, the Status becomes a link that, when hovered over, displays the reason for the rejection.

For example, on a 100k Virtual Account, an order was submitted to buy 200 shares of a $1200 stock. It was rejected, and the message on the Order Status read:

![]()

Change Log

- Resolved “Erase All” behavior

- Reset Zoom function on Max W and M resolved

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: Bug Fixes

Change Log

- Index charts restored on Custom Page

- Dividend flags recoverd

- Mobile web order ticket corrected

- AI test time out corrected

- Chart Max view: Weekly & Monthly

Platform Features Release: New Zoom Functionality, Chart Panning

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

New Zoom Functionality

To activate Zoom, click on the Zoom button has been added to the icon toolbar:

![]()

- Once activated, the button changes color.

- Click/drag the mouse/cursor over the area of study.

- A “Reset Zoom” button will display when you want to restore the view.

Chart Panning Functionality

Click/drag now pans the time period/price range on the chart – when dragging your mouse/cursor either right/left

Other Additions

- “Choppiness Index” Chart Lower Indictor added

- “Are You Sure You Want To Cancel This Order?” added on Order Status tab

- Clicking on “Quotes By” box (lower right corner) will display source of quotes

Change Log

- Reuse .XSP and .SPX order functionality restored

- Trading Block OTM trade error fixed

- Schwab recognizes BRK.B now

- Resolved Liquidity Range in Screener