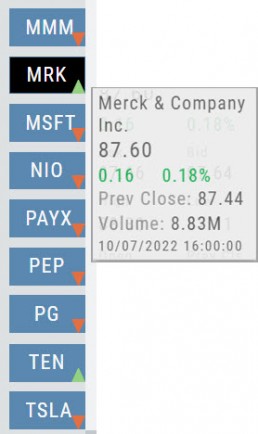

Price Change Indicator

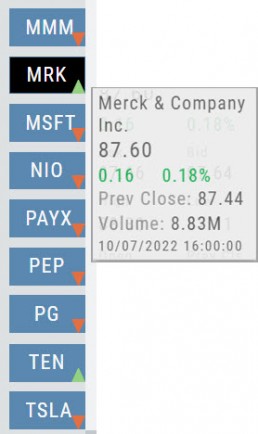

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Platform Features Release: April 2023

Announcing the latest feature(s)/function(s) updates, additions, or edits to the trading platform:

Cloning and Editing Trendlines

New Trendline Customization

Clone trendlines with the push of a button. Easily define or edit trendline endpoints.

Click on an existing trendline to display the Annotation Settings box, make your changes, then click “Save”.

Enhancements

- Reusing canceled GTC Order preserves Duration

Change Log

- Repaired contrast on Find>Scans>Filter table

- Chart crosshair behavior resolved

- Pivot Point indicator editing restored

- Removed duplicate Inner Circle>Insider Information

- Platform Notification>“Don’t show again” fixed

- Backtest>Analyze Date selection repaired

- Corrected date display above chart

- Seasonality Chart behavior corrected

- Screener functionality repaired on several items

- Hide function on Option functionality restored

- Russell 2000 restored on Find>HeatMap

- Backend fixes on previous releases

- Net Debit/Credit responsiveness restored on Manual Accounts

Platform Features Release: March 2023

Announcing the latest features/functions updates, additions, or edits to the trading platform:

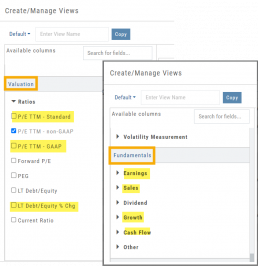

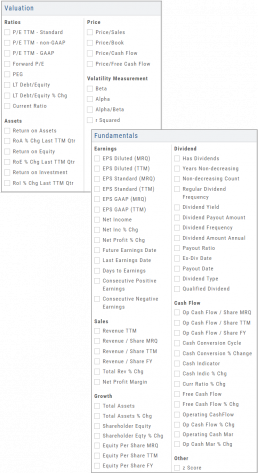

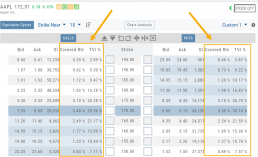

Valuation and Fundamental Data Points added

Users have more criteria to select from for both the Screener, to find potential trade candidates, and Watchlist Views to analyze candidates.

Valuation and Fundamental Data Points Added

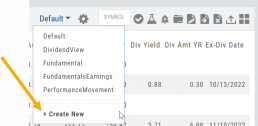

Watch List Views

Over 30 data points were added to the Valuation and Fundamental sections for Watch List Views.

Build, Save, and Edit your customized Watch List Views to your needs.

Learn how to use this feature:

Screener

Over 30 data points have been added to the Screener Function under the Valuation and Fundamental sections.

There are 3 Levels of Data Points. Level 2 has more Data Points than 1, Level 3 has all criteria available to select from.

Now users have more tools to choose customize screens. These may be saved and edited at any time.

Enhancements

- Added Average Volume line to (upper) Volume Indicator

- Saving Annotations/Texts, etc on charts are an automatic function. It no longer has to be selected.

- Scroll function added to lists on Custom, Market and Watch pages

- GAAP/non-GAAP PE/PEG (TPE and PE chart in Valuation section to reflect GAAP PE)

Change Log

- Resolved Screener Export Function

- Open/Close “save” function fixed in Backtest mode

- 2nd email saving in Notification feature setup

- Candlesticks and Volume bars line up

Platform Features Release: December 2022

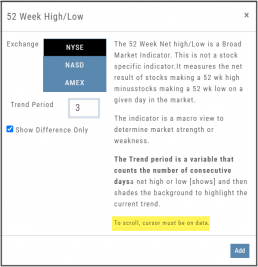

Announcing the latest Release which added a powerful Lower Indicator on the Charts Tab: 52 Week Hi/Lo. Price/Date info has been added to X/Y axis

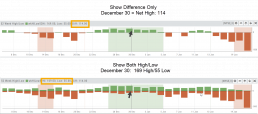

52-Week Hi/Low Indicator

The newest lower indicator: 52-week Hi/Low Indicator is a Broad Market Indicator. It is not Stock specific.

View how individual Stocks/ETFs are faring compared to the Broad Market.

Select from NYSE, NASD or AmEx

There are two views:

Show Difference Only – Display either a green or red (or no) bar representing the net advancers/decliners for that period.

Show High & Low (uncheck box)– Displays both green/red bars to illustrate number with new 52 week high/lows.

The background color identifies a bullish or bearish trend, based upon the number of days selected (Trend Period)

Example: If 3 days are selected, background highlight will begin on the 4th consecutive day of gains (or losses).

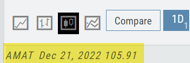

X/Y axis – Price/Date display

The cursor’s crosshairs will display the Price/Date info along the X/Y axis for easier reading.

This information will still appear in the upper/right corner above the chart:

Drawing Key Activation

Use your keypad to activate drawing lines on the Chart by following these steps:

1. Click either in Header area above the chart – OR –

Click the Annotation icon>Line

2. Click on chart, then “Alt” and “T” keys where you want to start line.

Once activated from either of the starting points (1), the function works on the current chart, without having to reactivate by clicking on the Header or Annotation icon.

Platform Features Release: November 2022

Announcing the latest Release allowing for customized Watchlist views. Improvements in Journal functionality will increase responsiveness and allow users to better control the data displayed. Format enhancements were also made to increase readability

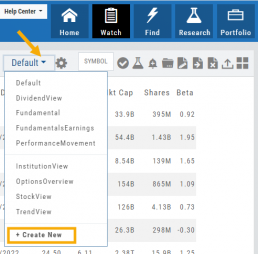

Watchlist Views – Create, Save & Edit

The ability to create your own Watchlist views based on criteria important to you enhances the work flow of finding the best candidates for trading.

Click on ![]() next to the (Default) Watchlist, then select “Add New” to get started.

next to the (Default) Watchlist, then select “Add New” to get started.

Build your own views from over 160 data points, then adjust the display position in the order you want them to appear.

Click on ![]() icon to edit a view you previously created.

icon to edit a view you previously created.

Learn more by clicking below:

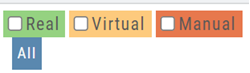

Improvements

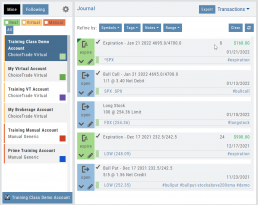

The Journal default displays Order/Trade activity from the Activated Trade Account.

To switch or add accounts, simply click on the other Account tabs or select by group: Real, Virtual, Manual or All accounts.

The improved functionality allows for faster journal activity display and easier trade analysis.

Change Log

- Resolved Score Icon Navigation from Home/Market Tab

- Corrected Fundamental/Dividend missing data

- Moving Average indicator functionality restored on Custom Page

- Corrected display data on Fundamental Tab

- Addressed candlestick not appearing first 20 minutes on Mondays.

- Rectified downloading data from Screener

Customize Watchlist Views

Customize Watchlist Views

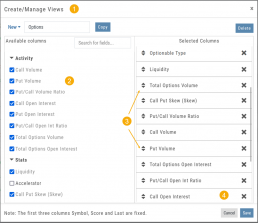

You have the ability to customize Watchlist Views – based upon criteria you want to see.

Click on the ![]() next to “Default” or current view you are on to create a different View.

next to “Default” or current view you are on to create a different View.

If/When you want to edit any of your personal views, simply click the ![]() icon, remove/add criteria, adjust placement, then click “Save”.

icon, remove/add criteria, adjust placement, then click “Save”.

From Assets to Z-Score, there are over 160 data points to select from including data from: Company Information, Technicals, Valuation, Fundamentals & Options.

Simply:

1. Name the View

2. Select Data Points

3. Arrange – clicking on arrows to move up/down

4. Save

Your Watchlists are now more powerful because they show the data you want to see to help you make your trade decisions.

The Result:

Note: The Symbol, Score Icons and Last Price are fixed

Research Your Watchlists

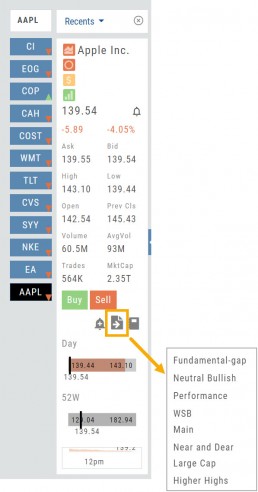

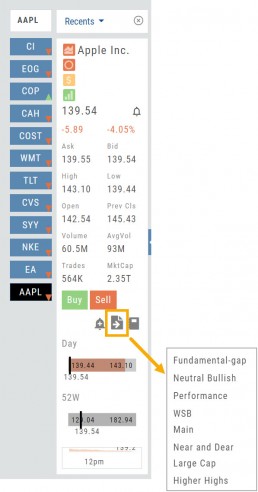

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

Platform Features Release: October 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

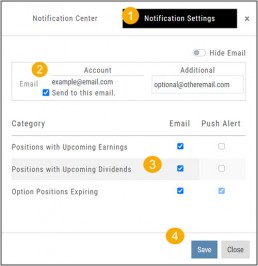

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

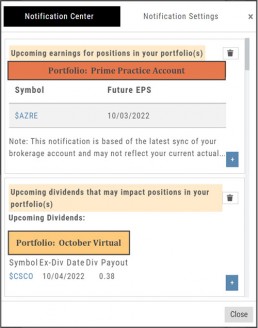

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

Platform Features Release: August 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These allow for more customizing ability and streamlines functions on accessing or displaying information. Highlights include:

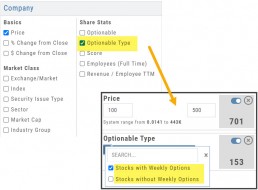

Screen for Weekly Options – The ability to screen for weekly options has been added to the Screen Function under Find.

Rearrange Screener Data Points – Change selection order directly on the Results page, by drag/drop action.

Large Chart Widget on Custom Page –The new widget fits an entire row on the custom page.

Customize Moving Averages – The Moving Average thickness can now be customized.

Vertical Zoom on Chart – Function expanding to allow for Horizontal and Vertical Zoom.

Double-click function on Expiration Cycle Page –Eliminates need to click “Okay” button

Screen for Weekly Options

The Screener – located under the Find Tab – now provides the ability to screen for Weekly Options.

Now customizing your own searches is even better!

Remember, you can save Screens for future use – and even edit/update them as needed.

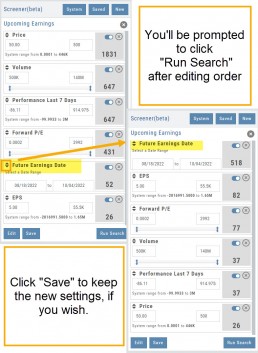

Rearrange Screener Criteria

Rearrange Screener data points on the Results page by clicking ![]() located on the upper left corner of each data point, then drag up/down.

located on the upper left corner of each data point, then drag up/down.

The data points are filtered with each entry in the order they are listed.

Additional edits can be made with the existing Screener data points:

Click ![]() to keep the data point but disregard in an updated “Run Search”.

to keep the data point but disregard in an updated “Run Search”.

Click ![]() to remove the data point from an updated “Run Search”.

to remove the data point from an updated “Run Search”.

Save to keep the edited Screener for future use.

Large Chart Widget on My Custom Page

An individual chart can be set on an entire row on the Custom Page by selecting the Large Chart widget.

The Custom Page set-up and arrangement remain the same.

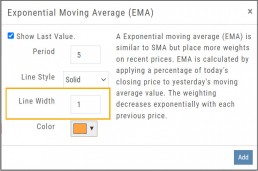

Customize Moving Average Lines

All Moving Average Indicators, Exponential, Simple, Triangular and Weighted can be customized to set Line Width. The default setting is ‘1’.

This update, along with previously added, user-defined “Line Type” allows for even more identification in charting analysis.

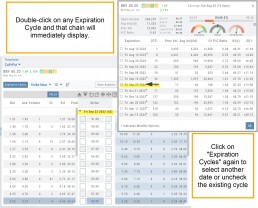

Expiration Cycle Double-click Functionality

Quickly access one or more Expiration Cycles by double-clicking on each row you wish to evaluate.

The selected dates will automatically display on the Chain.

Click “Expiration Cycles” button again to revise/add to existing cycles.

Vertical & Horizontal Zoom Functionality

Change Log

- Corrected “Extend By” behavior on Chart with Streaming

- Created ability to reconcile partial trades

- Updated Annotation editing capability when adding text

- Resolved Edge browser/Annotations conflict

- Volatility Stop Indicator – expanded

- Fixed navigation break: Chain>Chart>Chain

- Analyze function restored on certain strategies

- Alert tool-tip correction

- Adjusting Parallel lines now saving

- Corrected Pending/Executed Order on Chart display

Platform Features Release: April 2022

Announcing the updates, additions and edits to the trading platform:

Capability to adjust charts for splits

When a stock had a previous stock split, a button appears above to view Adjusted/Unadjusted Chart.

Data Points added to Option Chain

Get % return on Expiration and annualized % values for covered positions.

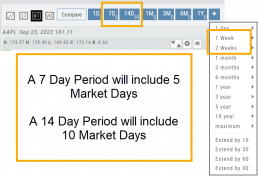

Intraday Chart Period Update

1 Week displays as 7 Days. 2 Weeks displays as 14 days.

Chart Adjusts for Splits

When a stock has a Split history, ![]() will appear next to the Indicator Box above the chart.

will appear next to the Indicator Box above the chart.

Make sure the chart period selected covers when the split occurred. This is identified on the x-axis of the chart as ![]() .

.

When the “UnAdj” button is clicked, the chart will display ‘before’ & ‘after’ split pricing.

Click the “UnAdj” button again to restore the prior chart display.

New Option Data Points Added

New data points have been added to assist in analyzing returns.

Covered Return – return based on expiration for $ used to buy shares for covered positions.

TVI% – Covered Return annualized

These are available on the Calls/Puts Chain and are also available as data points for Option Chain Custom Views

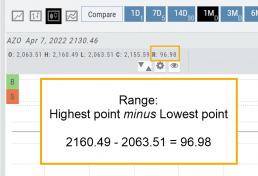

Chart Enhancements: Chart Periods & Candlestick Range

Change Log

- Resolved Saved Screener settings glitch

- Corrected Backtest Analyze date ability

- Restored sort capability in Institutional Activity

- Corrected profit/loss % display in Virtual Accounts

- Restored missing PEG/TTM data

- Enhanced contrast/dark theme notation

- Corrected Virtual Account Gain/Loss display

- Lower Indicator placement ability restored

- Earnings Data restored, added Time of Day

- Duplicate TDA Journal tab resolved