Platform Features Release: New Chart Periods, Mobile App Updates, Order Status Message

This Release includes Mobile App enhancements with some important upgrades, New Chart periods added and important Order Status messages.

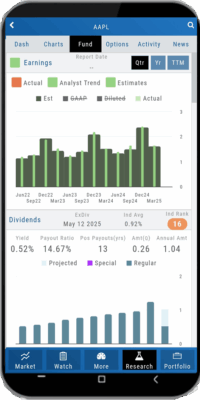

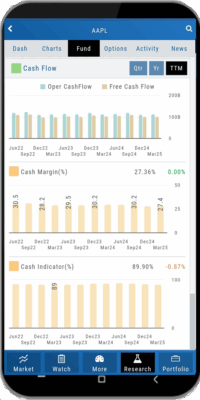

Fundamental Data: This tab greatly expands the amount of data provided, mirroring what is displayed on the desktop browser version

Faster response time: Technological updates enable the app to perform actions more quickly.

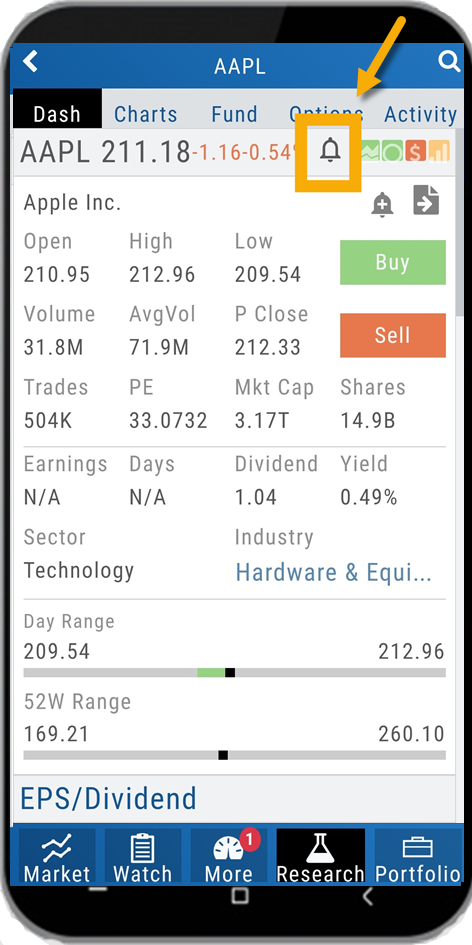

Alert Functionality on Mobile App: Upon enabling Notification functionality on your devices, you will receive alert notifications on your mobile device, even when not logged into the platform!

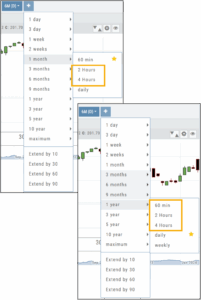

One, Two & Four-Hour Chart Views – New periods allow for more technical analysis.

Order Status Message – The status provides feedback if an order is rejected.

Mobile App – Fundamentals

The Fundamentals Tab allows you to scroll to see the same datapoints as on the desktop version. This includes the ability to select, where applicable, The last Quarter, Year or Trailing Twelve Months (TTM).

Toggle data displays by clicking on the individual datapoint in the legend for each section.

Enhanced Alert Functionality on Mobile

Enabling Alert notifications on your device will allow you to receive important updates – even when you aren’t logged into the app!

If you are logged in and such notifications are enabled, the notifications will appear as a pop-up on your desktop if you are logged into your platform or to your browser if you aren’t .

Alerts can be set up on Desktop (web and app) and the Mobile App.

Chart Periods

2-hour and 4-hour candlesticks have been added to the 1-Month Chart Period.

3-Months through 1-Year, inclusive, offer 1-hour, 2-hour, and 4-hour candlesticks for more in-depth chart analysis.

To add to the dro

p-down list of Chart Periods as a “Favorite”, hover your cursor to the right of the period selected for a sta

r to appear. Click.

To remove from the drop-down, click on the Star again.

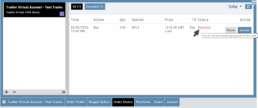

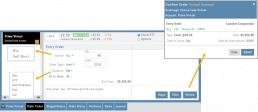

Order Status Message

If an order gets rejected, the Status becomes a link that, when hovered over, displays the reason for the rejection.

For example, on a 100k Virtual Account, an order was submitted to buy 200 shares of a $1200 stock. It was rejected, and the message on the Order Status read:

![]()

Change Log

- Resolved “Erase All” behavior

- Reset Zoom function on Max W and M resolved

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Fundamentals Tab

Fundamentals

Fundamentals provide valuable insights into the financial health and performance of a company. They offer a comprehensive analysis of the company’s operations, profitability, growth potential, and overall stability.

Fundamentals are comprised of Earnings, Dividends, Price Projections, Profitability, Growth, and Cash Flow.

Profitability, Growth, and Cash Flow offer even more detail. Either click the button in that section:

![]()

OR click the appropriate category at the top of the window:

Earnings data provide insight into a company’s financial health and performance.

Past earnings reports offer insight into the company’s historical growth, profitability, and stability. Positive earnings trends may indicate a well-performing company. Negative or declining earnings could be cause for concern.

Earnings

Earnings projections provide forecasts of a company’s future earnings to gauge Market sentiment and investor expectations. Projections are compiled by financial analysts using factors such as industry trends, company guidance, and economic conditions. Surpassing or falling short of projections can greatly impact stock price.

Some benefits to both the company and shareholders include:

Income Generation

Shareholder Loyalty

Return on Investment

Dividend Reinvestment

Signal of Financial Health

Possible Tax Advantages

Disciplined Capital Allocation

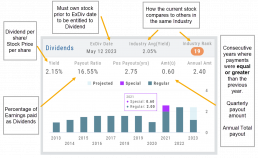

Dividends

The decision to pay dividends is up to the company’s management and board of directors, who weigh various factors, including the company’s financial position, growth prospects, and other capital allocation priorities. Dividend payouts are not guaranteed and may fluctuate or be suspended based on the company’s circumstances and strategic considerations.

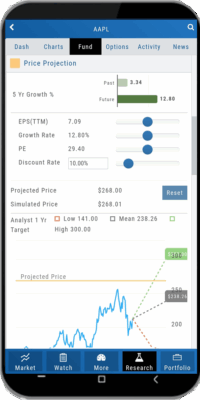

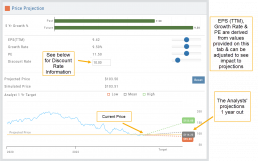

Price Projection

Discount Rate

Determining the appropriate discount rate for a stock is a subjective process and depends on various factors.

Here is an example:

- Risk-Free Rate: Start by considering the risk-free rate, (the theoretical rate of return on a risk-free investment such as government bonds). This serves as a baseline for the discount rate. An online search can locate this information for you.

- Risk Premium: Assess the risk associated with the specific stock you are evaluating. Stocks are inherently riskier than risk-free investments, so you need to add a risk premium to the risk-free rate. The risk premium accounts for the additional return expected by investors for taking on the extra risk. The risk premium can vary depending on factors such as industry, company-specific risks, economic conditions, and market volatility.

- Beta: This measures its sensitivity to market movements.

Beta of 1 = the stock moves in line with the overall market

Beta > 1 = the stock has higher volatility and would warrant a higher discount rate to reflect the increased risk. - Company-Specific Factors: Are there unique company factors (financial health, competitive position, growth prospects, management quality, etc) that could positively or negatively influence the discount rate?

- Sensitivity Analysis: Changing the discount allows you to assess the impact of the stock’s valuation. Some sectors are subject to more volatility than others: the Energy and Material Sectors tend to be more volatile than Consumer Staples or Utility Sectors.

The discount rate is subjective. Different investors might have different views on what the appropriate discount rate is for a given stock, based on their own risk tolerance, the specific risks associated with the company, and their expectations for future market conditions.

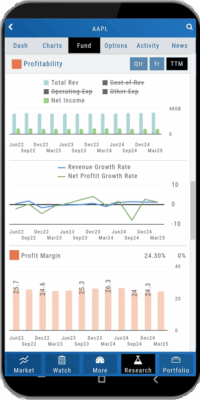

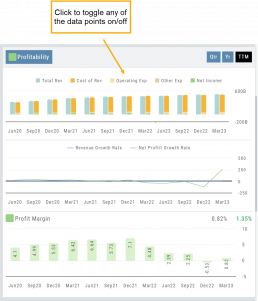

Profitability

Revenue: Money generated from sales of goods or services. It is income earned prior to deducting expenses or costs

Cost of Revenue: Expenses directly related to production, manufacturing, or acquisition of products/services sold. Typical examples include raw materials, labor, overhead, etc.

Operating Expenses: Day-to-day, necessary operating expenses not directly related to the production/acquisition of goods/services. Examples: Wages, utilities, depreciation, advertising, etc.

Other Expenses: Depending on the nature of the business can include: Taxes, Interest, Non-operating losses, Restructuring, Non-recurring, etc.

Revenue Growth Rate: Percentage change (+/-) in a company’s sales/revenue over a period of time:

Revenue Current–Revenue Previous/Revenue Previous x 100

Net Profit Growth Rate: Percentage change (+/-) in a company’s net profit over a specific period of time:

Net Profit Current–Net Profit Previous/Net Profit Previous x 100

Profit Margin: Percentage of revenue a company retains after deducting all expenses.

A higher profit margin indicates a company is generating more profit relative to its revenue. A lower percentage suggests higher expenses in proportion to revenue.

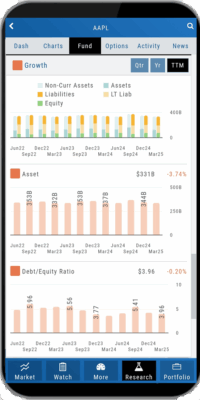

Growth

Asset: These can vary by industry/company. Common examples that contribute to a company’s growth are Financial, Intellectual Property, Human Capital, Physical Assets, Technology/Info Systems, Customer Base, Brand Equity, Partnerships, and Networks.

Debt/Equity Ratio: Total Debt divided by Total Equity. Interpretation varies by industry and a company’s specific circumstances: a high ratio can indicate higher financial risk OR effective management of debt through cash flow. A low ratio can indicate a conservative financial position OR under-utilization of debt and missed opportunities for growth.

Non-Current Assets: Resources not intended to be converted into cash or used up within a year.

Assets: Anything of value that has the potential to generate future economic benefits.

Liabilities: Obligation or debt a company owes to external parties that must be fulfilled in the near future.

Long-term Liabilities: Obligation or debt a company owes but has more than a year to repay.

Equity: The portion of a company’s value belonging to its owners or shareholders after all debts and obligations have been settled

Operating Cash Flow: Represents the cash inflow/outflow directly related to day-to-day activities including sales of goods and services, paying operating expenses, and collection of receivables.

Free Cash Flow: Cash flow available for discretionary use after accounting for operating expenses, capital expenditures, and changes in working capital. Positive values offer opportunities, negative values may indicate financial challenges.

Cash Flow

Cash Margin %: Percentage of cash generated from a company’s sales revenue after deducting its cash operating expenses. It measures the profitability and efficiency of a company’s operations to generate cash.

Cash Indicator: The industry percentile ranking of a company’s ability to generate cash from its operations.

Platform Features Release: Smart Trade Ticket, Global Chart Settings, Updated Fundamental Tab, Order/Trade Chart Display

Features Release Notes:

Smart Trade Ticket, Global Chart Settings, Updated Fundamental Tab, Order/Trade Chart Display

Announcing the latest features/functions updates, additions or edits to the trading platform:

The Smart Trade Ticket is easier to use and allows for future capability depending on what brokerages offer. One Example if this would be Conditional Orders.

Global Chart Settings have always housed where to control candlestick/volume bar colors as well as Tooltip displays. Now, clicking on the gear allows you the ability to display Annotations, Positions/Orders and Events.

The Fundamental Tab under Research has an improved, easier to read display with additional features for a clearer snapshot of a stock’s past and forecasted performance.

You’ll be able to differentiate a Conditional Order from a Staged Order as well as a Yet-To-Be-Executed-Order with the enhanced Order/Trade Display.

Smart Trade Ticket

Smart Trade Ticket

The redesigned Trade Ticket has defined sections for Stock/ETF trades and Option Trades. The Stock Ticket is divided into Open and Exit sections for easier use.

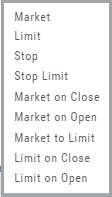

The Close Ticket provides a summary of any Profit/Loss on the trade. Brokerages determine available Order Types, which may include the following to open a trade:

Note: Closing Order Types may also include Trailing $ and Trailing %.

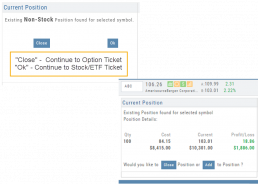

If there is an existing position on a Symbol when a new order is created, the Smart Ticket system will identify if there is an existing Non-Stock/Multi-leg Position or an existing Stock position.

If Non-Stock/Multi-leg position, clicking “Close” will navigate the user to the Option Trade Ticket. Clicking “Ok” will lead the user to the Stock/ETF Ticket.

If there is an existing Stock position, a summary of the existing will display along with the ability to Close or Add to the existing position.

Global Chart Settings

Global Chart Settings

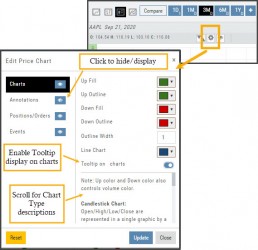

Manage common chart settings from one location by clicking on the left-most Gear icon on the Chart Header which is located under the saved chart periodicities.

In addition to setting your Bullish/Bearish candlestick and corresponding Volume bar colors and control of whether you want Tooltips to display on the chart, you can view/hide:

All Chart Settings

Annotations

Orders/Positions

Events (Dividends/Earnings)

Simply click the ‘eye’ icon to display/hide your selection. Once finished with your Global Settings, click “Update,” then “Close.” To reset to default settings, click “Reset.”

Improved Fundamental Display

Fundamental Data has a new look

The area charts under the Research>Fundamental tab have been replaced with bar charts for easier understanding.

A Tooltip appears when you hover your cursor over the bar charts providing information for that data point.

Estimated Earnings is now in the same window as Historic Earnings for clearer comparison as both sets of data now have the same orientation

The Earnings display has been enhanced to illustrate past and projected data in the same window to match the orientation for a more accurate ‘apples to apples’ comparison.

Click on any of the legend icons to toggle the data displayed.

![]()

The Analysts’ Target Window displays the current stock price as a horizontal line for reference.

Custom Page Enhancements

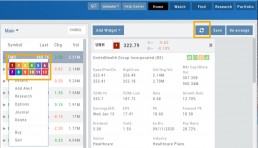

The widgets with that number will automatically populate accordingly.

To change displaying one symbol to another using a Watchlist, simply click on the Action Icon of new Symbol and select the number of the current Symbol you want to replace.

A refresh icon ![]() has been added to the Header to make it easy to update the Custom Page display after rearranging widgets.

has been added to the Header to make it easy to update the Custom Page display after rearranging widgets.

We’ve increased the number of symbols that can be tagged from 6 to 12.

Using the Watchlist displayed on the left side of the screen, click the Action Icon (triangle) to left of Stock Symbol you want to display and assign a number, 1 to 12.

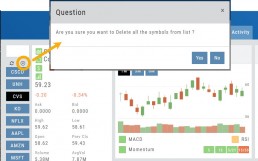

Delete Notice added to Research Tab

A Warning Notice now displays when ‘x’ is clicked on the Research Tab requiring confirmation prior to removing the list of symbols from the tab.

Change Log

- Heat Map filter setting/saving improved

- Interval call split adjustments

- Greek Summary displays on Positions tab

- ETF list on Home Page issue resolved

- Strike Arrow functionality restored on Option Chain

- Sorting Scan after scrolling behavior corrected

- Eliminated stacking Indicators on charts

- Alert list is scrollable

Fundamentals

A complete perspective of performance in one place.

Fundamentals looks at 20 critical financial analysis ratios in 5 different categories: Growth, Profit, Cash Flow, Key Ratios, and of course, Earnings.

We also take into account Quarter over Quarter, Year over Year, and Trailing Twelve Months’ (TTM) performance with our proprietary weighting formula. View historical data by clicking on the upper right corner buttons in each window.

Fundamentals is the slowest of The Score components to affect stocks, due to the limited times throughout the year data is released. Active investors would generally place more weight on Fundamentals than would a very short-term trader.