Positions Tab

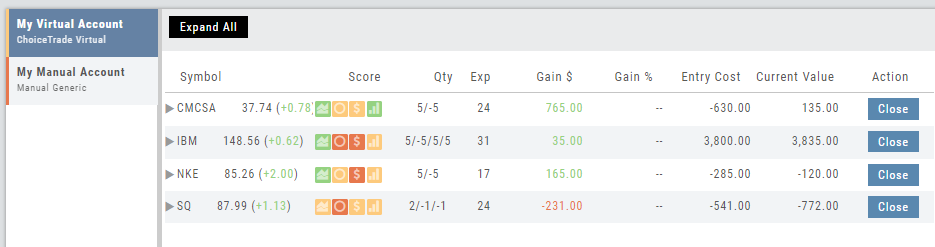

The Positions Tab offers 4 table views of your current trades. You can access these by clicking on the drop-down box in the upper right of the screen. “All” combines the 4 views.

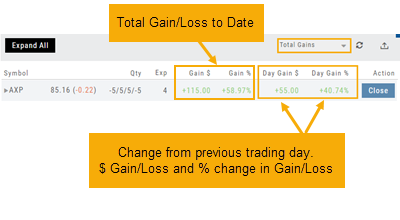

Total Gains

This table view displays the Overall $ and % Gain/Loss and the Daily $ and % Gain/Loss based on the previous trading day’s results.

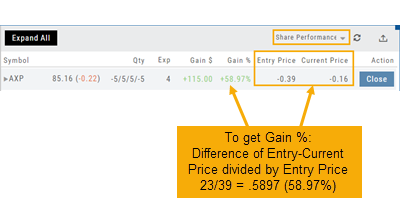

Share Performance

This table breaks down Total Gains by showing Entry Cost compared to Current Value per Share.

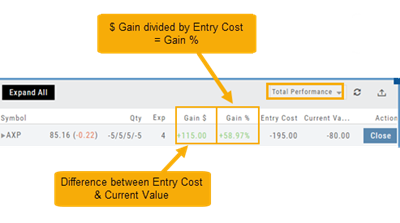

Total Performance

Similar to Share Performance, but shows Total Entry Cost and Total Current Value.

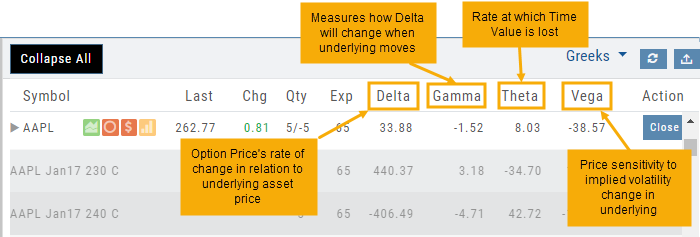

Greeks

Expand Trade Detail - Positions Tab

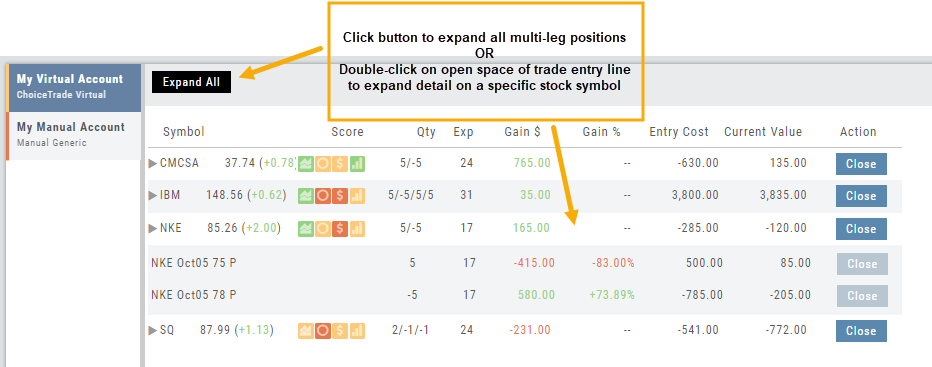

There are 3 ways to expand multi-leg trades in the Positions Tab.

Smart Icon – Click on the ![]() icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

Expand All – Click the button above the trade entries if you wish to expand all multi-leg trades. Once clicked, the button will change to Collapse All.

Double-Click – if you want to expand one trade or specific trades, simply ‘double-click’ on an open space of the trade entry line. Repeat to close.

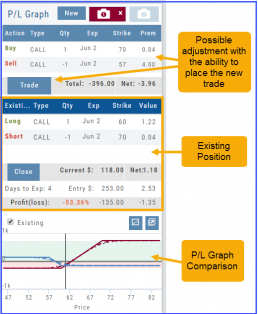

Trade Management

This platform makes it easy to manage and adjust trades when needed. The Snapshot feature and the P/L graph enables you to visually assess adjustments.

Once the existing trade is showing on the options page, take a ‘snapshot’. Enter the adjustment, then take another ‘snapshot’.

To submit the adjustment to the Order Ticket of your brokerage account, click “Trade”. The smart ticket system will even handle the trade adjustment automatically by entering the appropriate buy/sell, open/close combination.

Position Download Ability

Downloading/exporting capability added to the Positions tab.

This feature is also available in the “Gains” tab.

This allows even greater flexibility with record-keeping from the Journal/Brokerage Account.

I own the stock, how to I enter a Covered Call trade?

When you already own the stock, but want to enter a Covered Call position, follow the following steps:

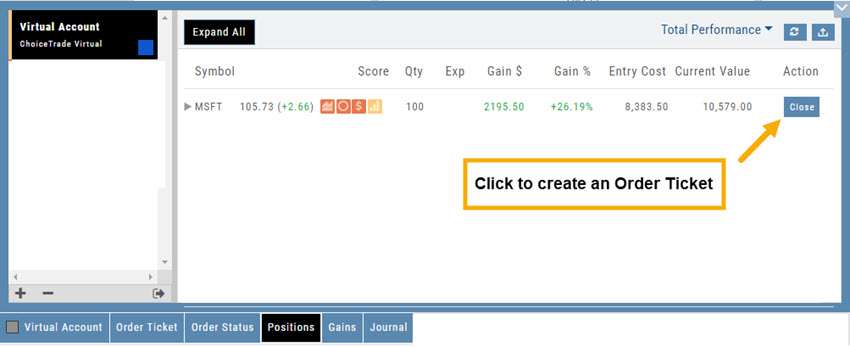

1. From the Positions Tab, click “Close”

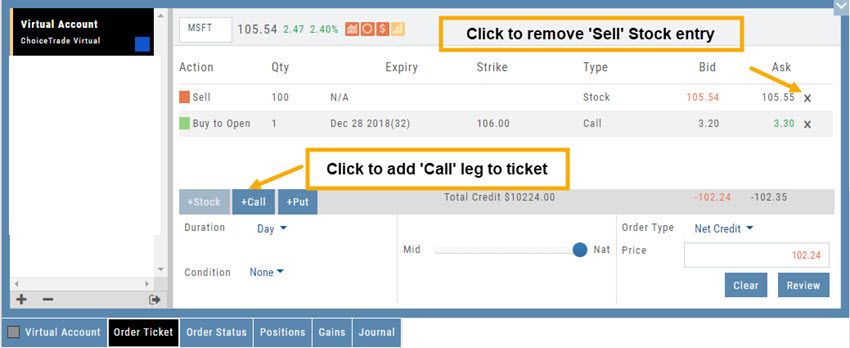

2. Add Call Leg (you’ll adjust this later) & Delete Sell Stock entry line:

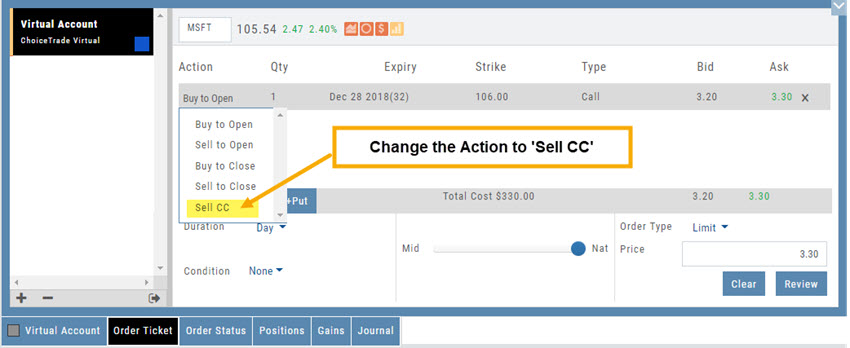

3. Change Action to Sell CC. Make any other adjustments to this Order Ticket, click “Review” to check for accuracy, then “Submit“.

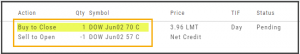

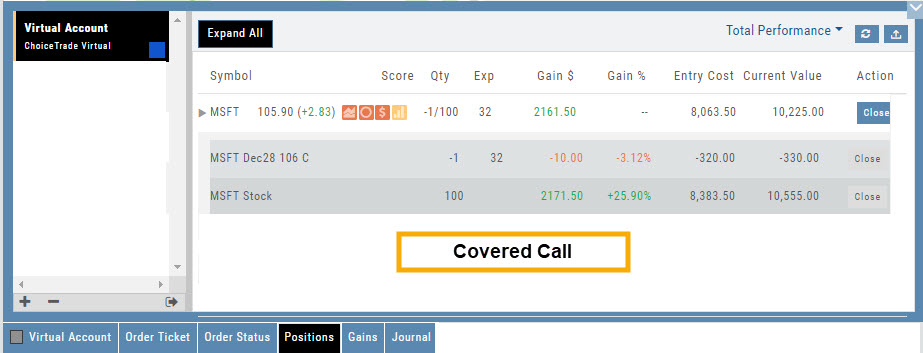

4. After the Order executes, it will show up in the Positions Tab as follows:

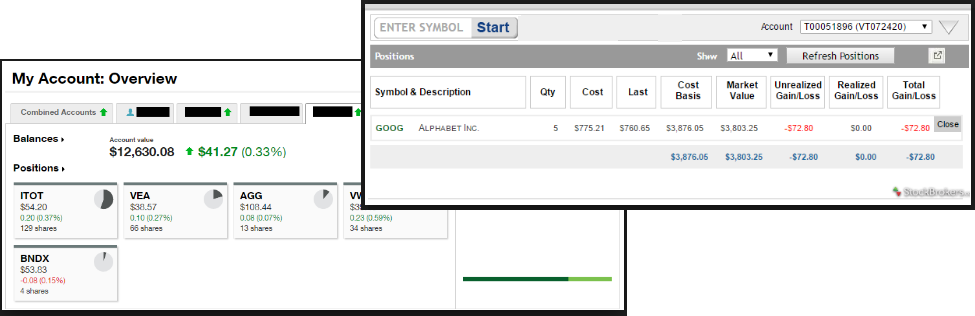

Account Differences Explained

When you set up your Live Account with TD Ameritrade, Choice Trade or other Brokerage you may notice account value differences on the Positions summary tab.

The Trade Tool Positions Account Values are tied to the Bid price (if you own a stock or option) and Ask price (if you are short a stock or option). Were you to close the position, you would receive the corresponding price – or better, since you are able to try to get a better price than Bid/Ask. This method ensures you will get at least the listed value – or better.

Choice Trade Accounts can be set up to have the price shown in the Positions Summary tied to the Bid/Ask or the default, “Last Trade Price“. Last Trade Price differs from Bid/Ask in that it shows the most recent transaction price, but does not always reflect the price you will receive if you were to buy or sell the security.

TD Ameritrade ties trade values to Mark – the point between Bid and Ask. Some trades will be closed at this price, but not all. Mark does not take into account if you own or are short a position, it is simply the halfway point between the two.