Multiple Position Analysis

We often have more than one position on a particular Stock/ETF, so how can each position, or leg be evaluated?

Conditional Orders (OCO)

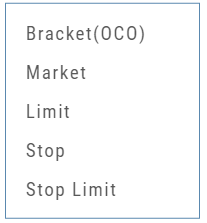

Conditional Orders Available with Tradier Brokerage

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

Such orders offer ways to take profits off the table while limiting exposure to losses.

-

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

Platform Features Release: Compare and AI capability added, Tradier Streaming

Join us Wednesday, October 25th for a special Office Hours session for an in-depth review session of the newest enhancements to your platform.

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process.

Research Tab/Dashboard:

Compare Tab: Provides an at-a-glance comparison of competitors of the same industry group with the ability to change symbols and Swing, Position, or Investor views (also “All” and “Default”)

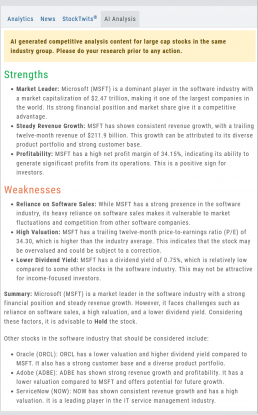

AI Analysis – AI generated competitive analysis for Large-cap stocks in the same industry group.

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

AI Analysis

Located within the Activity Tab in Research, Stock AI analysis has the potential to enhance and streamline the process of evaluating and trading stocks in the financial markets.

Stock AI analysis can quickly process and analyze vast amounts of financial data, news, and market sentiment in real-time. This enables investors and traders to make more informed decisions based on a comprehensive view of the market.

Click on the AI Analysis Tab for the current symbol you are viewing. A progress bar will appear while the information loads for the initial session view only. The information will remain even if you log out and back in again during the same Market Day.

It’s important to note:

While Stock AI analysis offers these benefits, it also comes with challenges and risks, such as overreliance on algorithms, potential biases in data, and the need for continuous monitoring and oversight. Investors and traders should use AI analysis as a tool to complement their decision-making process rather than relying solely on it.

Streaming Quotes with Tradier

Your Tradier Account offers Real-Time Streaming Quotes!

Simply log in to your Tradier account from the platform, and you’ll see the Real-Time quote updates without having to change screens or refresh your browser!

Change Log

- At-the-Money Strike price bolded on Templates

- Long Butterfly template error corrected

- Resolved slider bar/template editing functioning

- Event flag display function preserved

- Slider bar function corrected on template page

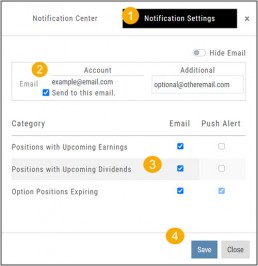

Position Notifications

When you Enable and Activate Account Notifications, you’ll receive emails on upcoming activity that may affect your existing positions.

- Upcoming Earnings – Monday Morning via Email

- Upcoming Dividends – Monday Morning via Email

- Option Position Expiring – Two days prior via Email

To begin, locate and click on the Envelope Icon at the top of the platform page, next to your Username:

![]()

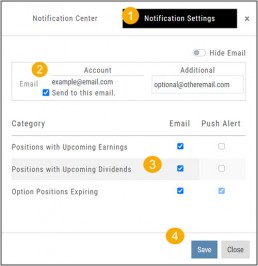

Follow the steps as outlined and illustrated:

- Click on Notification Settings

- Add your email (Optional: Add 2nd email)

- Check/uncheck Categories

- Click “Save”

The settings can be updated at anytime by following the above steps.

Next:

For each account you want to receive notifications on, toggle the switch located on the Account Summary tab to the “On” position as shown in the graphic.

**Without this step, you won’t receive the notifications.**

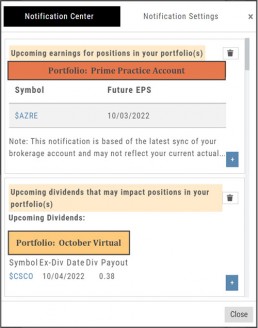

Expiration Notifications will be emailed 2 days in advance.

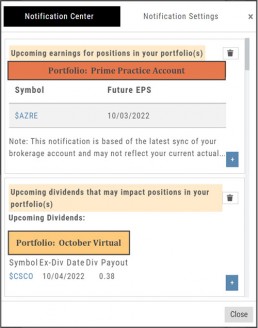

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

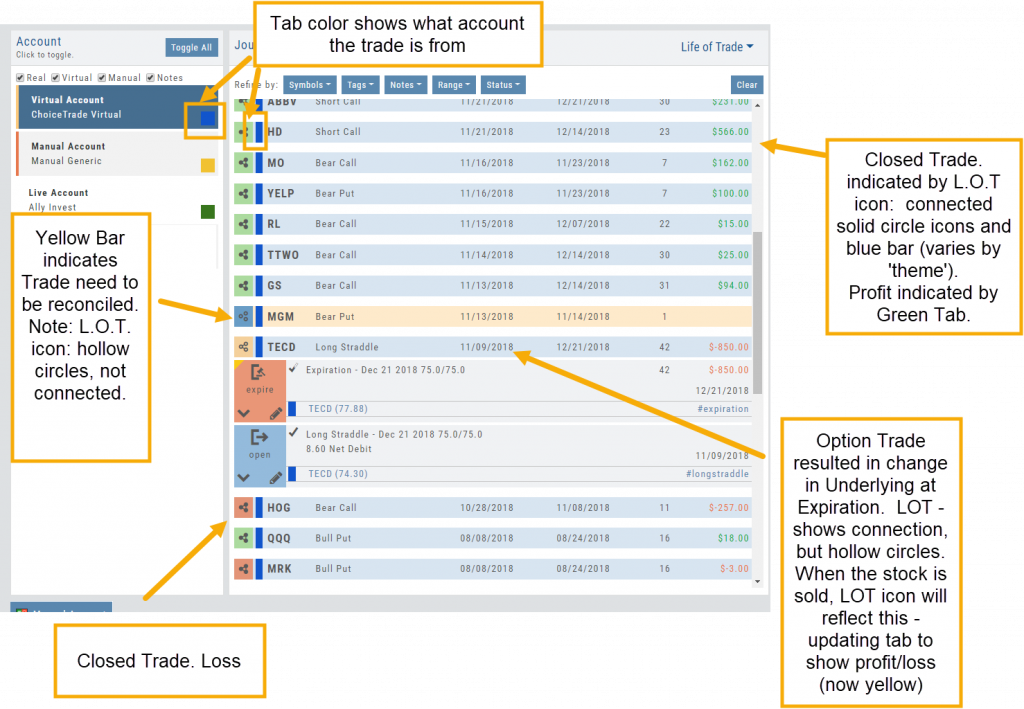

Life of Trade Journal View

Life Of The Trade

“Life of Trade” View in the Journal offers another way to view your trading activity and results.

Trades are grouped by Symbol, making it easier to follow the trade from Open-Adjust-Close – along with any Assigning/Exercising of the underlying stock.

This view further allows you to sort by Account, Symbol, etc for more targeted analysis.

Platform Features Release: December 2022

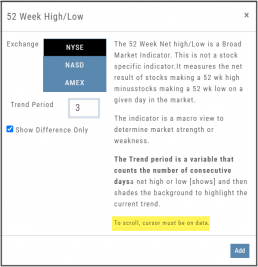

Announcing the latest Release which added a powerful Lower Indicator on the Charts Tab: 52 Week Hi/Lo. Price/Date info has been added to X/Y axis

52-Week Hi/Low Indicator

The newest lower indicator: 52-week Hi/Low Indicator is a Broad Market Indicator. It is not Stock specific.

View how individual Stocks/ETFs are faring compared to the Broad Market.

Select from NYSE, NASD or AmEx

There are two views:

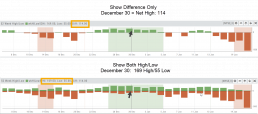

Show Difference Only – Display either a green or red (or no) bar representing the net advancers/decliners for that period.

Show High & Low (uncheck box)– Displays both green/red bars to illustrate number with new 52 week high/lows.

The background color identifies a bullish or bearish trend, based upon the number of days selected (Trend Period)

Example: If 3 days are selected, background highlight will begin on the 4th consecutive day of gains (or losses).

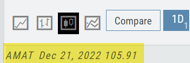

X/Y axis – Price/Date display

The cursor’s crosshairs will display the Price/Date info along the X/Y axis for easier reading.

This information will still appear in the upper/right corner above the chart:

Drawing Key Activation

Use your keypad to activate drawing lines on the Chart by following these steps:

1. Click either in Header area above the chart – OR –

Click the Annotation icon>Line

2. Click on chart, then “Alt” and “T” keys where you want to start line.

Once activated from either of the starting points (1), the function works on the current chart, without having to reactivate by clicking on the Header or Annotation icon.

Platform Features Release: November 2022

Announcing the latest Release allowing for customized Watchlist views. Improvements in Journal functionality will increase responsiveness and allow users to better control the data displayed. Format enhancements were also made to increase readability

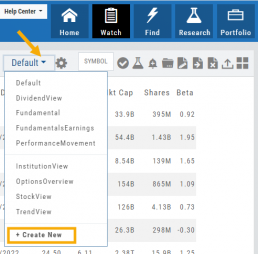

Watchlist Views – Create, Save & Edit

The ability to create your own Watchlist views based on criteria important to you enhances the work flow of finding the best candidates for trading.

Click on ![]() next to the (Default) Watchlist, then select “Add New” to get started.

next to the (Default) Watchlist, then select “Add New” to get started.

Build your own views from over 160 data points, then adjust the display position in the order you want them to appear.

Click on ![]() icon to edit a view you previously created.

icon to edit a view you previously created.

Learn more by clicking below:

Improvements

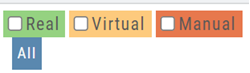

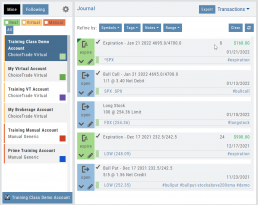

The Journal default displays Order/Trade activity from the Activated Trade Account.

To switch or add accounts, simply click on the other Account tabs or select by group: Real, Virtual, Manual or All accounts.

The improved functionality allows for faster journal activity display and easier trade analysis.

Change Log

- Resolved Score Icon Navigation from Home/Market Tab

- Corrected Fundamental/Dividend missing data

- Moving Average indicator functionality restored on Custom Page

- Corrected display data on Fundamental Tab

- Addressed candlestick not appearing first 20 minutes on Mondays.

- Rectified downloading data from Screener

Platform Features Release: October 2022

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

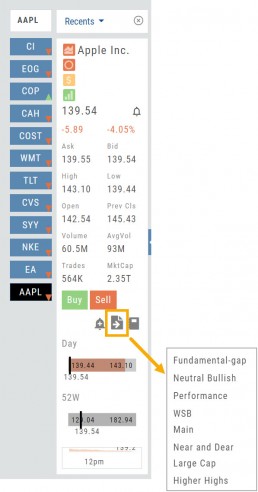

Research Watchlist Functionality

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

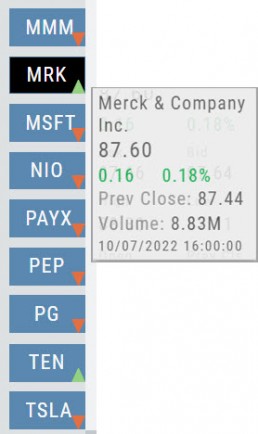

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

Platform Feature Release: Screener

Feature Release Notes: Screener

Announcing the latest feature/function updates, additions or edits to the trading platform:

Screener – Trading styles are unique. Screener, the platform’s newest feature allows for customized opportunity searches. Differing from Scans, which are predefined, Screener offers over 120 data points for customize searches based on what the user’s goals are. Additional data points will be forthcoming.

Screener searches may be saved and named for the user’s future use. In addition, System Screeners are available as starting point templates for the user to customize and save as personal Screeners.

Screener

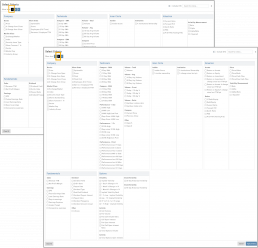

Located under the Find Tab, the Advanced Screener is designed to allow the user to customize their own trade candidate searches. Over 125 criteria selections are available – with more to follow.

Screener is flexible – allowing you to create save as many Screen searches as you wish, edit as needed, even download results.

Screens are user-defined, 100% customized by the user’s specifications. They can be edited, saved and deleted.

Left Control Panel

New – Create a new screener

Saved – Previously created and saved screens. Saved screens can be edited for a single-use or saved as a new screen or overwriting the previously saved screen

System – Templates available for use as starting points for new screeners. While the System screens themselves cannot be modified, they can be used as a foundation for newly created screens that – can be modified for personal use and saved.

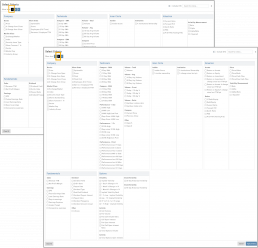

Select your Criteria

There are 3 Levels of Data. Currently Level 3 mirrors Level 2 – as more criteria will be added to this feature.

Level 1 offers Basic Information to select from. Level 2 expands upon what Level 1 offers.

After choosing your criteria, you’ll be able to set the parameters for each criteria selection on the next screen.

Click “Run Search”

Note: The order the criteria is selected, will be the order the selections are displayed on the next screen.

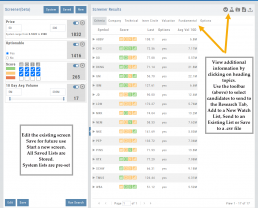

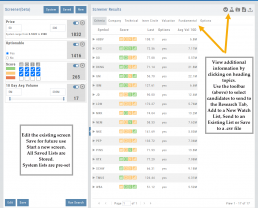

The Results

The criteria selected in this example were Price ($50-200), Optionable, Score (Green or Yellow for each Icon) and 10-day Average Volume (5M-293M) resulting in 17 candidates.

From here, using the Icon Toolbar, candidates can be selected and:

- Sent to Research for further analysis

- Sent to an existing Watch List

- Used to create a New list

- Can be download to a .csv file.

The Screen itself can be Saved (and named), further modified -either by

adjusting the existing criteria or adding new datapoints – or a New Screen

can be created.

Additional data is accessible by clicking on “Company”, “Technical”, etc

above the list of candidates.

System Screens are also available and new ones will be added.

The user can customize such screens and save to the platform just as any other

screen.

Candidates can be sent to Research, to a Watch List and/or

downloaded to a .csv file.

System Screens themselves cannot be modified and are designed to be

‘launching points’ for the user’s convenience if they wish to use them.

Note the colored bar graph of IV Range. It provides a ‘picture’ of where this

Stock/ETF is now for this datapoint.

Change Log

- TTM Squeeze Indicator added

- Option Chain column line up

- Double scroll bars appearing in Safari/Screener

- Split notification on Chart added

- Staged Order behavior -data loading resolved

- Trade Button appearance on Chart from Staged

- Industry Link responsive

- Mobile – corrected Stage Button function on Stock Order Ticket

- Mobile – updated “Save” Alert functionality

- Mobile – adding Indicator (Android) corrected

- Earnings < 7 days are noted in red

Screener (Premium Desktop Feature)

Screener

Located under the Find Tab, the Advanced Screener is designed to allow the user to customize their own trade candidate searches. Several hundred data points are available to select from, build your Screen, Save for future use and Edit as needed.

Screener is flexible – allowing you to create save as many Screen searches as you wish, edit as needed, even download results.

Screens are user-defined, and 100% customized to the user’s specifications. They can be edited, saved, and deleted.

Left Control Panel

New – Create a new screener

Saved – Previously created and saved screens. Saved screens can be edited for single use, saved as a new screen, or to overwrite the previously saved screen

System – Templates available for use as starting points for new screeners. While the System screens themselves cannot be modified, they can be used as a foundation for newly created screens that can be modified for personal use and saved.

Select your criteria

There are 3 Levels of Data.

Level 1 offers Basic Information to select from. Level 2 expands upon what Level 1 offers. Level 3 offers all available, in-depth selections.

After choosing your criteria, you’ll be able to set the parameters for each criteria selection on the next screen.

Click “Run Search”

Note: The order the criteria are selected, will be the order the selections are displayed on the next screen.

The Results

The criteria selected in this example were Price ($50-200), Optionable, Score (Green or Yellow for each Icon), and 10-day Average Volume (5M-293M) resulting in 17 candidates.

From here, using the Icon Toolbar, candidates can be selected and:

- Sent to Research for further analysis

- Sent to an existing Watch List

- Used to create a New list

- Can be downloaded to a .csv file.

The Screen itself can be Saved (and named), or further modified – either by

adjusting the existing criteria or adding new data points – or a New Screen

can be created.

Additional data is accessible by clicking on “Company”, “Technical”, etc

above the list of candidates.

Icon Tool Bar – Hover Cursor over Icon to view function

Select one or more symbols

Send selections to Research

Create a New Watchlist with Selected Candidates

Send Candidate to an Existing Watchlist

Download to .csv file

System Screens are also available and new ones will be added.

The user can customize such screens and save to the platform just as any other

screen.

Candidates can be sent to Research, to a Watch List and/or

downloaded to a .csv file.

System Screens themselves cannot be modified and are designed to be

‘launching points’ for the user’s convenience if they wish to use them.

Note the colored bar graph of IV Range. It provides a ‘picture’ of where this

Stock/ETF is now for this datapoint.

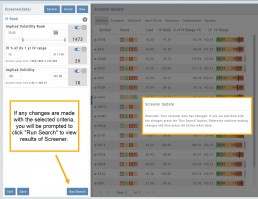

Edit Screeners

Edit current, Saved or System Screeners by adjusting parameters of existing criteria using the slide bars, entering values in boxes, etc.

A Screener Update notice will appear prompting you to select “Run Search” after adjustments are completed. Updated results will populate the left table.

From here, use the Icon Toolbar for further options: Select, Add to Watchlist, Research or Download.

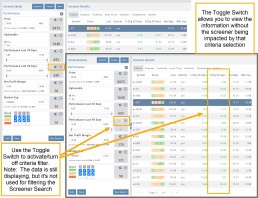

Toggle Criteria

The Toggle feature gives you additional flexibility in your Screener searches.

The ON position includes the selected criteria in calculating results.

The OFF position for that criteria will not affect the results when used to filter results. However, that data column will still be displayed with the other points selected.