26-01 Release Notes: Bracket Order Adjustment, Journal Reports, Show Confirmation

Adjust Limit and/or Stop Orders from the Chart

- Click on the Limit (or Stop) Order Dashed Line

- The Modify Order Price dialog box will appear

- Either move the dashed line to the new position, this will temporarily show up as a solid line. OR enter the new price in the dialog box.

- Click Modify

Once modified, the Limit order becomes a dashed line at the updated price.

Journal Reports

Journal Reports transform your trading data into visual insights that highlight performance trends, behaviors, and outcomes at a glance. With intuitive charts and summaries, you can easily evaluate results, refine strategies, and build more consistent trading habits.

Show Order Status (Go to Order Ticket)

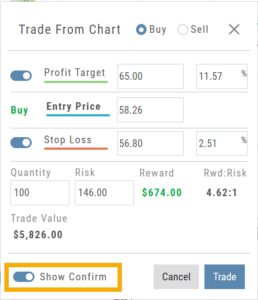

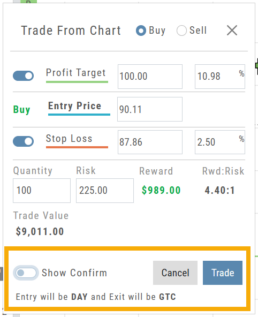

When trading from the Chart (OCO orders), you can elect to Show Confirmation – or not.

Toggling “On” will take you to the Order Ticket to review and submit your Order to the supporting brokerage.

The Order Ticket tab allows you to further adjust and even Stage the Order.

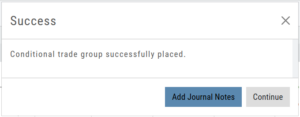

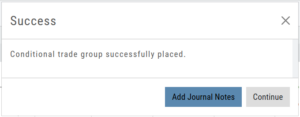

Once reviewed and submitted, you’ll get a confirmation the order was submitted, as shown here:

Toggling “Show Confirm” to Off, will bypass the Order Ticket window and convert the “Trade from the Charts” action to an Order Ticket itself.

Notice: The Entry is a Day Order, the Exit is a GTC order

Clicking “Submit” will send the order directly to the supporting brokerage.

Since the Order Ticket is bypassed, additional adjustments or Staging is not permitted when “Show Confirm” is in the “off” position.

Once submitted, as with “Show Confirm” activated, you’ll see this notice:

Conditional Orders (OCO)

Conditional Orders Available with Tradier Brokerage

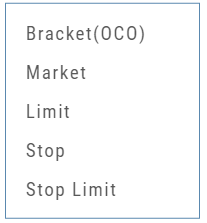

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

One-Cancels-the-Other (OCO) orders allow two orders to be placed at once, combining a Limit Order and a Stop or Stop/Limit Order. If/when one of the orders gets triggered and is executed, the other order is immediately canceled.

Such orders offer ways to take profits off the table while limiting exposure to losses.

-

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

Order Staging (Premium Desktop Feature)

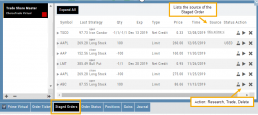

This feature allows the user to save Potential Trades for further consideration to decide the best ones to submit.

Staging is also useful when the Market is closed – to be reviewed when the Market is open to determine if it’s still a high-probability trade.

With one click, you can send to the Research Tab, Move to an Order Ticket or Delete and move on to the next staged order.

When Trade Sharing is enabled, Trades made in accounts you are following will be displayed in your Order Staging Tab. The Source will indicate the Account Name. Status of “Used” will display for those trades you submit on one of your accounts.

Expired Staged Orders will automatically be removed.

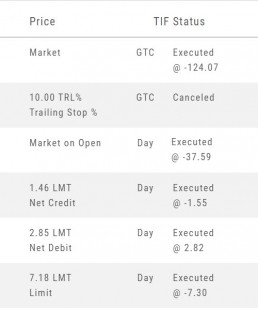

Order Types - How to Enter

Market Order are Buy or Sell orders to be executed immediately at current the Market Price. Execution of the trade is more important than price. As long as there is a willing buyer or seller, the trade will be executed.

Limit Orders (including Net Debit and Net Credit) allow you to set the Maximum Price to Buy or Minimum Price to Sell a security . Because these orders have ‘limits’ they may not be executed. When they are, they will be executed at the Limit Price – or better.

Low Volume, a slow or very fast market may mean your Limit Price may not be reached and thus, your order not executed.

Stop & Stop Limit Orders

These are protective orders, to be placed on a current position.

A Stop Order becomes a Market Order when the Stop Price is reached. This does not mean you will get the Stop Price when the Order executes. You are willing to Buy/Sell at any price once your Price is reached to have the Order execute.

A Stop Limit Order generally offers more protection: Once the Stop Price is reached, the order converts to a Limit Order to execute once that price – or better- is reached. Thus, there are two values to enter on the Order Ticket for Stop Limit Orders.

How to enter a Stop Order/Stop Limit Order:

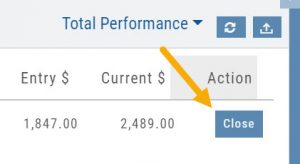

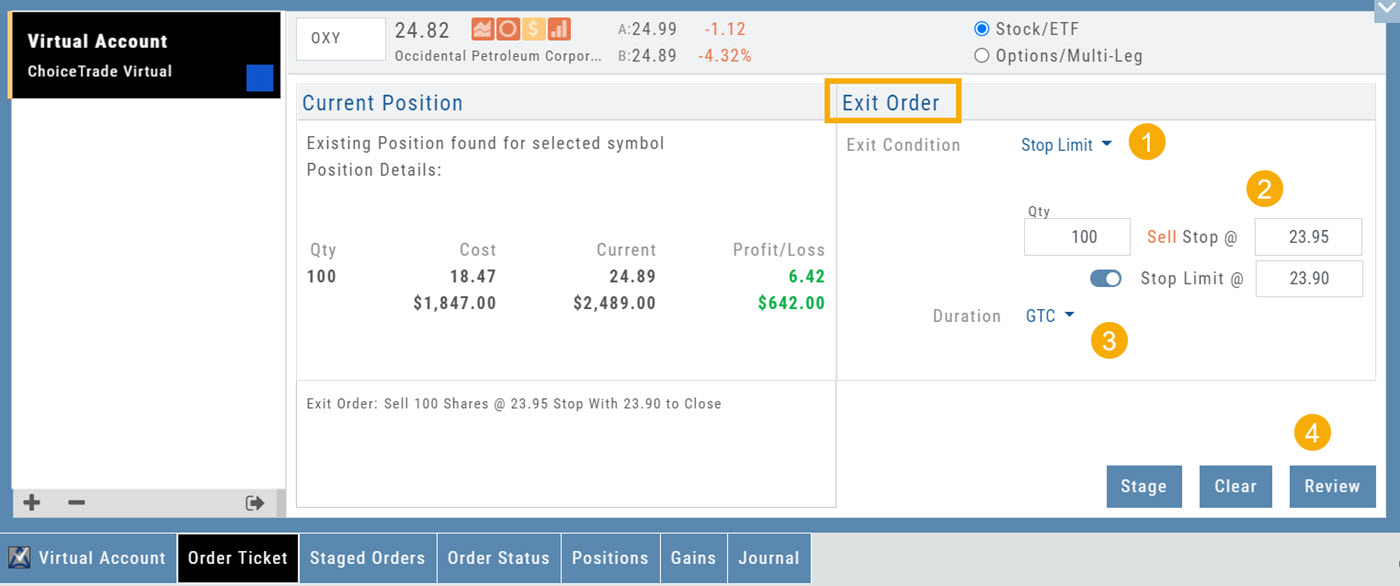

On the Positions tab, click “Close” for the Stock/ETF entry you want to add a Stop/Stop Limit Order to. You’ll be navigated to the Order Ticket tab to continue.

On the right side of the Order Ticket (Exit Order):

1. Change Exit Condition from default “Limit” to “Stop” or “Stop Limit“

2. Enter Stop Price. For Stop Limit Orders, the Stop Price will be the higher of the two values.

Enter Limit Price, if applicable.

3. Change Duration from Day (default) to GTC (which may vary by brokerage)

4. Review & Submit

Notes: As long as it’s not a Day order, the Stop/Stop Limit order will remain Live until you cancel the order or it executes*. (Some brokerages have expiration dates on such orders)

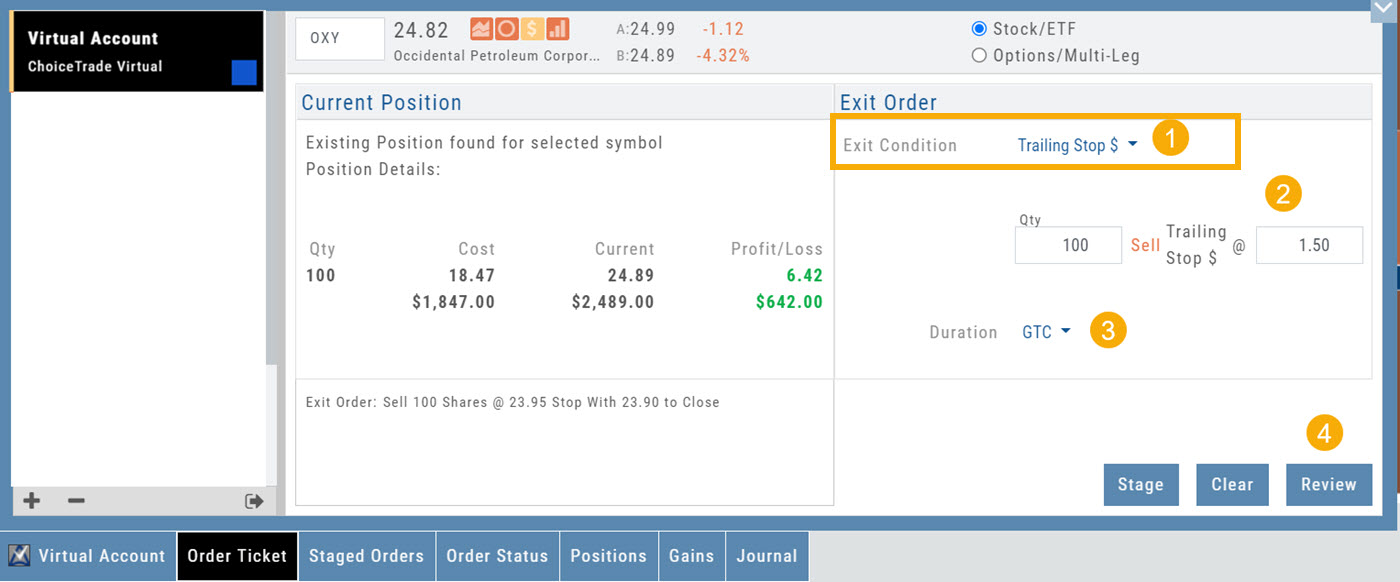

Trailing % and Trailing $

As the names suggest, these orders follow trades upward by a set $ or %. They are placed on a current position. Click “Close” from the Positions Tab, then follow the steps below:

1. Change Exit Condition to “Trailing % (or $)“

2. Enter price or percentage to exit trade

3. Select Duration (Day/GTC)

4. Review, then Submit

This will be a Live Order until it Executes, Expires or is Cancelled.

Bracket Order – One Cancels the Other (OCO)

- Opening Order OR the existing Position to Close

- Select “Bracket (OCO)”

- If the trade is favorable, the Limit Price will trigger to close and secure profit.

- If the trade is unfavorable, this Stop (or Stop Limit) Order can limit your loss

- Duration: “Day” or “Good Til Canceled”

- Summary of the Bracket-OCO Order

- Review for accuracy, then Submit on the next screen

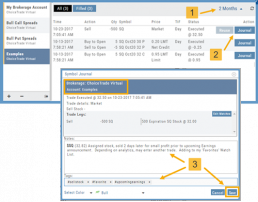

Updating Journal Entries

Updating closed or adjusted trades in the Journal Tab is easy by the following steps:

1. Go to the Order Status Tab, change the default “Today” in the upper-right area of the tab for previously executed trades.

2. Click “Journal” for the trade you want to update.

3. You can add Notes, #tags, outlook to be included in the Journal. Click “Save”. (Note the Account Name where this trade will appear)

4. The trade is now updated in the Journal Tab. Expand the tab to see trade detail: Number of days in the trade, the profit (loss), order execution details, notes, tags, the Account Name containing the trade, etc.

The Analytics section will update using tags from these trades, further assisting in tracking progress in your trading.

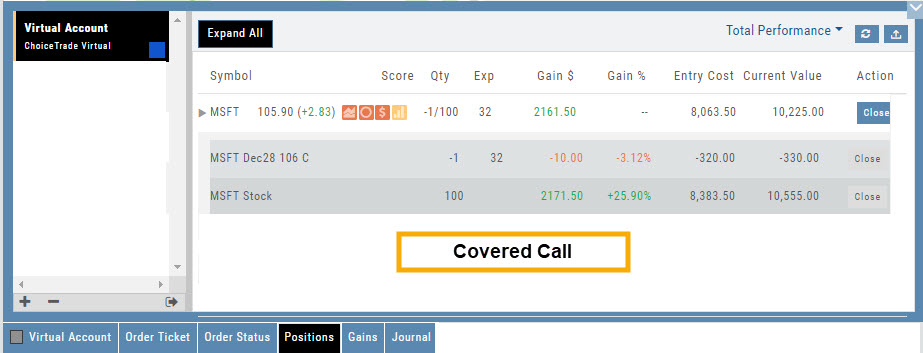

I own the stock, how to I enter a Covered Call trade?

When you already own the stock, but want to enter a Covered Call position, follow the following steps:

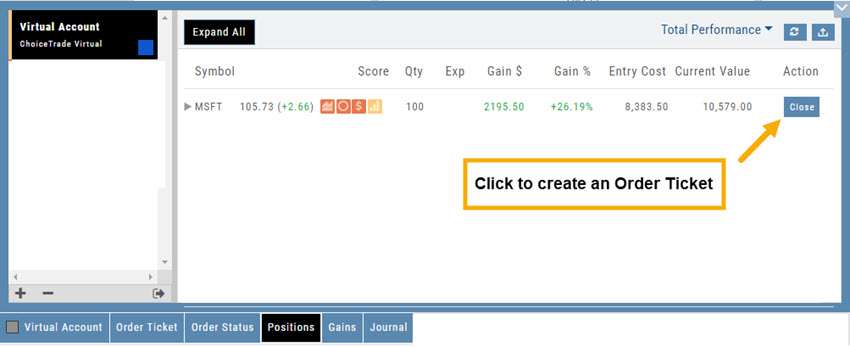

1. From the Positions Tab, click “Close”

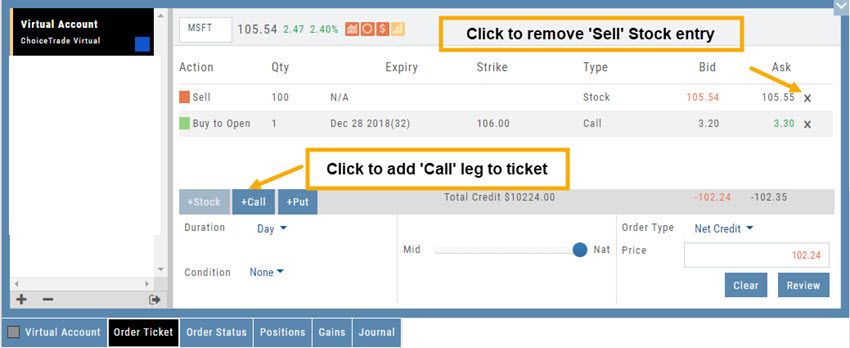

2. Add Call Leg (you’ll adjust this later) & Delete Sell Stock entry line:

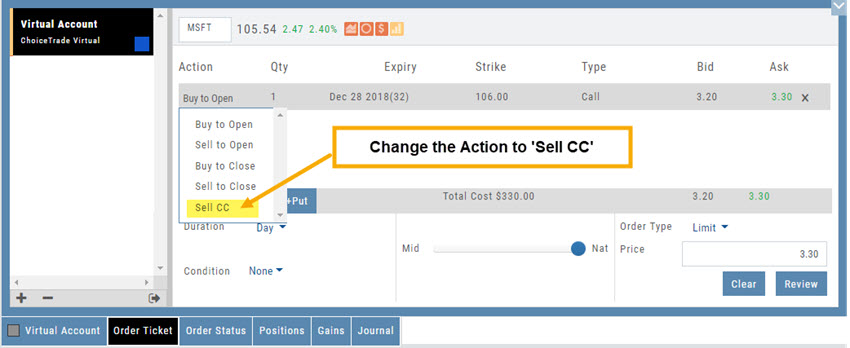

3. Change Action to Sell CC. Make any other adjustments to this Order Ticket, click “Review” to check for accuracy, then “Submit“.

4. After the Order executes, it will show up in the Positions Tab as follows: