Chart Adjustment/y-axis

Chart Adjustment

Adjusting the chart’s y-axis gives you more flexibility – whether it’s forecasting, adding notes, viewing current positions, etc.

Simply click you cursor to the right of the y-axis, then drag your mouse/cursor up or down.

To reset, click the ‘refresh’ icon ![]() on the chart toolbar

on the chart toolbar

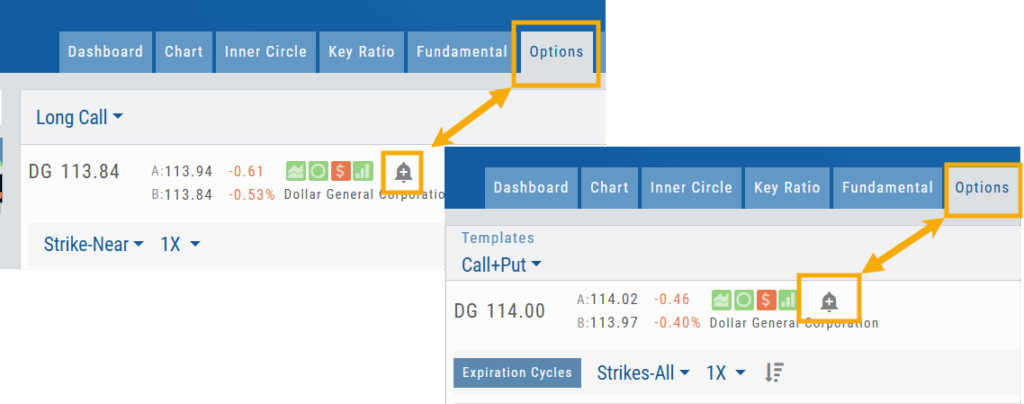

Platform Features Release: Set Alert from Option Tab

This Release focused on fixes and set-ups for future capabilities and added the following:

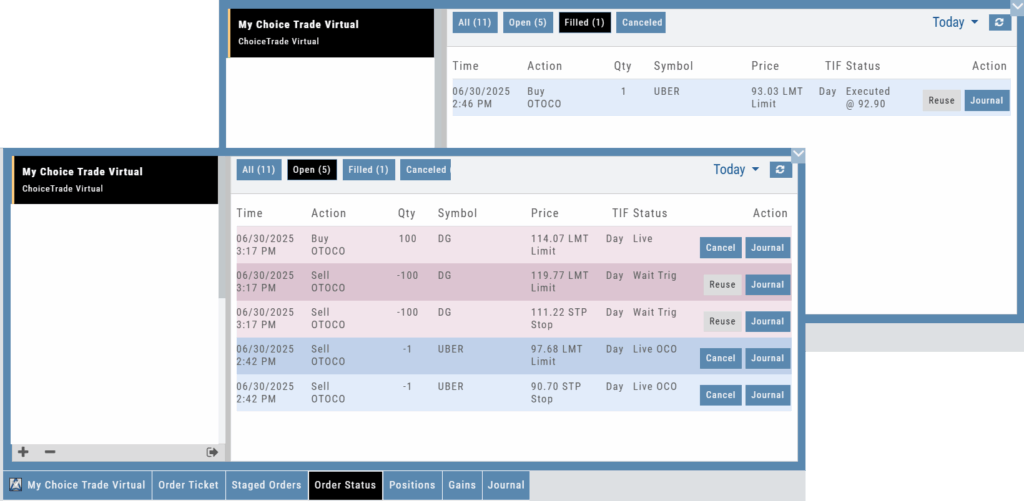

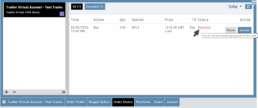

Setting Alerts Enabled from the Option Tab in Research.

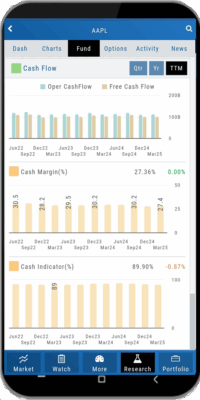

Bracket Order capability in ChoiceTrade Virtual Accounts

Set Alerts from Option Tab

Alerts can be set from the Option Tab – as, in Research, this was the only tab where the Info box on the left side of the screen was not visible.

ChoiceTrade has Bracket Order capability

ChoiceTrade supports Bracket Orders on Stock.

Change Log

- Resolved “Reset Zoom” function on chart vertical expansion

- Alert Expiration is midnight of Expiration day

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: New Chart Periods, Mobile App Updates, Order Status Message

This Release includes Mobile App enhancements with some important upgrades, New Chart periods added and important Order Status messages.

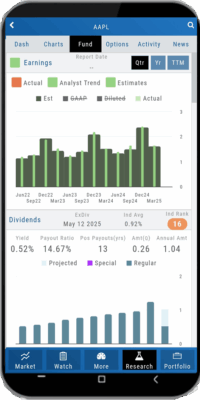

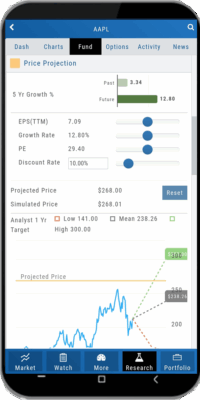

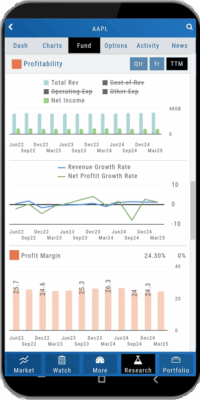

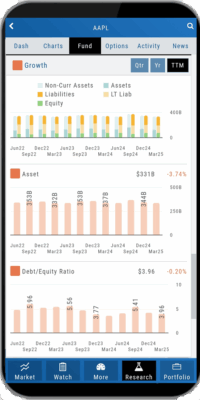

Fundamental Data: This tab greatly expands the amount of data provided, mirroring what is displayed on the desktop browser version

Faster response time: Technological updates enable the app to perform actions more quickly.

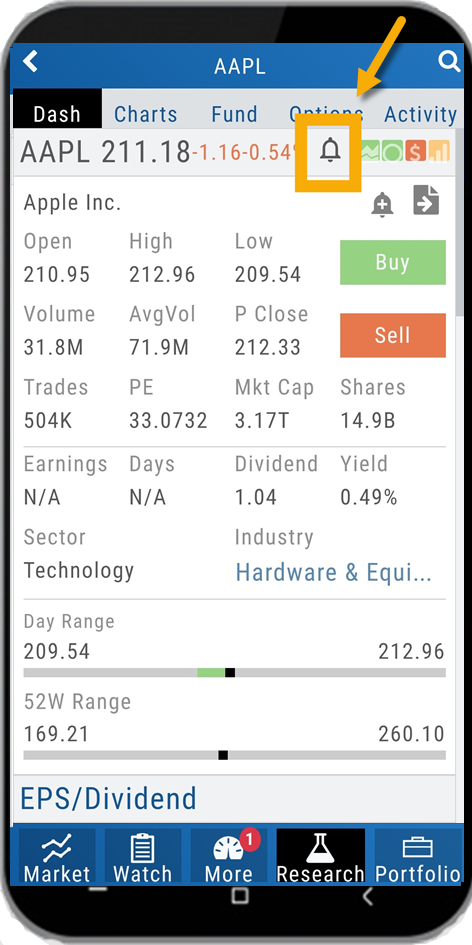

Alert Functionality on Mobile App: Upon enabling Notification functionality on your devices, you will receive alert notifications on your mobile device, even when not logged into the platform!

One, Two & Four-Hour Chart Views – New periods allow for more technical analysis.

Order Status Message – The status provides feedback if an order is rejected.

Mobile App – Fundamentals

The Fundamentals Tab allows you to scroll to see the same datapoints as on the desktop version. This includes the ability to select, where applicable, The last Quarter, Year or Trailing Twelve Months (TTM).

Toggle data displays by clicking on the individual datapoint in the legend for each section.

Enhanced Alert Functionality on Mobile

Enabling Alert notifications on your device will allow you to receive important updates – even when you aren’t logged into the app!

If you are logged in and such notifications are enabled, the notifications will appear as a pop-up on your desktop if you are logged into your platform or to your browser if you aren’t .

Alerts can be set up on Desktop (web and app) and the Mobile App.

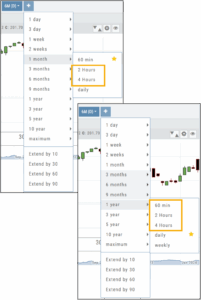

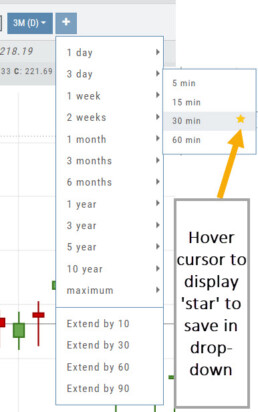

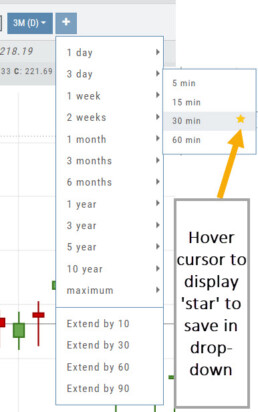

Chart Periods

2-hour and 4-hour candlesticks have been added to the 1-Month Chart Period.

3-Months through 1-Year, inclusive, offer 1-hour, 2-hour, and 4-hour candlesticks for more in-depth chart analysis.

To add to the dro

p-down list of Chart Periods as a “Favorite”, hover your cursor to the right of the period selected for a sta

r to appear. Click.

To remove from the drop-down, click on the Star again.

Order Status Message

If an order gets rejected, the Status becomes a link that, when hovered over, displays the reason for the rejection.

For example, on a 100k Virtual Account, an order was submitted to buy 200 shares of a $1200 stock. It was rejected, and the message on the Order Status read:

![]()

Change Log

- Resolved “Erase All” behavior

- Reset Zoom function on Max W and M resolved

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: New Zoom Functionality, Chart Panning

Announcing the latest Release of feature and functionality additions and enhancements to the trading platform to assist the investment/trading decision process.

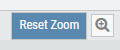

New Zoom Functionality

To activate Zoom, click on the Zoom button has been added to the icon toolbar:

![]()

- Once activated, the button changes color.

- Click/drag the mouse/cursor over the area of study.

- A “Reset Zoom” button will display when you want to restore the view.

Chart Panning Functionality

Click/drag now pans the time period/price range on the chart – when dragging your mouse/cursor either right/left

Other Additions

- “Choppiness Index” Chart Lower Indictor added

- “Are You Sure You Want To Cancel This Order?” added on Order Status tab

- Clicking on “Quotes By” box (lower right corner) will display source of quotes

Change Log

- Reuse .XSP and .SPX order functionality restored

- Trading Block OTM trade error fixed

- Schwab recognizes BRK.B now

- Resolved Liquidity Range in Screener

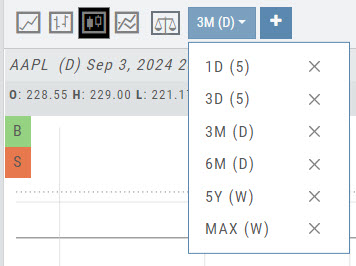

Chart Time Period

Chart Time Periods

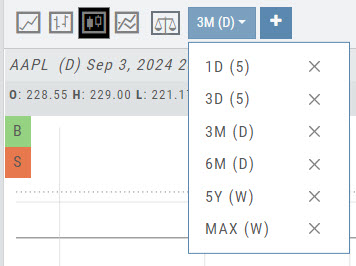

The Chart Period format has been streamlined for a more streamlined look.

The current chart period will be displayed at the top of the ‘favorite’ (saved) drop-down list.

“Extend By” can also be selected to “add time” to the left side of your chart.

Platform Features Release: Economic Dashboard, Chart Adjustment, Chart Time Period

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the investment/trading decision process.

Economic Dashboard: View chart data from dozens of economic reports. Includes information on why it is important, what to look for, and how to apply the data to trading.

Chart Adjustment: Ability to compress and expand y-axis.

Chart Periods: New look, improved functionality.

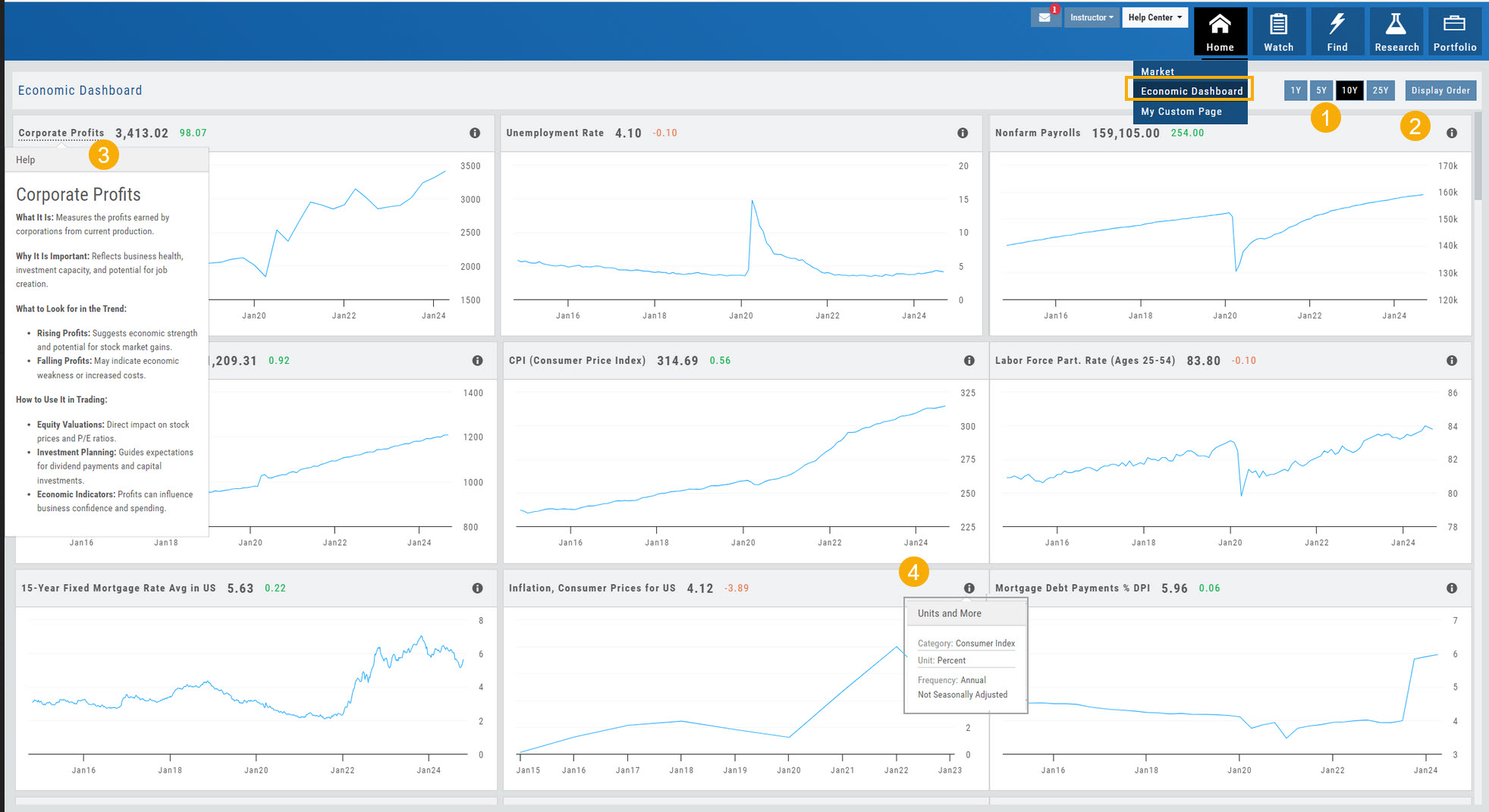

Economic Dashboard

Located under the Home/Market Tab, this powerful research tool provides important economic information in chart format.

- Select from 1*, 5,10 or 25-year views

- Allows you to select display order as well as ‘hide’ charts.

- Click on the Title to display: What the data represents, Why it is important, What to look for and How to apply the data in trading

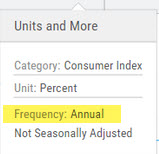

- Provides info on the Economic Report Category (Consumer), what the numbers represent (%, $, units, etc), how Frequent the data is reported (Quarterly, Annually, Monthly, etc)

* Some reports are released annually. 5, 10 or 25 year view are recommended in these instances.

Chart Adjustment

Adjusting the chart’s y-axis gives you more flexibility – whether it’s forecasting, adding notes, viewing current positions, etc.

Simply click you cursor to the right of the y-axis, then drag your mouse/cursor up or down.

To reset, click the ‘refresh’ icon ![]() on the chart toolbar

on the chart toolbar

Chart Time Periods

The Chart Period format has been streamlined for a more streamlined look.

The current chart period will be displayed at the top of the ‘favorite’ (saved) drop-down list.

Change Log

- ‘x’ moved to left side of symbol list in Research Tab

- Key Ratio and Compare Views are session sticky

- Seasonal chart corrected to show Price

- Cancel/Reuse display on Credit orders corrected

- Stock data restored on Scan backtest

- Staged Order display on chart functionality corrected

- Schwab Order Ticket close orders corrected

- Trade Station added under “Open New Account”

- Reward/Risk more clearly marked on Trade from Chart

- 1 Day/1 Minute added to Custom Page charts

- Resolved Seasonality percent chart

- Corrected MACD histogram overlap

- 60-minute charts/Schwab conflict resolved

- P/L Insight Graph includes up-to-date data

- Tradier Live Account Ticket credit/debit correction

- Staged Orders/Current Orders display consistency restored

- Screener – Score resulting in 0 candidates resolved

Compare Tab

The Compare feature, found under the Research Tab, allows investors to review a particular stock against its industry peers. Different Views offer Investors perspectives with different investment strategies, such as value or growth investing, to identify stocks that align with their preferred strategies within a specific industry.

Some of the Compare benefits include:

- Relative Valuation: Ratios like price-to-earnings (P/E), price-to-sales (P/S), or price-to-book (P/B) can be assessed whether a stock is overvalued or undervalued relative to its peers.

- Identifying Outliers: If a company has significantly different ratios compared to its peers, it may warrant further investigation to reveal potential investment opportunities or risks.

- Industry Trends: Analyzing ratios across an industry can reveal trends and patterns. For example, if the majority of companies in an industry experience a declining profit margin, it may indicate a broader industry challenge or trend.

- Risk Assessment: Comparing key ratios can help assess the financial health and risk profile in an industry context. Companies with lower debt-to-equity ratios, for instance, may be considered less risky, especially if this trend holds across the industry.

- Operational Efficiency: Comparing Ratios like return on equity (ROE) and return on assets (ROA) among industry peers can provide insights into a company’s operational efficiency.

NOTE:

While comparing key ratios within an industry offers valuable insights, it’s VITAL to consider other factors , such as the company’s business model, competitive advantages, management quality, macroeconomic conditions, etc. Ratios should be only part of a broader analysis to make well-informed investment decisions.

The fields automatically populate with industry peers. They can be changed to compare other symbols of your choice.

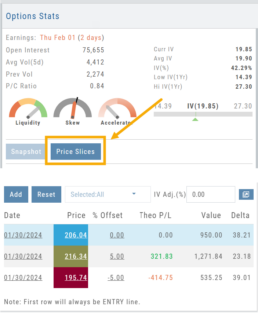

Price Slices - Premium Feature

Price Slices

Price Slices allow users to view theoretical outcomes of option positions, while providing the flexibility of changing data points, such as entry price or what the results will be if the stock price moves a specific dollar or percentage amount.

This feature is helpful with building discipline on when to exit a trade if it goes against you.

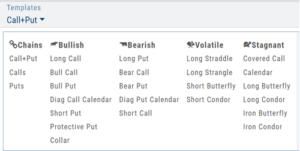

This feature is accessible when using the Strategy Templates on the Research>Option Tab

The default starting points include:

- Entry Point – shown in Blue in our example.

- High Point – considered Target or Resistance point – shown in Green.

- Low Point – considered Stop or Support point – shown in Red

(Up to 7 Price slices can be added for additional evaluation. See below for more details)

On Research>Option Tab, click the down arrow next to the default “Call+Put” view in the upper left corner of the window to access the Strategy Templates:

Select your Strategy and set up the position:

Quantity, Expiration Date, Strikes

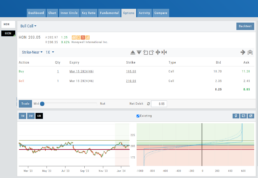

On the right side of the same screen, click the ![]() button to display the default settings.

button to display the default settings.

Using our example:

Entry point is $206.04 (Current Stock Price) shown in Blue

High point – defaults to 5% above Entry: $216.34, shown in Green/Gold

Low point – defaults to 5% below Entry: $195.74, shown in Red

The values are for ‘today’: what the Profit or Loss would be if the stock price were the High or Low price.

The Date, Price and/or % Offset can be manually adjusted, as indicated by the underline – to view different scenarios.

Price Slices – Adjust the % Offset Value

% Offset values were manually changed to 10% and -10%.

The lines on the graph are dynamically updated

Price Slices – Adjust the lines

In this example, the Top and Bottom lines were adjusted on the graph itself.

The new placement dynamically updated the values on the right.

Price Slices – Add, Reset, Go Big

Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

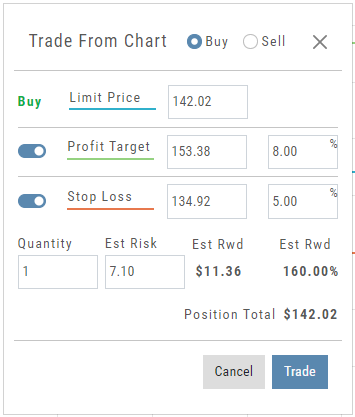

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

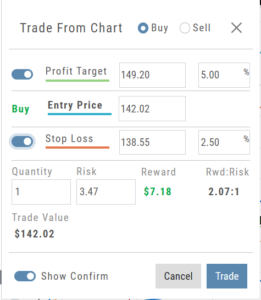

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

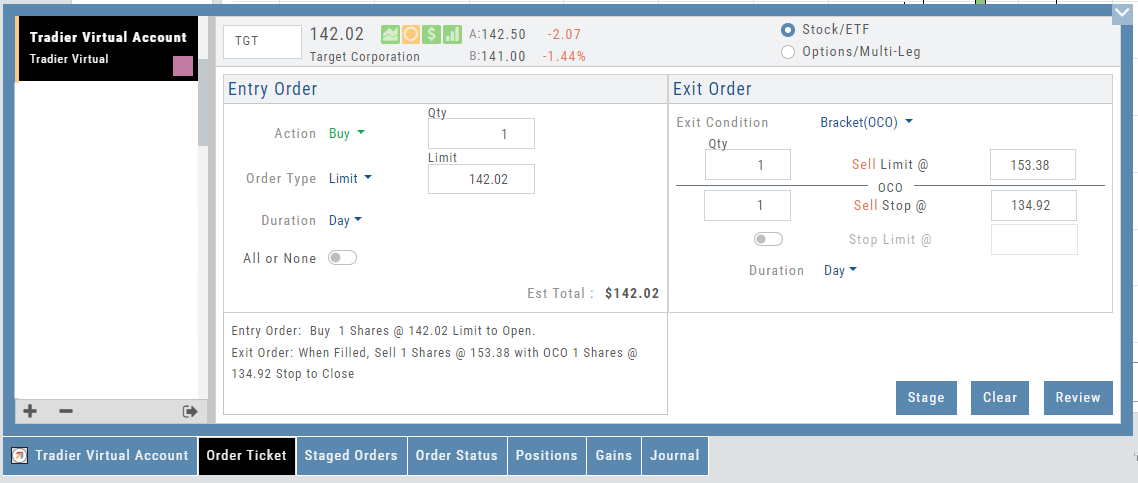

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

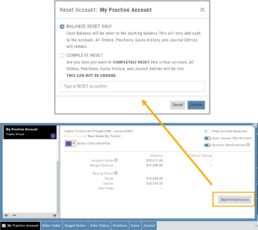

Reset Tradier Virtual Account – 2 options

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Trade from the Chart

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

Show Order Status (Go to Order Ticket)

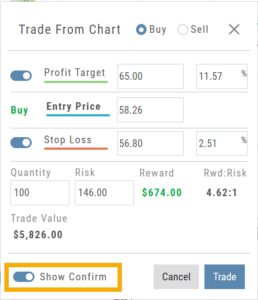

When trading from the Chart (OCO orders), you can elect to Show Confirmation – or not.

Toggling “On” will take you to the Order Ticket to review and submit your Order to the supporting brokerage.

Additional edits and staging the order are enabled with this selection.

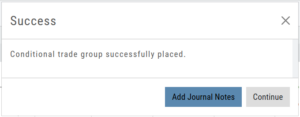

Once reviewed and submitted, you’ll get a confirmation that the order was submitted, as shown here:

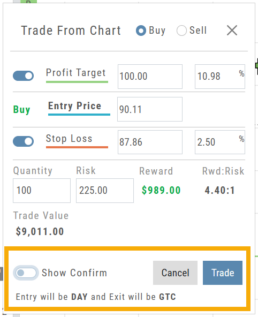

Toggling “Show Confirm” to Off, will bypass the Order Ticket window and convert the “Trade from the Charts” action to an Order Ticket itself.

Notice: The Entry is a Day Order, the Exit is a GTC order

Clicking “Submit” will send the order directly to the supporting brokerage.

Since the “Order Ticket” is bypassed, this order cannot be further edited or Staged.

Once submitted, as with “Show Confirm” activated, you’ll see this notice: