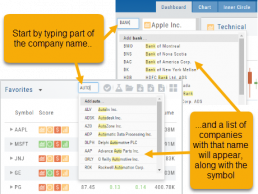

Don't Know the Symbol?

No Problem

You can search for symbols from several entry points including “Market” and “Watch”. Simply start typing all or part of the Company’s name and the system will proactively provide you with suggestions. You can use this feature anywhere including Insiders and Institutions.

For example, typing “Bank” in the Symbol box will bring up the stock symbols and names of companies with “bank” in their name.

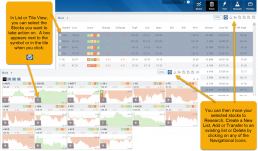

Depending where you are in the Platform, clicking on the selected symbol while you are in:

The “Market” or “Watch” tab, it will be added to your currently open list of stocks.

The Dashboard of the “Research” Tab, it will automatically provide the top layer of information on the stock. As always, you are able to navigate to different areas or ‘drill down’.

Insider or Institutions of the “Research” Tab, the corresponding data will display, such as data by Quarter, the biggest buyers and sellers and more.

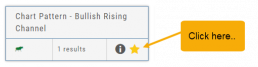

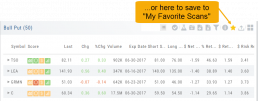

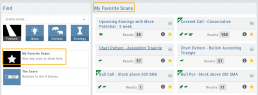

Save your Favorite Scans

Create your Customized Scan List

Star any scan to have it show in Feature > My Favorite Scans.

There are two ways to do this:

Simply click the star ![]() on the Tile View of the scans or on the header in the results view of any scan.

on the Tile View of the scans or on the header in the results view of any scan.

Favorites will be easily access from the Scan main page

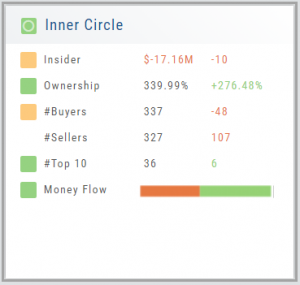

Inner Circle - Behind the Scenes

Insider and Institutional Activity.

Insiders’ and Institutions’ activities in a stock is a powerful tool.

Insiders: Our proprietary Insider Score looks at who the insiders are, how many there are, and how much stock is being bought or sold to derive a score algorithm.

Institutions: We monitor overall and individual institutions’ activities around a stock with historical comparison to evaluate the Institution Score.

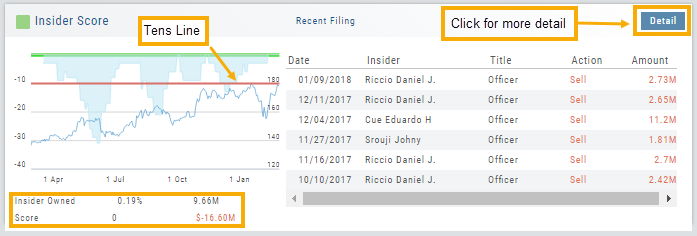

You have the ability to delve into as much information as you want by clicking on the ‘Detail’ box in “Insider Score” and “Institutions”. Find top buyers/sellers by week, month, 3 months, or one year. Search Institution Ownership by selected Quarter Report, newly added, reduced, current, top holders, etc. Dive deeper to gain insight into Institutions’ other holdings.

The information is easily accessible when you want it – just by the click of an icon, drop-down box, or arrow.

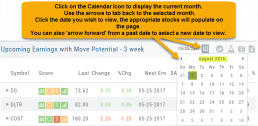

Past Scan Results

When viewing scan results, you can select a past date by clicking on the Calendar Icon, then the back arrow until you get to the month you want to search from. Click on the date you wish to view & the appropriate stocks will populate the screen.

The date you are searching will be displayed in the header

Note: Past Scans availability dates vary. When a new scan is added, the history is available from the day it was added to the platform going forward.

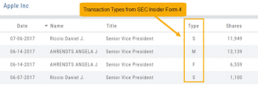

Trade Transaction Types

Rule 16b-3 Transaction Codes

A — Grant, award or other acquisition pursuant to Rule 16b-3(d)

D — Disposition to the issuer of issuer equity securities pursuant to Rule 16b-3(e)

F — Payment of exercise price or tax liability by delivering or withholding securities incident to the receipt, exercise or vesting of a security issued in accordance with Rule 16b-3

I — Discretionary transaction in accordance with Rule 16b-3(f) resulting in acquisition or disposition of issuer securities

M — Exercise or conversion of derivative security exempted pursuant to Rule 16b-3

Derivative Securities Codes (Except for those exempt pursuant to Rule 16b-3)

C — Conversion of derivative security

E — Expiration of short derivative position

H — Expiration (or cancellation) of long derivative position with value received

O — Exercise of out-of-the-money derivative security

X — Exercise of in-the-money or at-the-money derivative security

Other Section 16(b) Exempt Transaction and Small Acquisition Codes (except for Rule 16b-3 codes above)

G — Bona fide gift

L — Small acquisition under Rule 16a-6

W — Acquisition or disposition by will or the laws of descent and distribution

Z — Deposit into or withdrawal from voting trust

Other Transaction Codes

J — Other acquisition or disposition (describe transaction)

K — Transaction in equity swap or instrument with similar characteristics

U — Disposition pursuant to a tender of shares in a change of control transaction

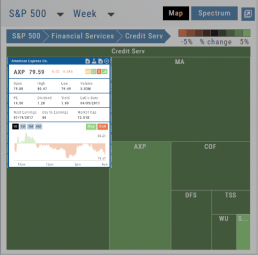

Heat Map & Spectrum Overview

Broad Market Insight that allows you to drill down

The Heat Maps are accessible in the Market tab and under Find>Explore and provide powerful visual views of market performance. This feature is designed to adapt to a variety of strategies and outlooks according to your portfolio needs. Select Index and Time Frame using the Action Icons. These can be changed going forward in any map screen.

In the Map view, each box represents either an industry group (default) or a stock when you drill down. The size of the box represents the market cap. By hovering your cursor over each box, an info box appears with info on that group within that industry, including the the number of companies, Market Cap, % Change in selected time frame.

Inner Circle - Inside Score

The Insider Score window provides insight into the buying/selling activity of Company insiders. Clicking “Detail” provides more in-depth information on such activity.

The Tens Line provides a benchmark upon which to base the Inner Circle Score.

Zero & above – indicates net buyers and thus, a Green Score.

Between zero and -10 will yield a Yellow Score, as some insider selling is normal and expected.

A Red Score indicates heavier selling outside of a normal, expected range.

The bottom left of the window shows the % of all shares that are Insider Owned, equivalent $ amount last Quarter, the Score and Net Dollar amount traded last Quarter.

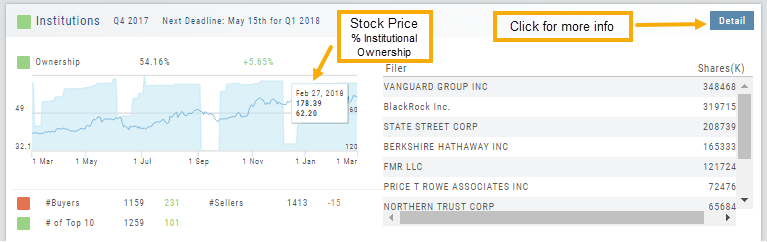

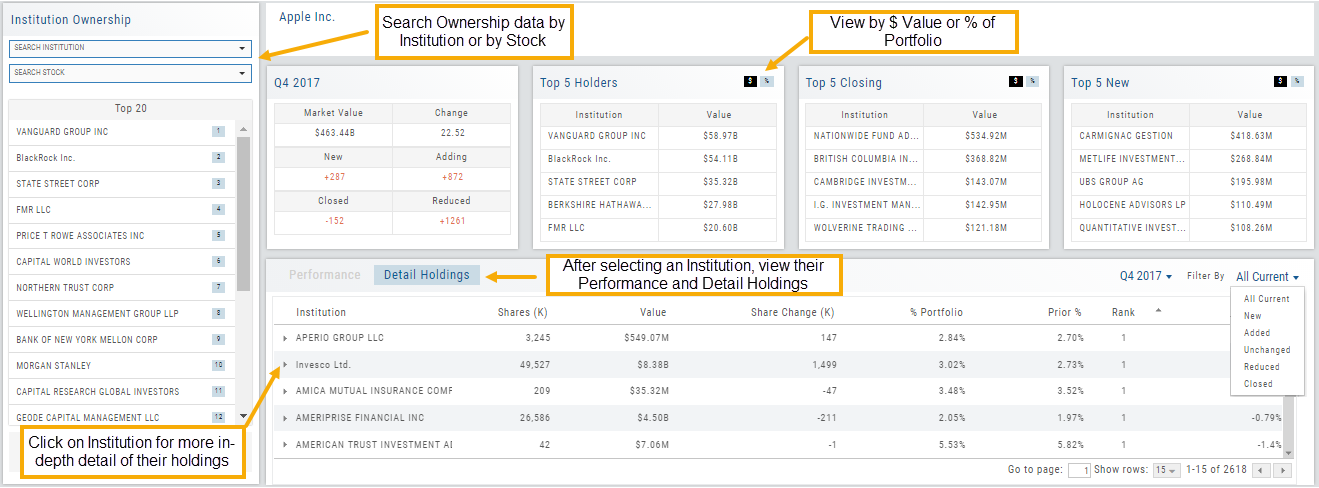

Inner Circle - Institutions

While Insiders are required to update their ownership status within a few days. Institutions are required to do so Quarterly.

The main tile shows data from the most recent reporting Quarter.

% Institutional Ownership and % change (+/-) from the previous Quarter

# of Buyers/Sellers with number gain/loss.

# of Institutions where the Stock is in their Top 10 Holdings

Note the Deadline for the Q1 2018 Report.

While the # of Buyers grew by 231 in Q4 2017, the number of Sellers outweighing buyers was enough to give this compenent a Red Score.

The # of Institutions holding AAPL grew enough to have a Green Score.

Clicking on “Detail” provides information on the last 20 Quarters. The information is layered allowing you to research ownership data further by Institution or Stock. You can further filter the ownership by those who added, reduced, dropped, unchanged etc. View holdings as a $ value or as a % of the Institutions’ portfolios.

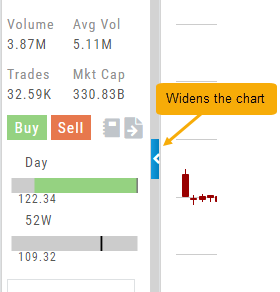

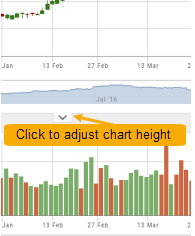

Adjust Chart Height & Width

The height of the chart can be adjusted by clicking and dragging the tab under the main chart.

This is a feature unique per device. You can have separate settings for your laptop/desktop,notebook or even tablet.

To widen the chart, click the blue tab on the left side of the chart. This will collapse the Quote Bar to the left of the chart. You can ‘undo’ this by clicking the tab again.