Platform Features Release: October 2022

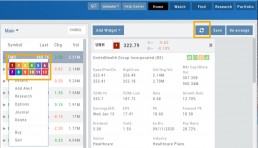

Announcing the latest Release of feature and functionality enhancements to the trading platform. These features and enhancements help keep users informed with activity on their trades. Functionality has been added to review a Watchlist in the Research tab, while being able to see at a glance which symbols have a price increase or decrease.

Notifications – Receive emails on upcoming Earnings, Dividends or Expiring Positions

Watchlist Research Functionality – Access and view your Watch Lists in the Research Tab via a drop-down box

Price Action Arrows on Symbols in Research Tab – Instantly see latest price action while on the Research Tab

Trade Position Notifications – Premium Feature

Want to receive weekly emails of Expiring Positions, Upcoming Earnings and/or Dividends on existing trades you have in your accounts?

This Premium Feature allows you to do just that in a 2-part process:

First: Click on the the Envelope Icon at the top of the platform screen:

![]()

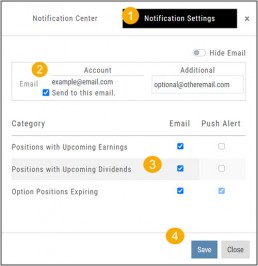

Go to “Notification Settings.”

Provide your email address(es).

Select Notifications you want to receive.

Click “Save”.

Next: On your Portfolio Accounts, go to the Account Summary Page and Toggle the switch to the On position.

Repeat this process for each Account you want emailed Notifications.

Expiration Notifications will be emailed 2 days in advance.

Each Monday, prior to Market Open, an email will be sent where there’s an Earnings or Dividend for any of the positions in the account(s) you have activated.

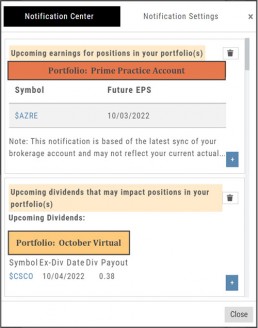

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

Each Monday, prior to Market Open, an email will be sent where there’s Earnings or Dividend for any of the positions in the account(s) you have activated.

The Notification Center will list what has been emailed to you for each account you have activated.

The Account Name and associated Color Tag will be displayed on each Notification and allows for quick identification.

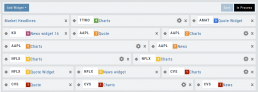

Research Watchlist Functionality

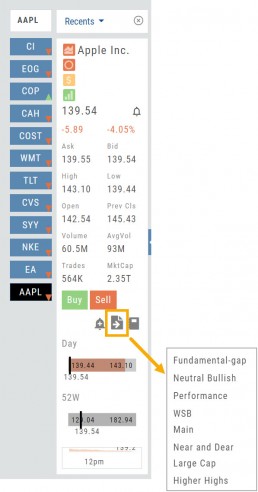

Users are able to access all Watchlists from the Research Tab.

Click the ![]() to access the dropdown list as shown in the graphic.

to access the dropdown list as shown in the graphic.

Lists with more than 20 symbols will have a scroll bar allowing for easier research of larger lists.

All other functionality remains the same: Symbols can be moved to other lists, have alerts set, deleted, add Journal notes

When a symbol is entered in the Symbol Search Box on the Research Tab, the symbol will automatically be displayed on the default “Recents” list.

In addition, when a symbol or group of symbols is sent to Research from anywhere else on the platform, it will appear on a list under the default “Recents” list.

Examples of when the “Recents” list will be displayed:

- Sending a symbol/symbols from a list on a Watch Tab.

- Selecting a group of symbols from a Scan or Screener list.

- Clicking on the Technical Icon from any symbol when not in the Research Tab. will be displayed under “Recents”.

The functionality of adding a note, an alert or sending a symbol to a specific list remains the same.

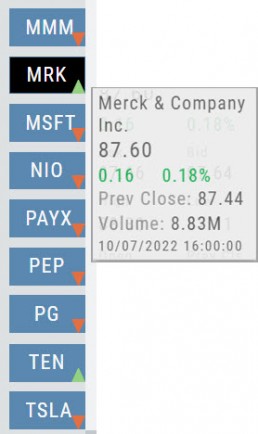

Green and Red Arrows have been added to each symbol tab when in Research.

This applies to any selected Watchlist or the default “Recents” list.

Each time one symbol is clicked, the entire list will update the latest price update.

Change Log

- Upper Indicator responsiveness corrected

- Profitability info loads correctly on Fundamental Tab

- Completed Bear Put description on Strategy Template

- Corrected display data on Fundamental Tab

Platform Features Release: April 2022

Announcing the updates, additions and edits to the trading platform:

Capability to adjust charts for splits

When a stock had a previous stock split, a button appears above to view Adjusted/Unadjusted Chart.

Data Points added to Option Chain

Get % return on Expiration and annualized % values for covered positions.

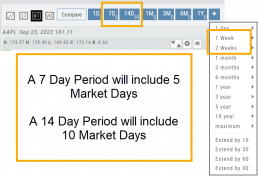

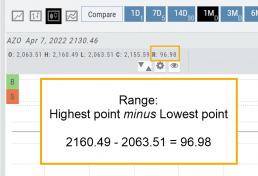

Intraday Chart Period Update

1 Week displays as 7 Days. 2 Weeks displays as 14 days.

Chart Adjusts for Splits

When a stock has a Split history, ![]() will appear next to the Indicator Box above the chart.

will appear next to the Indicator Box above the chart.

Make sure the chart period selected covers when the split occurred. This is identified on the x-axis of the chart as ![]() .

.

When the “UnAdj” button is clicked, the chart will display ‘before’ & ‘after’ split pricing.

Click the “UnAdj” button again to restore the prior chart display.

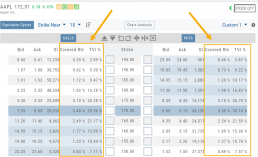

New Option Data Points Added

New data points have been added to assist in analyzing returns.

Covered Return – return based on expiration for $ used to buy shares for covered positions.

TVI% – Covered Return annualized

These are available on the Calls/Puts Chain and are also available as data points for Option Chain Custom Views

Chart Enhancements: Chart Periods & Candlestick Range

Change Log

- Resolved Saved Screener settings glitch

- Corrected Backtest Analyze date ability

- Restored sort capability in Institutional Activity

- Corrected profit/loss % display in Virtual Accounts

- Restored missing PEG/TTM data

- Enhanced contrast/dark theme notation

- Corrected Virtual Account Gain/Loss display

- Lower Indicator placement ability restored

- Earnings Data restored, added Time of Day

- Duplicate TDA Journal tab resolved

Platform Features Release: Enhanced Annotation Capability and Indicator Settings

Announcing the latest features/functions updates, additions or edits to the trading platform:

Enhanced Annotation Capability

Additional features have been added to create Annotations, Trendlines and Notes on the Chart. Each can be customized by color, size and easily placed on individual charts.

Volume and Moving Average Indicator Updates:

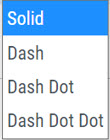

Users have the ability to further differentiate Moving Averages on the charts by changing the type of Line.

Volume can now be selected as an Upper Indicator and/or Lower Indicator

Enhanced Annotations, Trendlines, Notes & Fibonacci capabilities

Additional & Enhanced Tools for Charting

Enhanced Annotations, Trendlines, Notes & Fibonacci Retracements allow you to customize and edit for greater flexibility on your charting.

Rays, Horizontal Lines and Arrows have been added. All allow you to select the color and thickness of each for greater differentiation on the charts. Easily reposition with a simple click and drag to new location.

Notes can be text and color edited as well as repositioned.

Parallel Lines have been added and they, along with Fibonacci Retracements – allow you to customize the color and transparency on the charts.

Edits are easy: Click on the entry, edit as needed on the Annotation Box – which can be moved anywhere on the platform- as needed, to make any changes.

Volume and Moving Average Enhancements

Customize your Moving Average indicator Lines – not only by color – but by the type of line:

Volume, already available as a Lower Indicator, can be added as an Upper Indicator on the charts.

In addition, the Volume bar colors can be customized as they are an independent indicator from the candlesticks. This is done by clicking on the gear icon, as shown.

Change Log

- Added Stock/ETF symbol to Option Chain Window

Platform Features Release: New Option Chain Functionality/Appearance, Responsive P/L Graph

Features Release Notes:

New Option Chain Functionality/Appearance, Responsive P/L Graph

Announcing the latest features/functions updates, additions or edits to the trading platform:

Option Chain Functionality/Display has been revamped to allow users to control which information to view and increase responsiveness. Symbols, such as SPY and SPX, will load noticeably faster. An incorporated Dashboard provides a snapshot of current activity allowing users to make more informed decisions.

Responsive P/L Graph adjusts when the slide bar between Bid and Mid price is adjusted. This is especially helpful when the spread is considerable.

Option Chain Display/Functionality

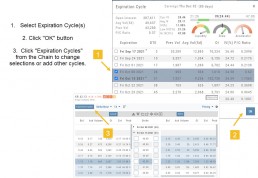

Select Expiration Cycles

The redesigned Option Chain allows users control of what Expirations to view instead of the platform defaulting to a cycle approximately 30 days out.

Click on the Options Tab from Research.

A window with available Expirations will appear along with a Dashboard with pertinent information (Volume, IV, OI, Earnings Date, etc) for more informed decision-making.

As a bonus, this structure allows data to load faster – especially helpful for those symbols with large option chains.

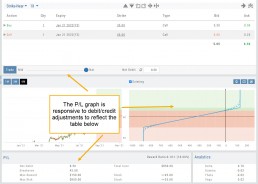

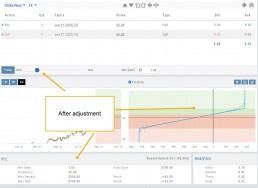

Responsive P/L Graph

The P/L graph on the Options Tab is responsive to adjustments made to the trade set up for the entry Net Debit/Net Credit.

Note, the smaller the spread between the Bid/Ask, the smaller the graph adjustment will be.

The example illustrates a large spread to better illustrate this feature update.

Change Log

- Price representation on chart X/Y axis corrected

- Journal Notes enhancement

- Saved screeners adjustment

- Active Watchlist access corrected

- Close from Backtest saves Symbol

- Clarified wording on Warning Message

- Mobile version of Saved and System Screener

- Mobile app – rolling trade adjustments

- P/L ‘Go Big’ data correction

- Account Summary page enhancement

- Large number displays on HeatMap

Platform Features Release: Smart Trade Ticket, Global Chart Settings, Updated Fundamental Tab, Order/Trade Chart Display

Features Release Notes:

Smart Trade Ticket, Global Chart Settings, Updated Fundamental Tab, Order/Trade Chart Display

Announcing the latest features/functions updates, additions or edits to the trading platform:

The Smart Trade Ticket is easier to use and allows for future capability depending on what brokerages offer. One Example if this would be Conditional Orders.

Global Chart Settings have always housed where to control candlestick/volume bar colors as well as Tooltip displays. Now, clicking on the gear allows you the ability to display Annotations, Positions/Orders and Events.

The Fundamental Tab under Research has an improved, easier to read display with additional features for a clearer snapshot of a stock’s past and forecasted performance.

You’ll be able to differentiate a Conditional Order from a Staged Order as well as a Yet-To-Be-Executed-Order with the enhanced Order/Trade Display.

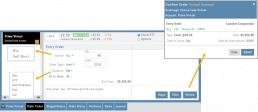

Smart Trade Ticket

Smart Trade Ticket

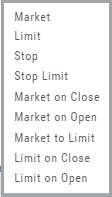

The redesigned Trade Ticket has defined sections for Stock/ETF trades and Option Trades. The Stock Ticket is divided into Open and Exit sections for easier use.

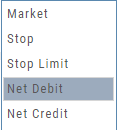

The Close Ticket provides a summary of any Profit/Loss on the trade. Brokerages determine available Order Types, which may include the following to open a trade:

Note: Closing Order Types may also include Trailing $ and Trailing %.

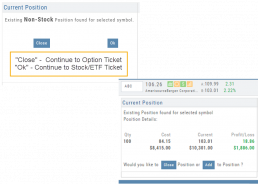

If there is an existing position on a Symbol when a new order is created, the Smart Ticket system will identify if there is an existing Non-Stock/Multi-leg Position or an existing Stock position.

If Non-Stock/Multi-leg position, clicking “Close” will navigate the user to the Option Trade Ticket. Clicking “Ok” will lead the user to the Stock/ETF Ticket.

If there is an existing Stock position, a summary of the existing will display along with the ability to Close or Add to the existing position.

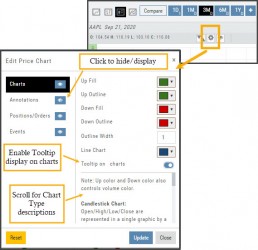

Global Chart Settings

Global Chart Settings

Manage common chart settings from one location by clicking on the left-most Gear icon on the Chart Header which is located under the saved chart periodicities.

In addition to setting your Bullish/Bearish candlestick and corresponding Volume bar colors and control of whether you want Tooltips to display on the chart, you can view/hide:

All Chart Settings

Annotations

Orders/Positions

Events (Dividends/Earnings)

Simply click the ‘eye’ icon to display/hide your selection. Once finished with your Global Settings, click “Update,” then “Close.” To reset to default settings, click “Reset.”

Improved Fundamental Display

Fundamental Data has a new look

The area charts under the Research>Fundamental tab have been replaced with bar charts for easier understanding.

A Tooltip appears when you hover your cursor over the bar charts providing information for that data point.

Estimated Earnings is now in the same window as Historic Earnings for clearer comparison as both sets of data now have the same orientation

The Earnings display has been enhanced to illustrate past and projected data in the same window to match the orientation for a more accurate ‘apples to apples’ comparison.

Click on any of the legend icons to toggle the data displayed.

![]()

The Analysts’ Target Window displays the current stock price as a horizontal line for reference.

Custom Page Enhancements

The widgets with that number will automatically populate accordingly.

To change displaying one symbol to another using a Watchlist, simply click on the Action Icon of new Symbol and select the number of the current Symbol you want to replace.

A refresh icon ![]() has been added to the Header to make it easy to update the Custom Page display after rearranging widgets.

has been added to the Header to make it easy to update the Custom Page display after rearranging widgets.

We’ve increased the number of symbols that can be tagged from 6 to 12.

Using the Watchlist displayed on the left side of the screen, click the Action Icon (triangle) to left of Stock Symbol you want to display and assign a number, 1 to 12.

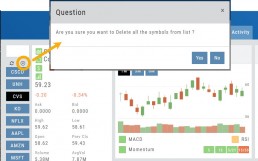

Delete Notice added to Research Tab

A Warning Notice now displays when ‘x’ is clicked on the Research Tab requiring confirmation prior to removing the list of symbols from the tab.

Change Log

- Heat Map filter setting/saving improved

- Interval call split adjustments

- Greek Summary displays on Positions tab

- ETF list on Home Page issue resolved

- Strike Arrow functionality restored on Option Chain

- Sorting Scan after scrolling behavior corrected

- Eliminated stacking Indicators on charts

- Alert list is scrollable

The Order Ticket - Stock/ETF

The Order Ticket is designed for ease of use and flexibility.

Selecting “Stock/ETF” or “Options” will display the appropriate ticket.

Brokerages determine what Order Types and Duration selections are available.

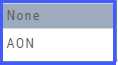

All or None allows you to dictate whether to accept partial fill of an order or not. Toggle to turn this on/off.

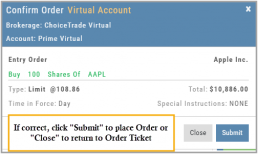

The Order Summary appears below Order details as an additional security step to ensure your order is correct.

Click “Stage” for later review, “Review” to continue the Order process or “Clear” to start over.

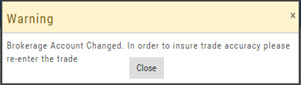

Note: If you start an Order in one account, then switch accounts, you’ll review the following notice:

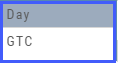

Order Types are in a drop-down box and the types offered often vary from one brokerage to the next.

‘Duration’ – How long the order is good for: Day (current trading day) or GTC (Good til Cancelled)

‘Condition’ – Must be met for the order to be filled/executed: “None” (no conditions) or “All or None” (all of the order must be filled, or none at all).

After completing the order ticket, click ‘review’, then ‘submit’.

After completing the order ticket, click ‘review’, then ‘submit’.

Platform Features Release: Additional Alert Functionality, Watch List Alerts, Info Button, Trade from Charts

Features Release Notes:

Additional Alert Capability, Set Watchlist Alerts, Alert Management Info Button, New Trade Button on Charts

Announcing: Expanded Alert Capabilities, Watchlist Alerts Information Button, Trade Function from Charts

We’ve increased Alert capabilities to give users more ability to identify trade entry, exit and management opportunities. An Info button (i) is added to on the Alert Management Page to assist/guide users on the criteria offered.

Set Alerts by Watchlist as well as individual symbol.

Trade functionality is available from the Charts, streamlining the process when you have an existing trade or staged trade. Where there are more than one position on the same symbol, you’ll be given the option of what action to take.

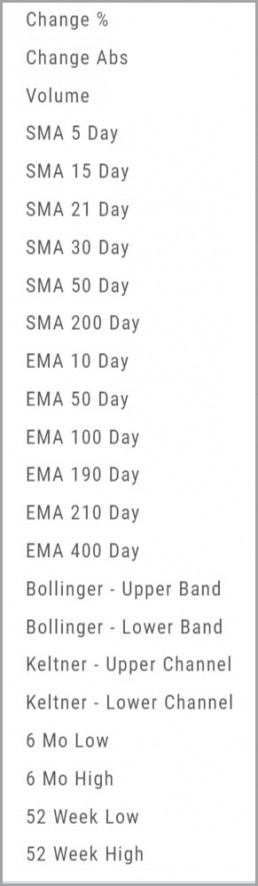

Increased Alert Functionality

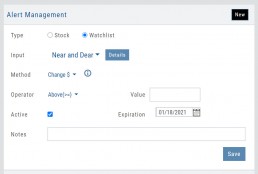

Set Alerts by Watchlist

You are able to set Alerts on your Personal Watchlists . There are 2 ways to do this:

1. On the Watch Tab using the Alert Icon in the Icon bar

2. The Alert Management Page, click “Watchlist”, then select from the drop-down which will automatically populate available lists to choose from.

Criteria available for single stock/etf symbols are available to set for an entire watchlist, include Real Time, up to 6 month activation and the ability to add Notes.

Clicking the “Detail” button will display the symbols contained in the selected Watchlist

With the exception of Last Price, all Methods are available for both individual alerts as well as Watchlist Alerts.

Simple Moving Average

Exponential Moving Average

Bollinger Bands

Keltner Channels

6 Month Hi/Low

52 Week Hi/Low

As you see, SMA & EMA offer numerous time periods. The shorter the time period, the more alerts you will receive – especially when set on Watchlists.

Note: The Active Alert box on the left side of the Alert Management page will have ‘wl‘ indicated when the alert is on a Watchlist.

A Reminder on Alerts:

Alerts are RealTime if you have Streaming Quotes on the platform – OR – have a linked brokerage account that provides RealTime quotes to the platform – AND – have logged into that account in the last 30 days.

Alerts on OTC stocks will be delayed

Make sure to enable “Push Notifications” on your computer as well as mobile devices (if you have the app downloaded). You do not have to be logged into the platform to receive alerts as long as you have these notices activated.

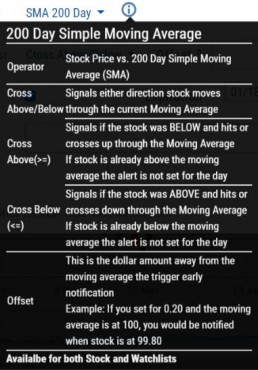

Information Button – Alert Management Page

An Information Button has been added to the Alert Management page.

Located next to the Method drop-down, (i) clicking on this button will display in-depth information on criteria available to set your alerts.

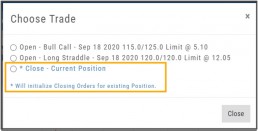

Trade from Charts (Live, Virtual, Manual or Staged Orders)

Submitting existing trades or staged orders is streamlined.

In the example chart above, there are two staged orders and a Live Trade.

Clicking “Trade“, located above the stock chart , will display a menu of an existing trade(s) in the activated trade account.

Staged Orders, on the same symbol, will display regardless of the trade account activated.

Staged orders will be shown in bold/black.

Active trades, whether Live, Virtual or Manual will be shown lighter/blue.

To the right is what displays after clicking “Trade”:

1. Open (Enter) the Bull Call Position

2. Open (Enter) the Straddle Position

3. Close the existing Active Trade (Manual, Virtual or Live)

The next action will take you to the Order Ticket to continue the trade process, as usual.

Change Log

- Ability to save Backtested trades after Market hours restored

- Dividend display corrected

- Adjusted links in BZ news

- Mobile App – scrolling issue resolved in Scans

Premium Features Release: Custom Home Page & Alert Functionality

Features Release Notes:

Custom Home Page, Alert Capability

Announcing: New Powerful Premium Features Added to the Trade Tool Trading Platform

Two new features, exclusive to the premium desktop version of the trading platform have been designed and implemented to help you make better trading decisions and have more control in managing existing trades.

Custom is located in the redesigned former Market Tab and gives you control of features you want to see in one customizable location.

Alerts gives you more control of your trading by setting up notifications set by your criteria.

Both features allow for expansion on future releases.

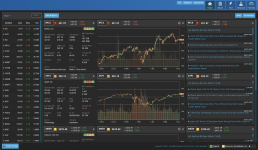

Custom Home Page

You now have a Custom Home page!

Located in the “Home” Tab (formerly Market), this is a flexible feature which allows for a convenient way to research trades or find opportunities – in one place – all defined by you.

Start by adding Widgets: Chart, Quote and News pertaining to the stock, and even Market News The platform system will automatically adjust according to the available space on your desktop/laptop.

Each symbol can have multiple Chart set-ups – each with their own time period, chart type and indicators.

Want to rearrange the widgets? Custom allows you to do so.

Want to keep the settings, but change the selected stocks quickly? That’s covered too.

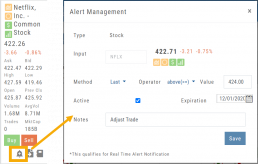

Alert Functionality

Alert capability gives you more control of managing existing trades or being notified of possible trade opportunities. Set by Last Price, $ or % Change, % Offset or Volume.

Receive triggered alerts on your computer and/or mobile device (with the mobile app).

Alert Management, located in Research, allows for easy modifying or removing active alerts from your current list.

Increase your profitability while minimizing risk on existing trades with this powerful feature!

Alerts are easily set up from the Research Dashboard.

Click on the bell icon, located in the Quote Box,

Complete each field

Click “Save”

Quotes are RealTime if you have Streaming Quotes on the platform – OR – have a linked brokerage account that provides RealTime quotes to the platform – AND – have logged into that account in the last 30 days.

Change Log

- Researching Staged Orders resolved

- Adjustments/Building trades in Order Ticket issues corrected

- Deleting Snapshot trade in chain corrected

- Research/Dashboard/EPS data aligned

- Scroll bar improvement on PCs in Journal, Watch Lists

- Corrected “Position/Order Display” on Charts

- “Existing Positions” label displays on Charts

- Earnings display corrected when adding 10,30,60,90 periods

- TDA – History data updated

- TDA – Login resolved for Android mobile & Google Pixel

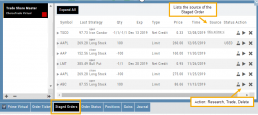

Order Staging (Premium Desktop Feature)

This feature allows the user to save Potential Trades for further consideration to decide the best ones to submit.

Staging is also useful when the Market is closed – to be reviewed when the Market is open to determine if it’s still a high-probability trade.

With one click, you can send to the Research Tab, Move to an Order Ticket or Delete and move on to the next staged order.

When Trade Sharing is enabled, Trades made in accounts you are following will be displayed in your Order Staging Tab. The Source will indicate the Account Name. Status of “Used” will display for those trades you submit on one of your accounts.

Expired Staged Orders will automatically be removed.

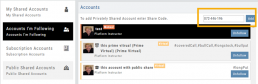

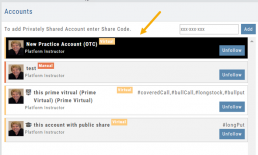

Following a Shared Account (Premium Desktop Feature)

Under Portfolio>Sharing, click on “Accounts I’m Following” on the left-hand panel.

The center panel, above the Account List has a section to enter the code for the Account to be shared on your platform. Enter the code, then click “Add“

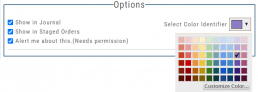

On the bottom, right panel box under “Options“, make sure to check boxes:

Show in Journal

Show in Staged Orders

Alert me about this (Needs permission)

Your device’s settings need to be permissioned for Alerts.

Finally, for easy trade identification, select a color identifier from the dropdown box in the right corner of the Options box.