Overview of Scans

Want some ideas to take advantage of market conditions? This is the place to find Stock and Option opportunities based on bullish, bearish and stagnant outlook.

Choose from dozens of scans based on events or components of “The Score”: Fundamentals, Valuation, Technical & Inner Circle.

Ideas and Features offer even more opportunities.

The [i] icon provides a short explanation of the strategy.

Best of all, you are able to keep your favorites all in one place by ‘starring’ it for future use.

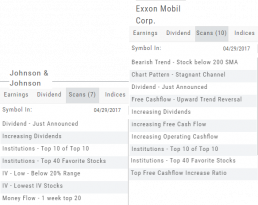

The Dashboard Scan Tab

Get the current ‘story’ on a stock.

The Scan Tab is particularly interesting. In addition to providing a list of scans the stock is currently included in, it can give you a “story” about the stock. Based on the scans that the stock is showing up in, you can get an overview of outlook on the stock.

For example: JNJ shows solid longer term positive outlook.

XOM Shows stagnant with improving longer term outlook

Create Watchlists

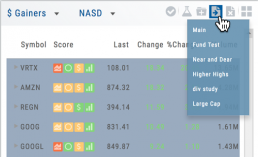

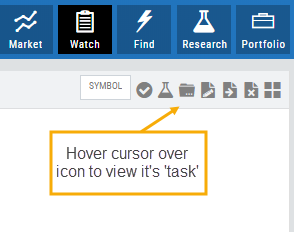

The Market & Watch Tab Icon ToolBar allows you to Create/Modify/Manage your Lists.

Hover your cursor over the icon to view it’s ‘task’:

Select Candidates

Send to Research

Create/Delete a List

Modify an existing List

Send candidates from one List to another

Remove candidates from existing List

Change View: List or Tile

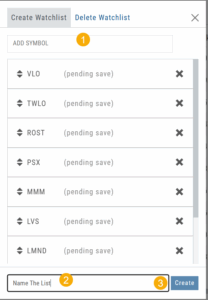

To Create a New Watchlist:

1. Under ‘Create Watchlist’, enter symbols to automatically add

2. Enter the name of New Watchlist

3. Click “Create”

Other ways to Create Lists include:

Research>Chart>”Recents” list.

From the Find Tab>Scans and Find Tab>Calendar.

Selecting candidates from Scans (Ex: Bullish Ascending Triangle ) or Calendar for an Earnings or Dividend date to get the list of stocks that fit your selected criteria, click the “Check” icon to the stock symbols you want to keep, then click the Folder + icon to , name your new Watch List then click “OK”.

You can also copy/paste up to 100 symbols from an outside source to a newly created (or existing list) provided the following apply:

The symbols are separated by:

A Space: TSLA ZM GOOG NFLX

Or by a Comma: TSLA,ZM,GOOG,NFLX

Or a Return:

TSLA

ZM

GOOG

NFLX

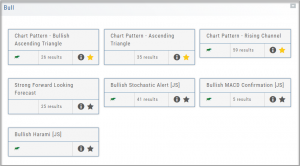

The Top 4 Categories

The names may be different, but the scans remain the same!

Feature – Your favorite and our highlighted scans, including scans related to The Score.

Ideas – Scans for general ideas including Dividends, Money Flow, Volatility, Earnings and more.

Outlook – For Bearish, Bullish and Stagnant outlook conditions.

Strategy – Over 20 strategy-specific scans including Bull Put, Bear Call, Iron Condor and more.

Technical Analysis

Technicals: The fastest indicators of The Score

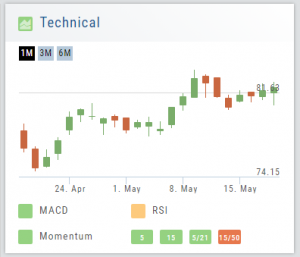

In Technical Score, 3 primary categories of studies are evaluated – MACD, RSI, and Momentum.

Momentum is made up of 4 different trend analysis timelines.

5 = Stock over the 5-day moving average

15 = Stock over the 15-day moving average

5/21 = 5-day moving average over the 21-day moving average

15/50 = 15-day moving average over the 50 day moving average

Note: Momentum indication is from fastest to slowest. This can be helpful in determining your time frame/outlook for the appropriate strategies.

By clicking on the Technical Score Icon anywhere in the platform, you’ll be taken to the Chart Tab under Research for that Company/Symbol.

Go to Charts for more in-depth information.

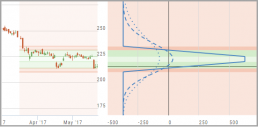

Performance Channels

Performance Channels can assist in visual analysis across both the P/L Graph and the Chart.

- Dark Green – Stock movement affects gain

- Light Green – At maximum gain

- Dark Red – Stock movement affects loss

- Light Red – At maximum loss

The width of the channel on the chart represents the timeframe of the trade. If options expire in 30 days, the channel will display back 30 days on the chart. This give a visual reference for the time frame of the trade.

Note: Channels are displayed based on expiration of the trade. Past performance is not indicative of future results. Performance channel date orientation is for reference only.

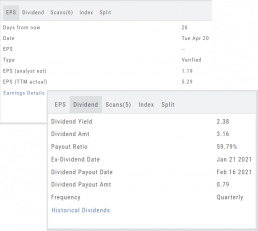

Earnings, Dividends and more...

The far right, lower box in Research provides the following:

Earnings Tab: Get Earnings date, number of business days until announcement, Estimated and Actual Trailing Twelve Months (TTM) EPS, and link to the prior 12 Quarter Earnings details.

Dividend Tab: Get Yield, Amount, Payout Ratio (dividend/EPS), the Ex-Dividend Date (deadline to complete a stock purchase to be entitled to dividends), Payout information, Frequency and link to the prior 12 Quarter Dividends.

Scans Tab: Quickly view how many & which scans the stock symbol appears on.

Index Tab: Lists the symbol and indices name(s) on which this stock appears.

Split Date: Provides most recent Split Date, Detail and a link to view Split History

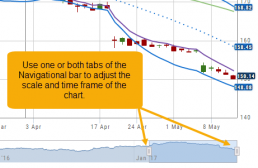

Chart Navigation

Hovering the cursor over the icons will display it’s function.

In the upper right of the Chart screen, you can select which Chart Profile to research from the drop-down box, then save or delete the profile.

The next set of icons immediately below this gives more charting capabilities: Increase/Decrease price ranges, Reset price range, Hide/Show Navigation Bar, Move the date Back/Forward, Export/Print Chart

![]()