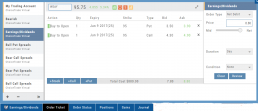

Positions Tab

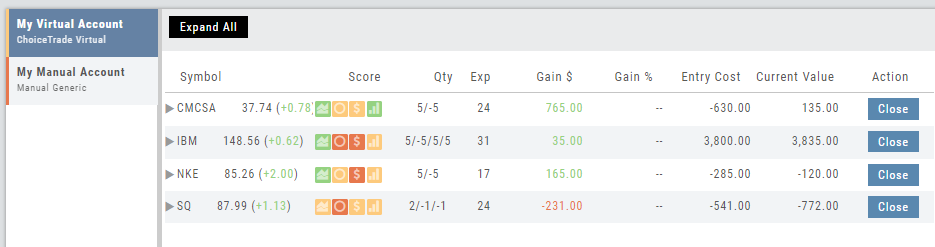

The Positions Tab offers 4 table views of your current trades. You can access these by clicking on the drop-down box in the upper right of the screen. “All” combines the 4 views.

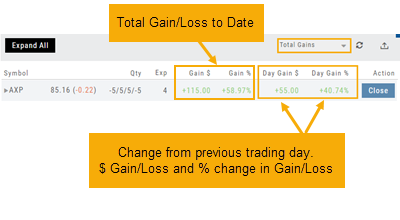

Total Gains

This table view displays the Overall $ and % Gain/Loss and the Daily $ and % Gain/Loss based on the previous trading day’s results.

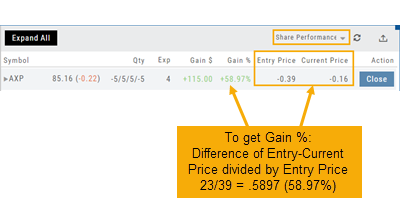

Share Performance

This table breaks down Total Gains by showing Entry Cost compared to Current Value per Share.

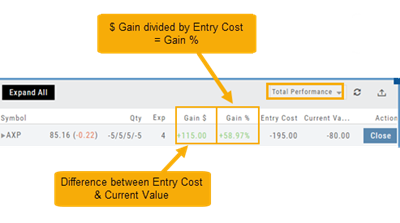

Total Performance

Similar to Share Performance, but shows Total Entry Cost and Total Current Value.

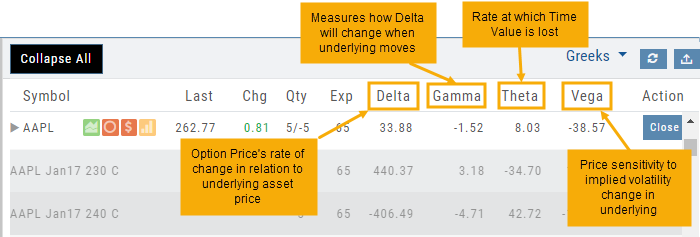

Greeks

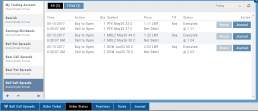

Access Trading Account Information

No need to login to Brokerage Account site for normal day-to-day activity.

Each account includes a Summary page showing the Account Balance, Margin Balance, Stock, Option & Day Trading Buying Power and tracks the current trading day’s activity.

Besides the Order Ticket, the Order Status, Current Positions & Transaction History are all available. You can view previous order history in the Order Status tab by clicking on the drop-down menu on the upper-right corner of that screen.

You can access any account and switch accounts with a single click. You can even change the account from the order ticket.

The newest feature, Journal provides the means of organizing, noting, analyzing & reconciling trades.

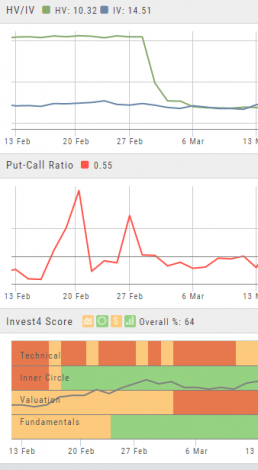

Advanced Indicators

We offer select Advanced Upper and Lower Indicators that are not just derived from the price, including proprietary indicators like “Invest4Score” and “Insider Score”. They are accessible by using the “Add Indicator” drop-down box.

Upper Indicators include:

- Event Flags – showing Earnings and Dividends

- Journal Display

- Support/Resistance

- Extrema Trend Lines

Lower Indicators include:

- Historic Volatility/Implied Volatility

- Insider Score

- Institutional Percentage

- Invest4 Score

- Momentum Score

- Open Interest

- Options Volume

- Put Call Ratios

Fundamentals

A complete perspective of performance in one place.

Fundamentals looks at 20 critical financial analysis ratios in 5 different categories: Growth, Profit, Cash Flow, Key Ratios, and of course, Earnings.

We also take into account Quarter over Quarter, Year over Year, and Trailing Twelve Months’ (TTM) performance with our proprietary weighting formula. View historical data by clicking on the upper right corner buttons in each window.

Fundamentals is the slowest of The Score components to affect stocks, due to the limited times throughout the year data is released. Active investors would generally place more weight on Fundamentals than would a very short-term trader.

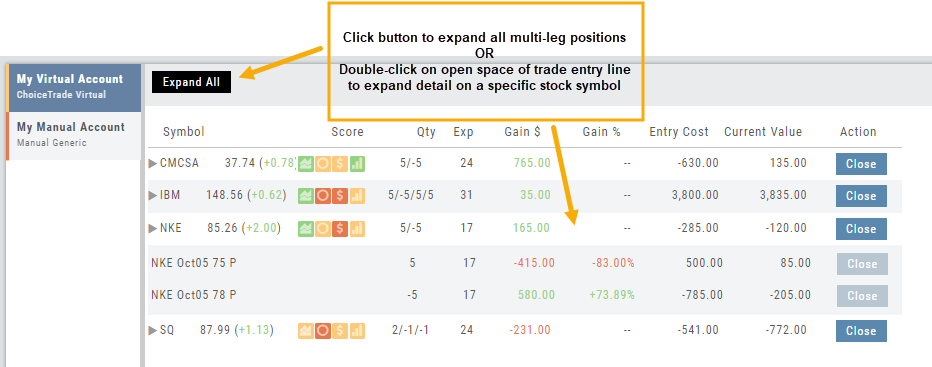

Expand Trade Detail - Positions Tab

There are 3 ways to expand multi-leg trades in the Positions Tab.

Smart Icon – Click on the ![]() icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

icon to the left of the stock symbol, select ‘Expand/Collapse’. Repeat to close.

Expand All – Click the button above the trade entries if you wish to expand all multi-leg trades. Once clicked, the button will change to Collapse All.

Double-Click – if you want to expand one trade or specific trades, simply ‘double-click’ on an open space of the trade entry line. Repeat to close.

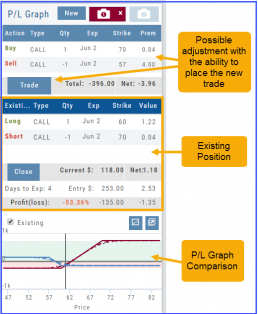

Trade Management

This platform makes it easy to manage and adjust trades when needed. The Snapshot feature and the P/L graph enables you to visually assess adjustments.

Once the existing trade is showing on the options page, take a ‘snapshot’. Enter the adjustment, then take another ‘snapshot’.

To submit the adjustment to the Order Ticket of your brokerage account, click “Trade”. The smart ticket system will even handle the trade adjustment automatically by entering the appropriate buy/sell, open/close combination.

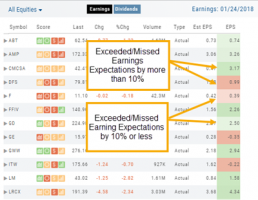

Earnings Per Share Performance

Once a date has past and earnings have been announced, Earning Per Share (EPS) is color-coded based on how much the company beat (or missed) Expectations.

Go to Find>Calendar, select “Earnings” and view any past date, where earning have been announce, to view the results.

Dark Green/Dark Red is considered surprise, and indicate the company beat/missed estimates by more than 10%

Light Green/Light Red indicate the company beat/missed estimates by 10% or less

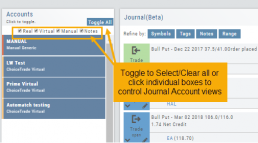

Journal Account Multi-Selector

Reviewing your Journal Accounts is made easier by using the Multi-Select tool on the Journal Tab. Control your Journal Account Views by selecting from Live, Virtual, Manual accounts or Notes or any combination of these.

Use the “Toggle All” button to switch or toggle your selection. Example: If you have your virtual selected and not your real accounts, Toggle will switch to real account and unselect virtual account. This can be a great way to analyze your results and compare real and virtual.

You can further sort by Symbol, Tags, Notes or Date Range within an Account by using the following tabs in the Journal:

NOTE: Any filtering, including account selection, will refine your analytics results too. Want to find your results from a specific account. Select just that account and analytics will refect accordingly.

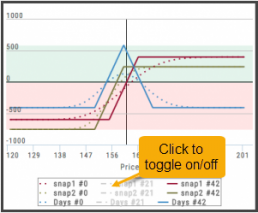

Clickable Legends

When comparing trades using the Snapshot feature, the P/L Graph can get a little crowded. You can clear some of the lines by simply clicking on the legend to toggle visibility.

Clickable legends are also available in other graphs and charts within the platform.

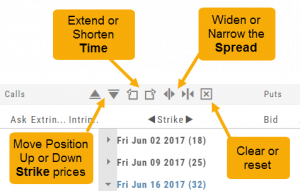

Rolling Positions

It’s easier & faster to evaluate your Trade

Once you have entered a position, you can easily make adjustments for further evaluation using the group of Rolling Icons in the upper-center part of the Option Table.

These icons will allow you to move the whole position:

Up or Down Strike Prices

Extend or Shorten Time

Widen or Narrow the Spread

The [X] acts as a clear function. Clicking once will clear the current positions in the chain. Clicking a second time will act as “all clear”. This will clear any snapshot trades and fully reset the option chain.