Advanced Analytics

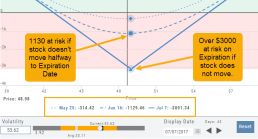

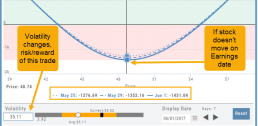

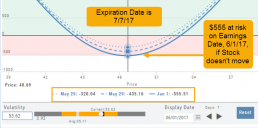

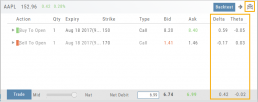

Some strategies are more responsive to time decay and/or volatility than others. This platform has tools to help analyze these components.

- Construct the position in the Option Chain table

- Select the ‘Go Big’ icon on the P&L Graph

- The Graph shows 3 data points: Current Day, Halfway point to Expiration Day & Expiration Day. The corresponding legend, immediately below the graph, follows the cursor slider along the graph.

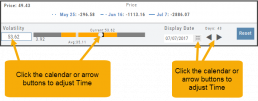

- The bottom of the screen contains a Calendar (Time) & Volatility Scale. Both can be manipulated to analyze the position.

Time: You can select a date to analyze as well as user stepper buttons to move day by day backward or forward.

Volatility: Use the volatility slider or enter a value in the entry box to see the impact of changes in volatility. The slider bar also displays the current (circle), average (gray), and 1 year high / low of implied volatility (orange portion of the slider) for easy reference.

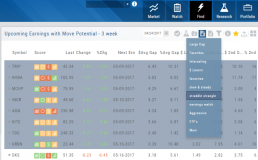

Sending from One “List” to Another

You can send symbols from any list, including Find, Explore, Actives, to your Watch lists — including from one watch list to another.

Simply (1) click the “Check” icon, (2) select the symbol(s), (3) click the “Page/Arrow” icon and select the List you want the selections sent to.

You can also ‘Click & Drag’ – highlighting a group of symbols you want moved to another list, or to the Research Tab.

Note: Research can handle up to 20 stock symbols at a time.

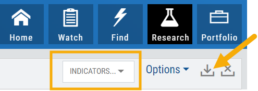

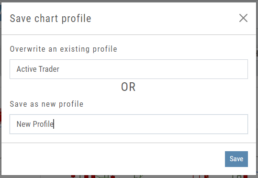

Add/Delete/Save Chart Profiles

Create multiple chart profiles for your analysis. Saved profiles will remember your settings: chart type, time frame including “Extend By 10,30,60 or 90 Days”, indicators, etc.

After you’ve set up your chart:

1. Click the ‘Save’ Icon

2. You’ll be prompted to Overwrite an existing profile or Save as a new profile**

3. Click ‘Save’ – (the box will disappear after a second or two)

That’s it!

You can remove unwanted profiles by clicking the [x] icon to delete, located next to the ‘Save’ icon.

**Note: Active Trader, Options, and Standard View are System views and cannot be altered or deleted. You will be prompted to save the new settings or overwrite a different view.

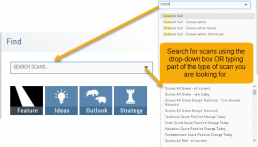

Scan - Smart search

The search box is found at the top of Find. It performs ‘smart searches’ by pulling all scans related to what is typed in. If you don’t know the name of the specific scan, but know it is related to Earning announcements, type “earning” and a list will populate showing scans that are about Earning. Typing “Bull” or “Bear” will bring up scans with “Bull or Bullish” or “Bear or Bearish” in their names, respectively.

Of course, you can also elect to search by clicking the arrow for a complete list of available scans in a drop-down search.

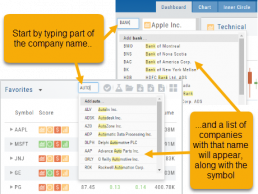

Don't Know the Symbol?

No Problem

You can search for symbols from several entry points including “Market” and “Watch”. Simply start typing all or part of the Company’s name and the system will proactively provide you with suggestions. You can use this feature anywhere including Insiders and Institutions.

For example, typing “Bank” in the Symbol box will bring up the stock symbols and names of companies with “bank” in their name.

Depending where you are in the Platform, clicking on the selected symbol while you are in:

The “Market” or “Watch” tab, it will be added to your currently open list of stocks.

The Dashboard of the “Research” Tab, it will automatically provide the top layer of information on the stock. As always, you are able to navigate to different areas or ‘drill down’.

Insider or Institutions of the “Research” Tab, the corresponding data will display, such as data by Quarter, the biggest buyers and sellers and more.

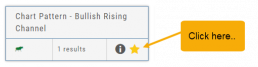

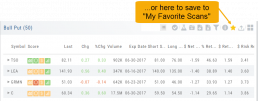

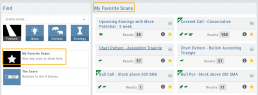

Save your Favorite Scans

Create your Customized Scan List

Star any scan to have it show in Feature > My Favorite Scans.

There are two ways to do this:

Simply click the star ![]() on the Tile View of the scans or on the header in the results view of any scan.

on the Tile View of the scans or on the header in the results view of any scan.

Favorites will be easily access from the Scan main page

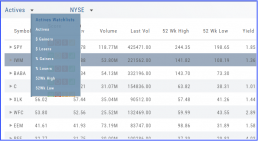

The Other Lists

In addition to your Personal and Dynamic Watch lists, the platform also provides “Actives Watch lists” from which you can add results to a new or existing Watch list.

If you want to eliminate low price, low volume stocks, click on the appropriate header to sort, then you can either click/drag to highlight the ones you want to delete – or – click the Check icon from the navigational icons to select the ones to delete – or to send to Research or another Watch List. ![]()

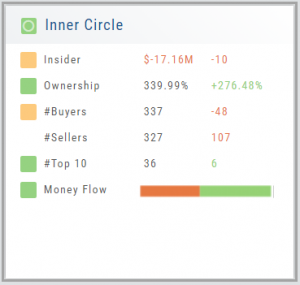

Inner Circle - Behind the Scenes

Insider and Institutional Activity.

Insiders’ and Institutions’ activities in a stock is a powerful tool.

Insiders: Our proprietary Insider Score looks at who the insiders are, how many there are, and how much stock is being bought or sold to derive a score algorithm.

Institutions: We monitor overall and individual institutions’ activities around a stock with historical comparison to evaluate the Institution Score.

You have the ability to delve into as much information as you want by clicking on the ‘Detail’ box in “Insider Score” and “Institutions”. Find top buyers/sellers by week, month, 3 months, or one year. Search Institution Ownership by selected Quarter Report, newly added, reduced, current, top holders, etc. Dive deeper to gain insight into Institutions’ other holdings.

The information is easily accessible when you want it – just by the click of an icon, drop-down box, or arrow.

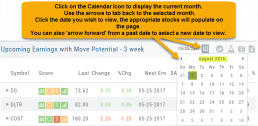

Past Scan Results

When viewing scan results, you can select a past date by clicking on the Calendar Icon, then the back arrow until you get to the month you want to search from. Click on the date you wish to view & the appropriate stocks will populate the screen.

The date you are searching will be displayed in the header

Note: Past Scans availability dates vary. When a new scan is added, the history is available from the day it was added to the platform going forward.