Platform Features Release: Annotation Enhancements, Condor Trade Set Up

Announcing the latest Release of Annotation improvements and Strategy template adjustment. We’ve also made several practical changes for better access to features/functions.

Independent Default Settings for Annotations

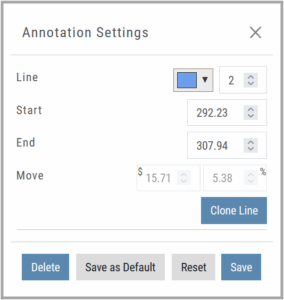

When adding Annotations such as lines, rays, arrows, etc, to the chart, the settings for that type of annotation can be set as a “Default”. Line settings are independent of other annotations’ settings.

Add the Annotation.

Click on the annotation to display the Dialog box (shown).

Make any adjustments.

Click “Save as Default”

The newly added and future annotations of the same type will have the new settings.

Click “Reset” to revert to original settings.

Fibonacci Too!

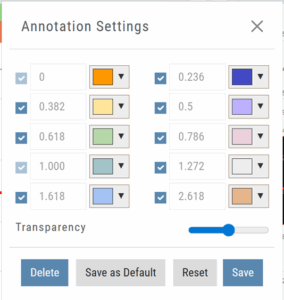

The Fibonacci Annotation has been enhanced to allow you to select which Retracement Levels you want to view in addition to adjusting the color for each as well as transparency overall.

The Fibonacci Annotation has been enhanced to allow you to select which Retracement Levels you want to view in addition to adjusting the color for each as well as transparency overall.

The settings can be set as the Default for new chart entries.

**Please note: Existing Fibonacci annotations cannot be edited with this new coding. They must be deleted, then added back.

Condor Strategy Template Adjustment

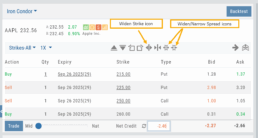

The core functionality of Condor Strategy Templates has been adjusted. (Iron/Long/Short)

The center strikes are now anchored by default and will only change if you adjust them manually on the template itself or by using the “Widen Strike” icon —making trade construction more intuitive and consistent.

Widening/Narrowing of the center Strikes will change the spread of the Condor, which can be done manually on the template or by using the “Widen” or “Narrow Spread” icon.

Other Additions

- EOD lower Indicators will display “Chart Unavailable for intraday charts.”

- Zoom feature now includes a double-click “on-off” functionality

- HeatMap legend (Find>HeatMap) is movable

Change Log

- Heatmap legend is no longer fixed when clicked to view

- Transparency for shapes is resolved

- Price slice functionality adjusted for price changes

- Zoom feature is now toggle functionality

- Scrolling chart/arrow functionality resolved

Platform Features Release: Set Alert from Option Tab

This Release focused on fixes and set-ups for future capabilities and added the following:

Setting Alerts Enabled from the Option Tab in Research.

Bracket Order capability in ChoiceTrade Virtual Accounts

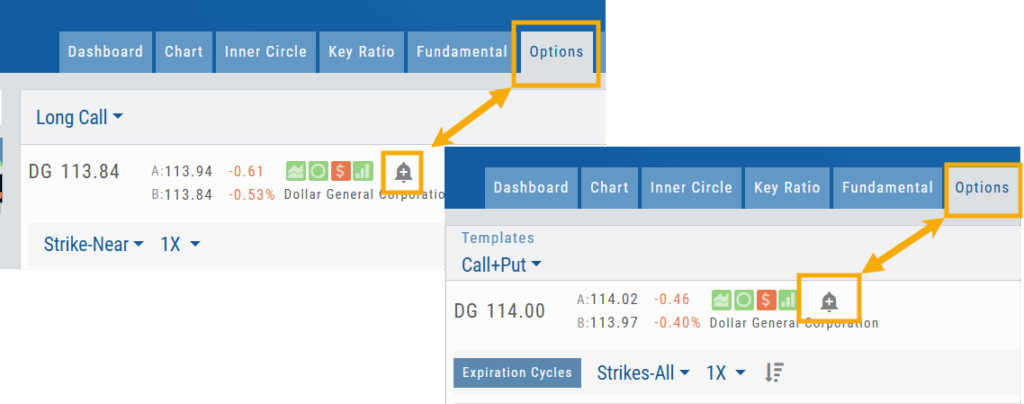

Set Alerts from Option Tab

Alerts can be set from the Option Tab – as, in Research, this was the only tab where the Info box on the left side of the screen was not visible.

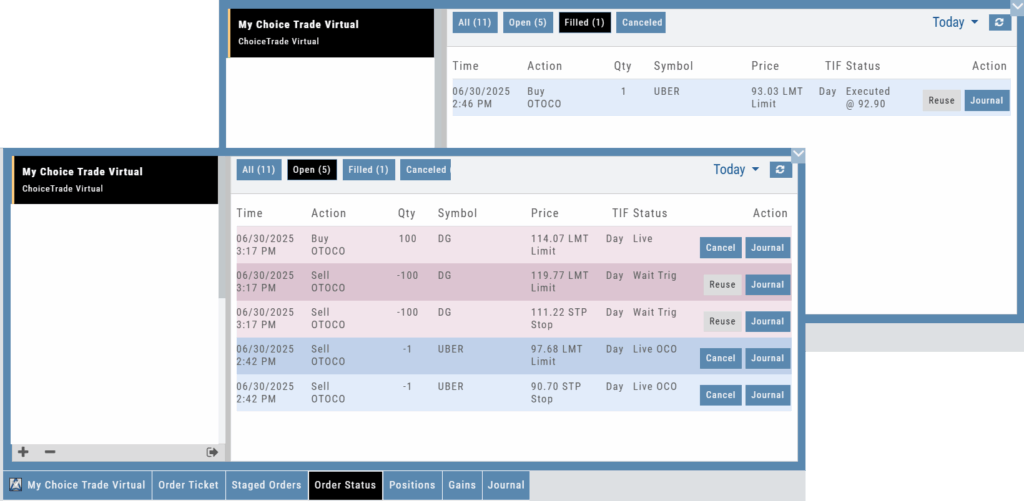

ChoiceTrade has Bracket Order capability

ChoiceTrade supports Bracket Orders on Stock.

Change Log

- Resolved “Reset Zoom” function on chart vertical expansion

- Alert Expiration is midnight of Expiration day

- Mobile App Account highlight function corrected

- Chart Period selection – activation area increased

Platform Features Release: Trade from the Chart, Price Slices, Reset Virtual Account Options

Announcing the latest Release of feature and functionality enhancements to the trading platform to improve the position evaluation process, trade submitting process as well as offer additional practice account settings:

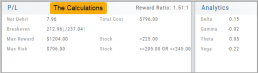

Price Slices: Evaluate theoretical outcomes of option positions when using the Strategy Templates.

Trade from the Chart: Use the control box or lines on Chart to adjust the entry point, Target Price and/or Stop Price.

Reset Virtual Account – Add ‘funds’ to an existing account OR reset everything and start fresh. You decide.

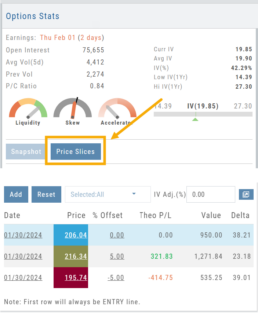

Price Slices (Premium Feature)

The ![]() Button appears on the right side of the screen when using the Strategy Templates.

Button appears on the right side of the screen when using the Strategy Templates.

Select one of the 22 Option Strategy Templates.

Build the position.

Click the Price Slices button to start your evaluation

Change the Date (default ‘today’), Price levels and/or % Offset

Add IV to view how this affects the theoretical P/L

Click the Go Big icon to view additional Greek data

Trade from the Chart

The ![]() button appears at the top of the chart for any symbol – whether there is an existing position or not.

button appears at the top of the chart for any symbol – whether there is an existing position or not.

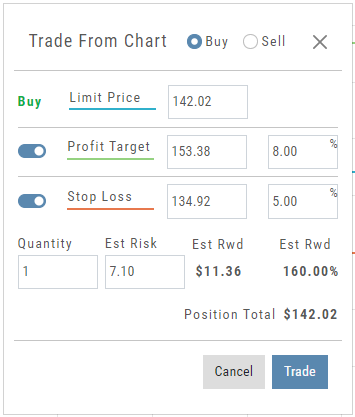

Clicking this button activates an Order Window on the Chart, like this:

Note: Buy, Profit and Stop Loss line colors will match those displayed on the chart itself.

The values in the Order Window can be manually adjusted by $ or %

The values can also be dynamically adjusted by moving the corresponding line(s) on the Chart itself.

The Quantity value default is “1” to show the ‘per share’ dollar and percentage estimated risk, reward, as well as Position Total.

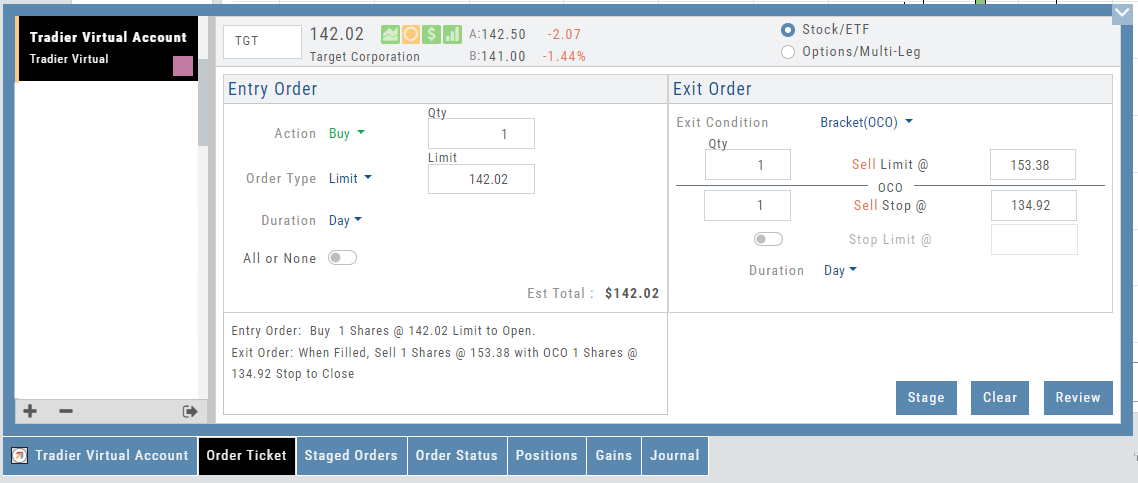

Click “Trade” for the prefilled Order Ticket to display.

The Order Ticket can be further adjusted, Staged or Reviewed to ensure it’s completed to your satisfaction, then Submitted.

Note: The brokerage selected must support Bracket Orders if the Stop/Stop Limit values are selected on the Order Window

Reset Tradier Virtual Account – 2 options

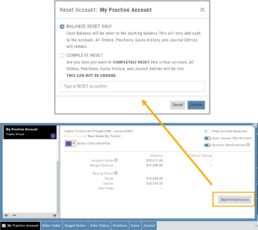

Tradier’s Virtual Account gives you the ability to add more “Cash” to your practice account – OR – completely start over:

On the account summary page, click “Reset Virtual Account”

Select “Balance Reset Only” – to keep your existing trade activity, but add more “cash” to your virtual account.

Select “Complete Reset” – if you want to remove all prior transactions, including Journal Entries, Gains, Orders, Positions, etc. Note: This selection cannot be undone once it’s processed.

Type RESET in the box provided, then click the “Confirm” button

Enhancements

- ATM Option Strikes are bolded for easier identification

Change Log

- Adjusted theme contrast

- Corrected Order Type Limit price entry

- Snapshot functionality restored

Platform Features Release: July 2023

Announcing the latest Release of feature and functionality enhancements to the trading platform with the goal of improving the investment/trading decision process. These two areas of the platform have undergone a major redesign and expansion of metrics.

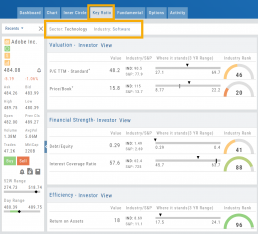

Key Ratio Tab(formerly Valuation)- Reworked and expanded data points offered as well as provided context of how well a stock is performing compared to its Industry and the S&P.

Fundamental Tab – Improved display of the expanded data available offer the ability to view fundamental metrics by Quarter, Year or Trailing Twelve Months (TTM) with the ability to adjust the time period and data display views.

Register for Office Hours, Wednesday, July 12th

Join us for a special Office Hours session, Wednesday, July 12th at 4:15 Eastern (15 minutes after Market Close)

Rance will be showcasing the Key Ratio and Fundamental tab data – how to read, understand and utilize the metrics provided.

Register using the button below. A confirmation email will be sent with a link to join for the scheduled time.

Key Ratio Tab

Key Ratio analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Key ratio indicators provide valuable information about a company’s financial health, profitability, growth prospects, operational efficiency, and overall value enabling traders to make more informed decisions:

Valuation: Helps determine whether a stock is priced attractively in relation to its earnings, sales, or book value.

Profitability: Signifies a company’s ability to generate returns for its shareholders.

Financial Strength: Assesses the ability to meet financial obligations and weather economic downturns.

Growth: Analyzes potential for expansion and increased earnings over time.

Efficiency: Measures how effectively a company utilizes its resources to generate output.

Cash Flow: Provides insights into the company’s ability to generate and manage cash.

Fundamental Tab

Fundamental Analysis involves a comprehensive examination of a stock’s financial health and its underlying value, as well as other relevant financial and non-financial metrics, to form an overall view of a company’s financial health and value.

This information is displayed in charts and graphs making it more useful in the analysis process.

It’s important to note that fundamental analysis is just one approach to evaluating stocks, and it should be complemented with other forms of analysis, such as technical analysis and market sentiment, for a well-rounded investment decision.

Enhancements

Price has been added to the Volatility Chart on the Option Chain display. Slide your cursor along the chart to display the Date, Price, HV & IV

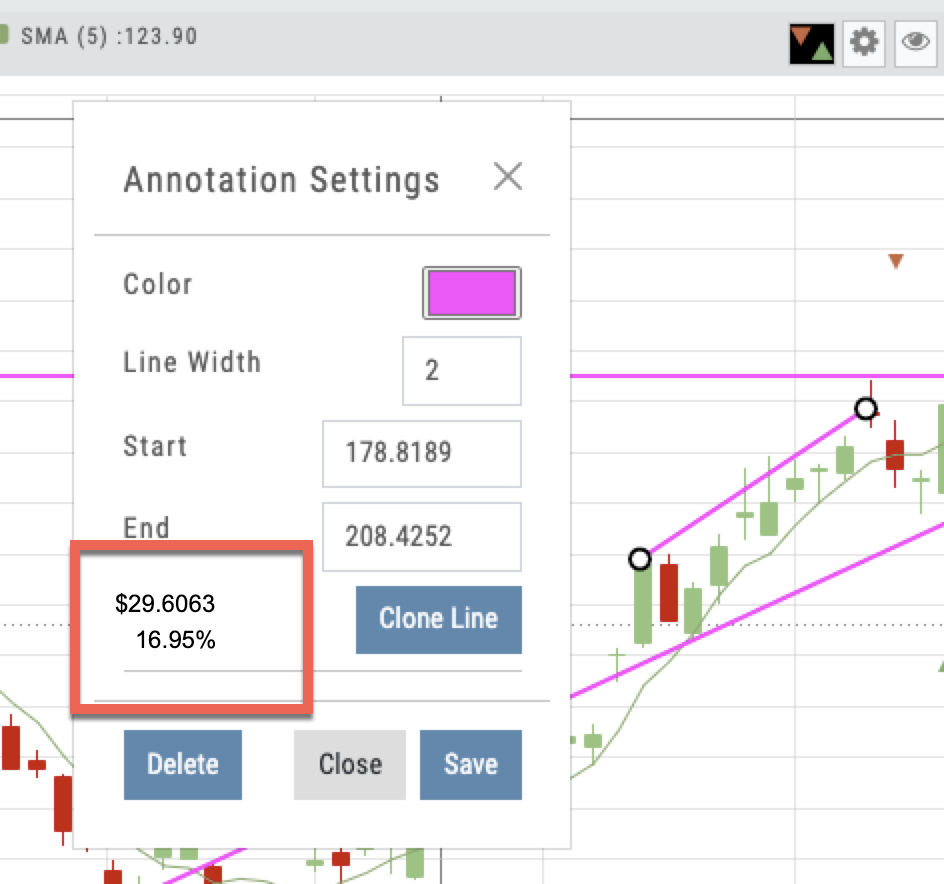

Dollar and Percentage Move added to Line Settings:

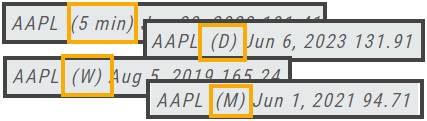

Timeframe displayed on chart when not on “Favorite”:

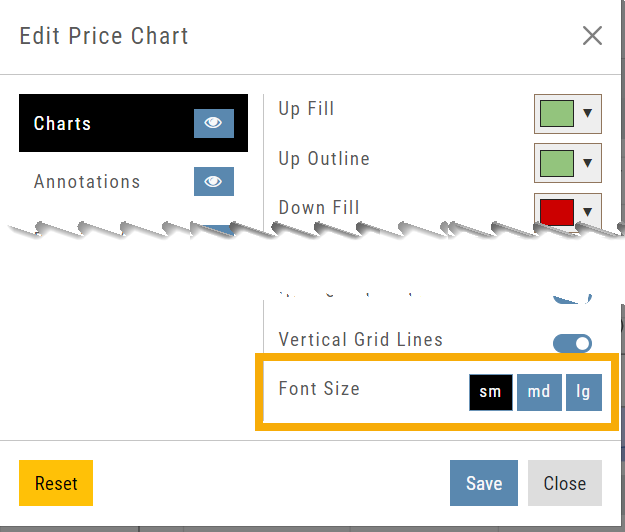

Font Size Selector for Price Chart

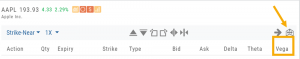

Vega added to Strategy Templates. Click the ‘expand’ icon, if needed:

Change Log

- Linear Regression Channel period number updating

- Roll-out time icon synced with Risk Graph

- Added “No or Limited Dividend Information” message

- Corrected Backtest Net Debit/Net Credit responsiveness

- Reset button function restored on Projected Price

Intraday Trade Finder Scan Updates (Premium Desktop Feature)

Trade Finder Scans are updated every 30 minutes during Market Hours on the Premium Platform. That’s 12 more times than the Standard Platform version, which updates once after the Market opens.

Trade Finder Scans are easily identified with a Rocket Icon in the upper left corner of the Scan box.

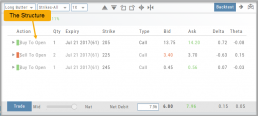

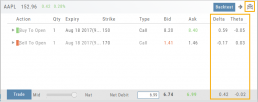

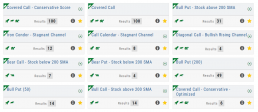

Strategy Template

A Strategy Template provides a shortcut to quickly create an option strategy, virtually eliminating structure errors. Once selected, you can modify the structure within the template using the tools on above the option tables: Moving Strikes up/down, rolling Time out/in, widening or narrowing Strikes.

![]()

Some strategies can be changed from all Calls to all Puts (and vice-versa).

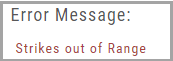

Note: The templates will not allow you to exceed certain parameters, as attempting to do so would result in an invalid strategy. This is a built-in safety net and you would receive a notice similar to:

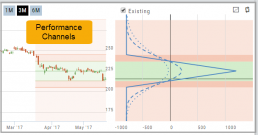

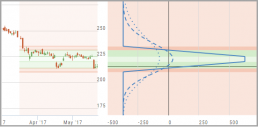

Performance Channels

Performance Channels can assist in visual analysis across both the P/L Graph and the Chart.

- Dark Green – Stock movement affects gain

- Light Green – At maximum gain

- Dark Red – Stock movement affects loss

- Light Red – At maximum loss

The width of the channel on the chart represents the timeframe of the trade. If options expire in 30 days, the channel will display back 30 days on the chart. This give a visual reference for the time frame of the trade.

Note: Channels are displayed based on expiration of the trade. Past performance is not indicative of future results. Performance channel date orientation is for reference only.

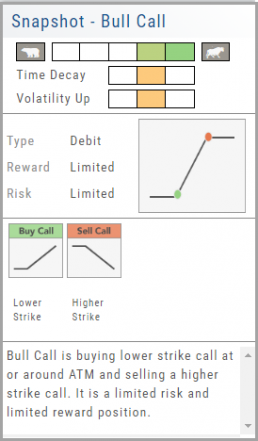

Strategy Snapshot

It’s the “Cliffnotes” version of your strategy

Each strategy template provides a quick reference for the construction and application of the strategy. The snapshot shows:

- what the strategy outlook is on the color-coded range from ‘Very Bearish’, ‘Mildly Bearish’, ‘Neutral’, ‘Mildly Bullish’ or ‘Very Bullish’.

- what effect ‘time decay’ and ‘volatility’ has on the strategy: ‘Increase’, ‘Neutral’ or ‘Decrease’.

- debit or credit trade

- risk & reward level

- strategy structure

- an overview summary of the strategy