Research

Narrow the field to find the highest probability trades.

Stock

You’ve narrowed the field by selecting potential candidates matching the outlook and selected strategy, but which of those have the highest probability of success? Research allows you to drill down for information as much or as little as you want.

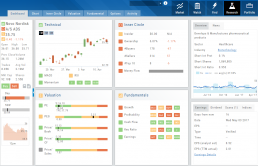

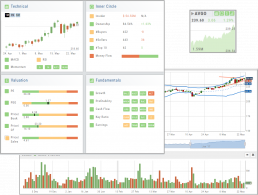

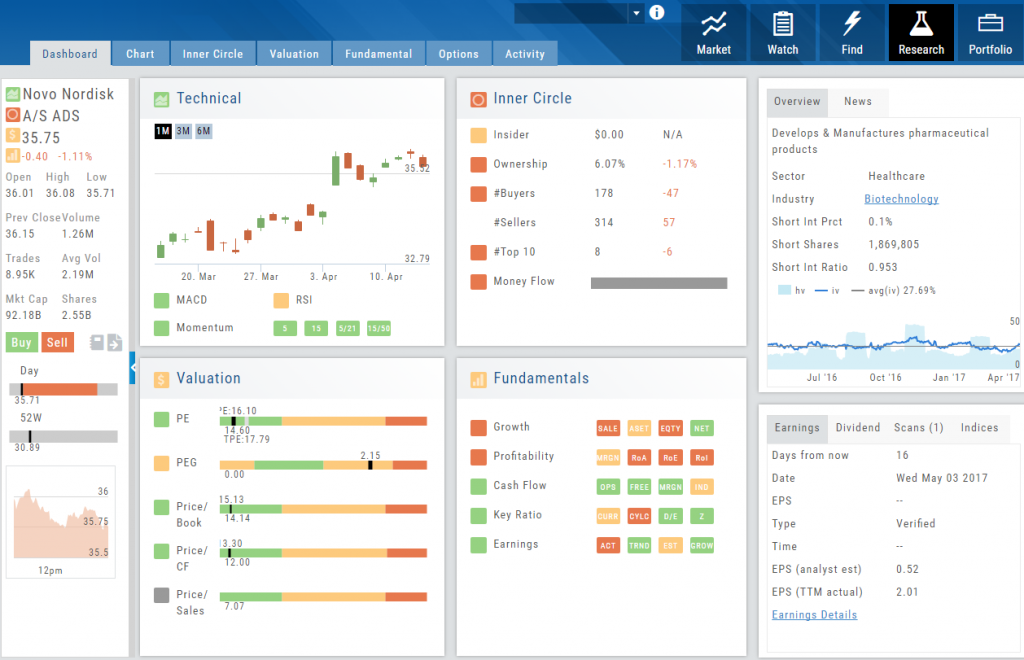

The Dashboard provides an overview: Quote Detail, The Score, Activity such as News/Earnings/Dividends and information about the Company and a list of other company stock symbols in the same industry. Each component has it’s own tab to provide more detail.

Components of The Score are designed to keep the information available to you, but out of the way when you don’t need it.

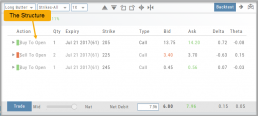

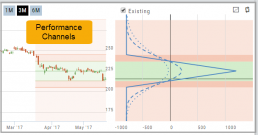

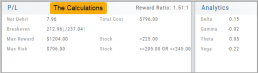

The Options Tab offers Strategy templates, option chains, snapshots and definitions of strategies, P/L Graph with Risk/Reward ratio, Analytics and Stock/Volatility charts.

The Activity Tab includes a Beta version of the Journal as well as News and StockTwits ®

Advanced/Declined & Highs/Lows

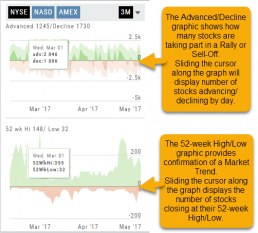

The Graphs on the left side of the Market page can provide confirmation of whether there was a Rally or Sell-Off in the time frame selected by providing the numbers of stocks taking part in of the movement.

The 52-week High/Low Graph further confirms if there is a Market Trend by showing how many stocks closed at their 52-week High/Low.

Note, you can select a 1, 3 or 6 Month or 1 Year time frame in which to view the data. By sliding the cursor along the horizontal ‘0’ (zero) line on each graph, data for each day will appear.

The Power of "The Score"

Our Proprietary Scoring System: Technical Analysis, Inner Circle, Valuation, and Fundamentals.

Designed with your workflow in mind and to give you the level of information you want, while keeping it out of the way when you don’t.

The order of The Score is based on the speed at which the stock is affected: Technicals being the fastest, and Fundamentals the slowest. For example, a very short term trader may not put as much weight on Fundamentals as with the Chart. However, as an actively managing investor, Fundamentals will be more influential on your trades.

Scans - Find Opportunities - Overview

Stagnant? Uncertain? Bearish or Bullish? Short or long term? No problem!

This “Find” category is where to find opportunities based on current Market activity and outlook, or select opportunities based on events, such as Earnings or Dividend announcements.

Whether looking for opportunities based on The Score, Events, Chart Patterns, Bullish, Bearish, Stagnant or Unknown outlook, a scan will help you find potential trade opportunities.

You can drill-down for scans by Category, Sub-Categories, then Group.

Example: Strategy>Time Spreads>Call Calendar Spreads. You can use the drop-down box, above the Category boxes to search for the scan you want or type in the box a generality about the scan. Examples: “Earning”, “Bull”, “Bearish”. “Score”, “Red”, “Green” will yield scans with that particular name in the scan

Designed to provide the level of information you want

As much information you want. When you want it.

Each of our scoring algorithms are derived from several factors, all captured in a user-friendly format.

The stock dashboard provides a more detail summary layer view of The Score. Each component: Technical, Inner Circle, Valuation and Fundamentals allows you the ability to obtain the information you want, when you want it – and kept tucked away, when you don’t.

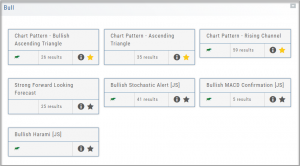

Overview of Scans

Want some ideas to take advantage of market conditions? This is the place to find Stock and Option opportunities based on bullish, bearish and stagnant outlook.

Choose from dozens of scans based on events or components of “The Score”: Fundamentals, Valuation, Technical & Inner Circle.

Ideas and Features offer even more opportunities.

The [i] icon provides a short explanation of the strategy.

Best of all, you are able to keep your favorites all in one place by ‘starring’ it for future use.

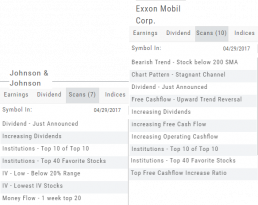

The Dashboard Scan Tab

Get the current ‘story’ on a stock.

The Scan Tab is particularly interesting. In addition to providing a list of scans the stock is currently included in, it can give you a “story” about the stock. Based on the scans that the stock is showing up in, you can get an overview of outlook on the stock.

For example: JNJ shows solid longer term positive outlook.

XOM Shows stagnant with improving longer term outlook

Create Watchlists

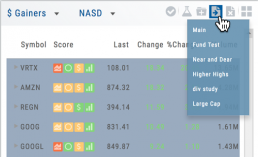

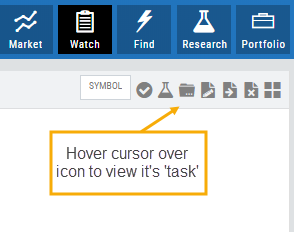

The Market & Watch Tab Icon ToolBar allows you to Create/Modify/Manage your Lists.

Hover your cursor over the icon to view it’s ‘task’:

Select Candidates

Send to Research

Create/Delete a List

Modify an existing List

Send candidates from one List to another

Remove candidates from existing List

Change View: List or Tile

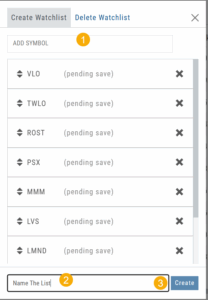

To Create a New Watchlist:

1. Under ‘Create Watchlist’, enter symbols to automatically add

2. Enter the name of New Watchlist

3. Click “Create”

Other ways to Create Lists include:

Research>Chart>”Recents” list.

From the Find Tab>Scans and Find Tab>Calendar.

Selecting candidates from Scans (Ex: Bullish Ascending Triangle ) or Calendar for an Earnings or Dividend date to get the list of stocks that fit your selected criteria, click the “Check” icon to the stock symbols you want to keep, then click the Folder + icon to , name your new Watch List then click “OK”.

You can also copy/paste up to 100 symbols from an outside source to a newly created (or existing list) provided the following apply:

The symbols are separated by:

A Space: TSLA ZM GOOG NFLX

Or by a Comma: TSLA,ZM,GOOG,NFLX

Or a Return:

TSLA

ZM

GOOG

NFLX