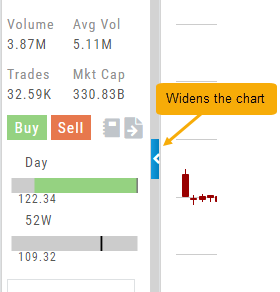

Adjust Chart Height & Width

The height of the chart can be adjusted by clicking and dragging the tab under the main chart.

This is a feature unique per device. You can have separate settings for your laptop/desktop,notebook or even tablet.

To widen the chart, click the blue tab on the left side of the chart. This will collapse the Quote Bar to the left of the chart. You can ‘undo’ this by clicking the tab again.

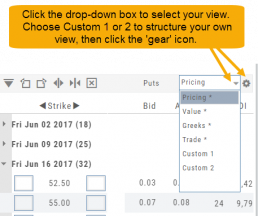

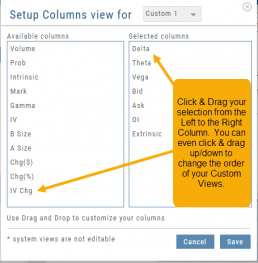

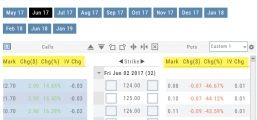

Create Customized Option Table Views

Create, edit and re-create custom Option Views.

This feature allows you to create up to two customized Option Tables. Add/remove categories or even change the order of category columns by clicking on the criteria, then drag/drop it to the new location.

Click ‘save’ and you’re done.

Note: You can change the order of your variables you select by clicking/dragging the variable up or down. The custom views can be changed at any time – to adjust to the user’s needs.

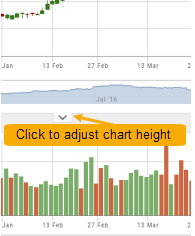

Inner Circle - Money Flow

Activity by Volume & Number of Trades

Money Flow shows trading activity in two views.

The darker shade in the middle of each column – either dark green or red- indicates difference

between the buy/sell volume and buy/sell number of trades.

For example, on February 27th, the top graph shows approx. 1.75 Billion

buying volume from just over 50k trades (bottom graph). Selling volume of

approx 1.5 B resulted from less than 50k trades.

Where the volume and trade columns overlap is an indication of

‘big money’ (Institutions) moving in(dark green)or out (dark red)

of the stock.

Note the dark green line overlap on both graphs for the Feb. 27th example.

Heat Maps Too

The Heat Maps on the Market page offer the ability to drill down to the stock level. You are able to do this with both the Map and Spectrum views. Clicking on a stock will also show the quote detail. From this you can also send to a list or research.

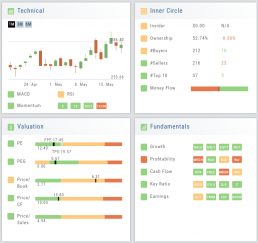

Valuation

Is it Overvalued or Undervalued?

Valuation looks at Key Ratios and Projected Price to evaluate the stock’s current value.

Key Ratios like both trailing and forward PE along with PEG (Price/Earnings/Growth) are weighed.

The Price compared to Book (flow of business), Cash Flow, and Sales are also very important factors to provide a well-rounded synopsis of the valuation modeling of the stock.

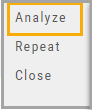

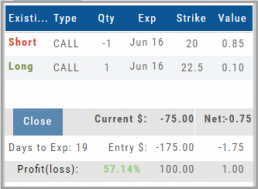

Evaluate Existing Positions

Positions will automatically show on the options chain for the active brokerage account.

You can also access directly from Broker Positions. Select “Analyze” from the Action menu.

This will display the current values as well as entry cost and current P/L.

Here you can also close the position or evaluate adjustments on the trade.

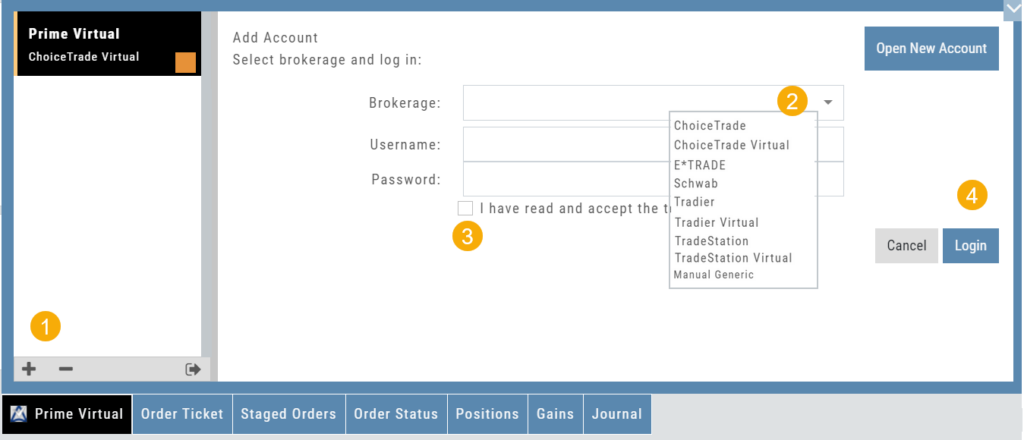

Adding an Account

Accessing a live account is easy. Currently Choice Trade, Tradier, Schwab, E*TRADE are offered through this platform. More brokerages will be added.

To add an Existing Brokerage Account or add a Virtual or Manual Account:

1. Clicking on the “+” icon will display the screen below

2. Select your Brokerage, Virtual or Manual Account from the drop-down

3. Read & Accept Terms and Conditions

4. Click “Continue”

Live Accounts will prompt you to enter your credentials on the next screen.

Virtual** and Manual Accounts will automatically activate.

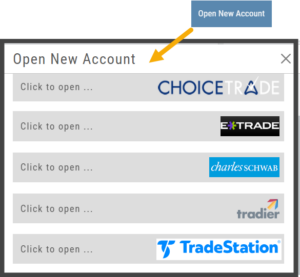

To add a New Live Account, click on the “Open New Account” box on upper right of the above screen.

To add a New Live Account, click on the “Open New Account” box on upper right of the above screen.

Select the account you want to add by clicking the selected brokerage.

Click the “Done” button.

You’ll be directed to the brokerage website to guide you through the process of completing an application.

**TradeStation requires a completed account application to create a Virtual Account.

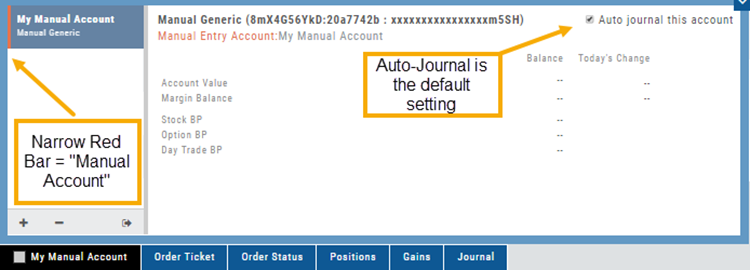

Manual Account Overview

A Manual Account is versatile resource tool which can enhance your trading effectiveness. You can also use this to track trades from an outside brokerage account.

Use the Manual Account for educational purposes.

- It offers flexibility and control, while providing the Analytics and Journal to help you reinforce the “Learning to Earning” process. This allows you to focus on learning the strategies.

- Place trades any time of day or night – all get immediately executed at the price entered. No need for the market to be open.

- No Buying Power limits – no expensive spread margin requirements to adhere to, no limit on how much you can buy/sell

- Place trades in the past.

- Enter trades from Backtest Mode

Use to tracking external accounts

- Can be used to track trades placed at brokers not integrated into the platform

- You can enter the date and fill prices of your actual trades

- This enables portfolio management along with your other accounts

- You can use full Journal function for tracking your progress

Manual Accounts are identified by a narrow Red Bar and are, by default, Auto-Journaled.

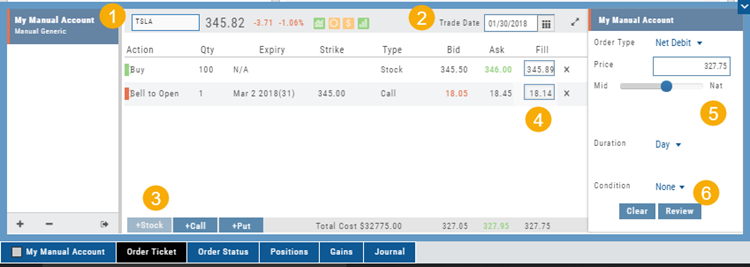

Entering trades in a Manual Account takes only a few steps and is similar to a regular trade.

You can also bring up the ticket from any trade point. Simply start a trade and select the manual account just like you would select any other account.

(Bold indicates unique to Manual ticket):

1. Enter the Stock Symbol, or name of Company (Smart search will display potential matches)

2. If this is a past trade, use the calendar/date picker to select date

3. Click “Stock”, “Call” or “Put” to build trade, change quantity, Expiry and Strike (if applicable)

4. Bid/Ask will automatically populate if a specific price is not entered

5. Complete Order Type, Duration and Condition

6. Click “Review” to confirm information is correct, then ‘Submit” on next screen.

The order will appear in Order Status as “Executed” and operate the same way as other accounts.

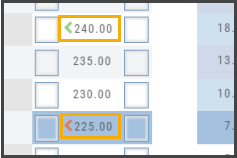

Position Indication on the Chain

When evaluating an existing position on the options chain, the positions held are indicated with arrows on the chain. The arrows point to the quantity entry box of the held position.

Green arrows ![]() indicate Long or Buy positions.

indicate Long or Buy positions.

Red arrows ![]() indicate Short or Sell positions.

indicate Short or Sell positions.